So what does it take to be a great leader in 2018, and how do companies attract and retain the right talent to develop leaders for the future? And what are the key takeaways from women in top finance jobs about what it takes be a successful leader today?

GREAT LEADERSHIP QUALITIES

The literature is vast on what makes a great leader, regardless of gender. One recent example from a Harvard Business Publishing research report, “The State of Leadership Development” (https://s.hbr.org/2vq7cfe), reveals that the most valued leadership qualities include demonstrating integrity, managing complexity, inspiring engagement, and acting strategically.

The authors point out that while integrity and strategy have always been high on the list of leadership characteristics, what’s different today stems from the demands of Millennials. They conclude that Millennials—who now make up the largest group in the workforce—are driven by values and demand transparency. They expect their leaders to be able to respond to new opportunities and that their companies develop midlevel leaders, bringing them into the strategic planning process.

In CFO roles, though, a disconnect exists between what Millennials expect to see and what many companies are actually doing. Results from Korn Ferry’s 2018 CFO Pulse Survey (http://bit.ly/2OjeOqZ) suggest that most CFOs aren’t internally developing the next generation of leaders to take on the top finance job and that the company would need to look to external candidates to fill the CFO roles should current leaders decide to leave. Only 34% of CFOs polled said that they had a succession plan in place for their role; when asked if there was an internal successor ready now to take on their role, 81% reported they had none.

While there may not be a specific succession plan in place for the top finance jobs, the same study shows that some CFOs have been restructuring the finance function not only to maximize scarce resources and deal with what many see as a shortage of talent but to broaden the opportunities for their staff. The survey found that 55% of CFOs combined roles in the finance function within the past year. When asked why the roles were combined, the most common reason (cited by 41% of CFOs) was a scarcity of talent, with half of those indicating a lack of resources or skills and the other half reporting that it was for career development opportunities.

As Millennials will compose 75% of the workforce by 2025, understanding what motivates them is key to developing leaders of the future. According to staffing firm Robert Half, attracting and retaining leaders of tomorrow will require different strategies from what companies have done in the past. “Millennials have the desire to break with the status quo” and aren’t easily locked into traditional career paths.

At the same time, Robert Half encourages companies to understand the “work smarter, not harder” mind-set of Millennials and to evaluate their work by the quality produced as opposed to the number of hours spent completing a task. To this end, a one-size-fits-all culture won’t work. Finance leaders are encouraged to create goals that both meet the needs of the organization and prove flexible enough to appeal to this group. They also recommend combining the learning and work environment while offering Millennials an à la carte menu of work-life balance options such as on-site day care, casual dress, flextime, and telecommuting, for example.

Finally, in order to nurture leaders of the future, companies must understand that Millennials want to be able to direct their own lives and to be allowed to innovate in their roles. Recommendations for bridging the leadership gap include mentorship programs, enriched engagement incentives, continual learning advancements, and other initiatives intended to support a work environment that nurtures new talent.

A VIEW FROM THE TOP

Although many leadership qualities span the gender gap, women who have reached the top finance jobs bring unique insights. How do they approach preparing the next generation of finance executives, and what skills do they see as essential in achieving the top finance job?

Kristina Merrill, chief financial officer of Sky Racing World LLC, explains that it’s critically important for finance executives today to be able to work with vast amounts of data. “As CFOs, we need to have a lot more education around technology in order to safeguard our companies’ assets. It’s part of the job to understand how we get our data, so having technology skills is even more important now than it was 10 years ago.”

Furthermore, critical thinking skills that CFOs look for now are much more robust than what they were several years ago, she explains. “In this kind of data-heavy age, there’s so much Big Data, and people coming into the accounting department need to be able to hit the ground running and know how to work with that data in so many different ways, not only from a technical perspective, but with an ability to read it, manipulate it, and interpret it.”

Merrill suggests that finance isn’t operating in a silo anymore. She adds, “It’s far-reaching across the organization, and working with your IT department is a daily occurrence.” This means that CFOs today need to have a different mind-set than their predecessors did. Leaders of the finance function need to take a holistic approach to their various responsibilities, says Merrill, and they need to have the ability to collaborate with other leaders across the organization—with the CIO, HR, operations, and the CEO.

“We have our hands on everything,” she says. “It’s much more extensive now than perhaps years ago where our primary responsibility was financial reporting, and maybe tax.” Merrill says that in her earlier leadership roles, she was really just focused on financial reporting, general ledger accounting, and managing the audit. “I wasn’t tapped into strategic conversations. Now I talk about strategy on a daily basis, and the relationships across the organization are far more collaborative than they used to be.”

It’s important for career development, she says. Management accountants need “to learn how to communicate effectively and exhibit a lot of confidence. If you aren’t confident in your own ability you can’t expect anybody else to have confidence in you.”

BUILDING CONSENSUS

According to Judy Munro, senior managing director at Robert Half Executive Search, being collaborative across the entire organization is a fit for women. Munro says, “Women are consensus builders.” And to a large degree, Millennials are driving that, she notes. “They want to be in inclusive environments, they want to contribute, and they want to be consulted with, and that speaks to the current trend in leadership in many companies.”

Leadership programs across the board are being built with this in mind, she adds, and one of the most important features for career development specifically for women is to find a champion. “In today’s environment, it’s quite common for people climbing the career ladder to find an internal mentor or sponsor,” Munro explains, “And I think that’s really important, certainly in larger organizations, particularly in helping with self-confidence. For successful women in top leadership roles, you can almost bet they had a strong sponsor within their company who identified their talent and helped them progress through the organization.”

Networking is also key, she adds. “Women need to be conscientious about joining groups and building both their internal and external profiles,” she says. “The more you build your internal and external profile, the higher you will rise, and one of the things I encourage very career-minded women to do is to get involved in not-for-profit work.”

Being involved in a not-for-profit worked well for Lorri Lowe, CFO of Connex Ontario Health Information Services and former chair of CMA Canada. “For me, being involved in CMA Ontario and CMA Canada gave me a lot of self-confidence and allowed me to continue to demonstrate my expertise while I earned a great deal of respect from my colleagues.” As to the key elements of leading CMA Canada—particularly during the difficult unification of the three separate accounting bodies [CGAs, CMAs, and CAs] into CPA Canada—she adds that it was all about being goal-oriented, setting a strategic direction, engaging others, and mobilizing knowledge to build networks and partnerships. “This is central to my current role and critical in any organization.”

In addition to those core competencies, a leader needs to understand that employees want to be valued and want to be able to add value, Lowe explains. Today, people want coaches rather than just being told what to do and how to do it, which is quite different from when Lowe started her career. “Back then, the leader made all the decisions, and the rule was this is your job and this is how you do it. Nowadays it’s more important that we take input from others and make sure that their opinions and their expertise are valued before any decisions are made,” she says.

THE WAY FORWARD

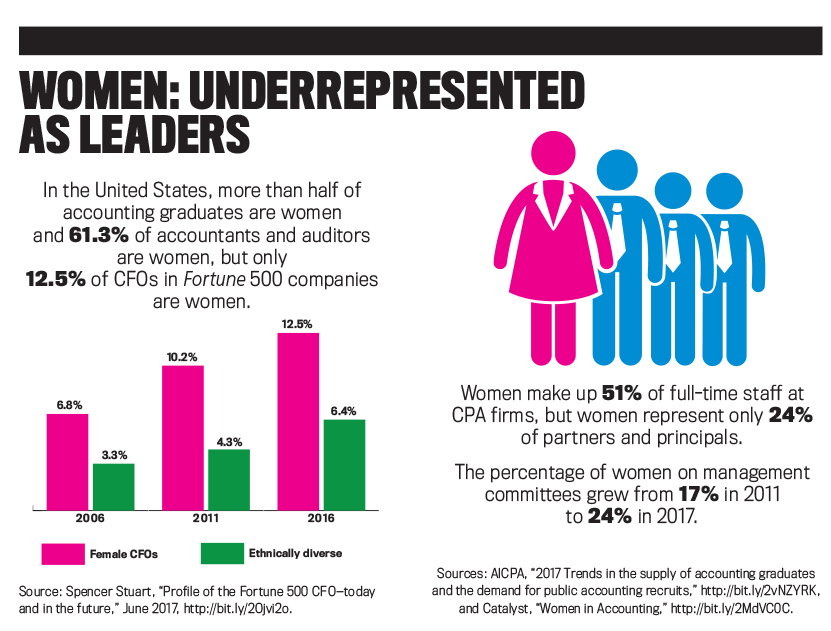

Historically, women have had to be twice as assertive as male counterparts to be heard, Lowe adds. Results from IMA’s semi-annual Women’s Accounting Leadership series held in March 2018 reinforced much of the popular wisdom on why more women don’t reach the top finance jobs. Family concerns come before career development in many cases. Many women are risk-averse in their career path and are often less assertive than their male counterparts. External social networking often essential for career advancement is typically designed for men, creating an intimidating men’s club atmosphere. Companies aren’t offering sufficient mentoring opportunities.

Finally, stereotypes still remain, misrepresenting women as less motivated in their career goals. But today, women are bringing value to the leadership table by being engaging, inclusive, and empowering. “While all leaders still have to stand their ground,” Lowe says, “to me the most important characteristic of great leadership is in valuing your team: Listening to your employees and encouraging innovative thinking lead to greater opportunities for success.”

The next Women’s Accounting Leadership Series will be October 26, 2018, at the University of Massachusetts Club in Boston, Mass.

For more information, visit http://bit.ly/2o4Qmyw.

© 2018 by Ramona Dzinkowski. For copies and reprints, contact the author.

September 2018