This article is based on a study funded by the IMA® Research Foundation.

Management accounting practices are broadly categorized into traditional and contemporary practices based on their period of development and distinct characteristics. Traditional management accounting practices (e.g., standard costing, variance analysis, return on investment, and capital budgeting) were developed by the 1920s, have an internal focus, are narrower in scope, and tend to focus on costing and cost control. In contrast, contemporary management accounting practices (e.g., strategic cost management, value chain analysis, activity-based management, and the balanced scorecard) have been developed since the 1980s, have broader applications, are more externally focused, and target a range of critical success factors.

Management accounting practices play an important role in supporting decision making, managing the intensity of competitive forces, supporting strategic priorities, and managing performance. Understanding the impact that management accounting practices can have on organizational effectiveness and strategy implementation—whether it’s (1) the direct effects of traditional and contemporary management accounting practices on organizational success (measured by organizational performance and competitive advantage) or (2) the moderating effect of traditional management accounting practices on the relationship between the intensity of competitive forces and organizational success, as well as the moderating effect of contemporary management accounting practices on this relationship—provides greater insight into how best to use and gain full advantage from the different types of practices. Our research sought to contribute to that understanding.

We surveyed 505 U.S. financial managers from various industry sectors, including manufacturing, financial services, wholesale and retail trade, and construction, in September 2021. We conducted regression analysis to examine the direct and moderated effects of traditional and contemporary management accounting practices on organizational success.

DIRECT EFFECTS

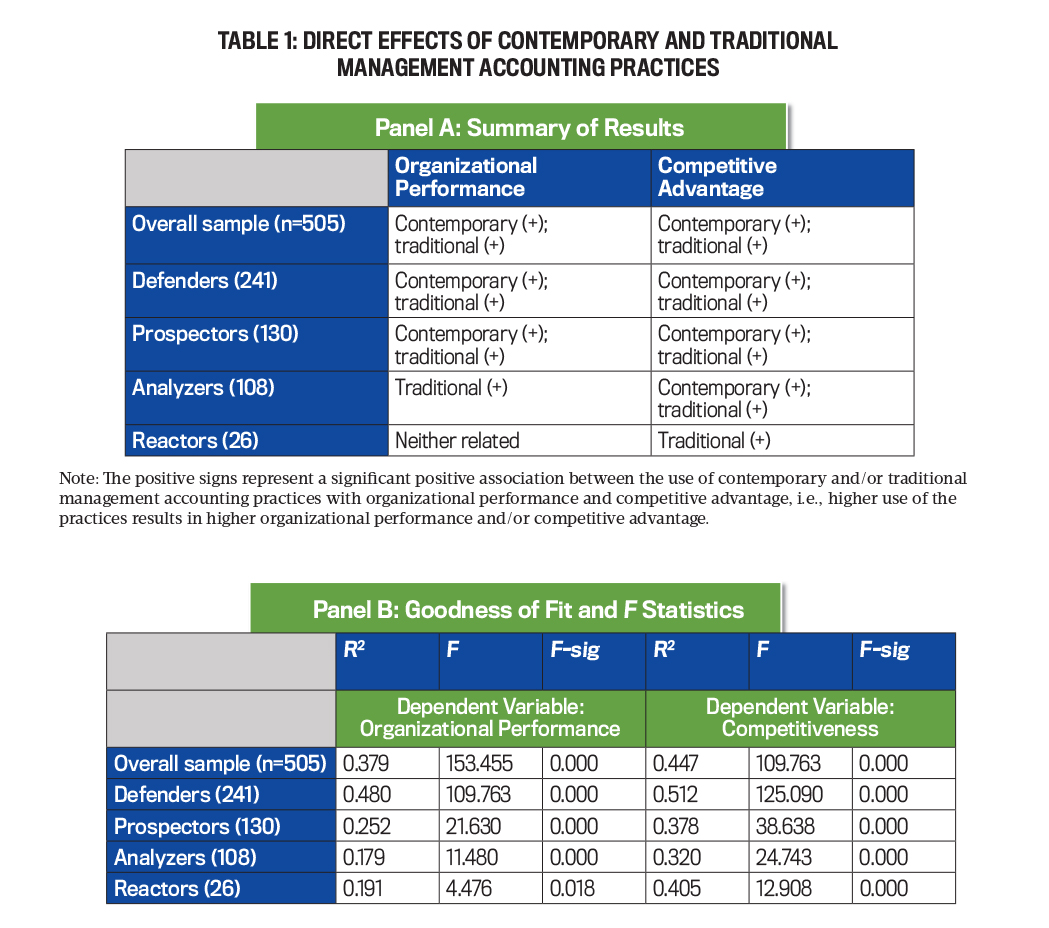

The survey examined the effect of traditional management accounting practices, such as capital budgeting, standard costing, variance analysis, and return on investment, and contemporary management accounting practices, such as activity-based management, the balanced scorecard, value chain analysis, and strategic cost management, on both organizational performance and competitive advantage. We considered the effect of the traditional and contemporary management accounting practices, both in respect to the overall sample and for each type of strategy: prospector, defender, analyzer, and reactor.

Prospectors are organizations that are first to respond to early signals or opportunities and thereby emphasize innovation and research and development. Defenders are organizations that operate in an environment considered to be relatively stable and certain and hence aspire to attain stability and control operations to maximize efficiency. While analyzers combine the strengths of both the prospector and defender types, the reactor strategy type is employed by those organizations that respond to changes in the business environment. (See Raymond E. Miles and Charles C. Snow, Organizational Strategy, Structure, and Process, 1978.)

Table 1 shows that traditional and contemporary management accounting practices exhibited a significant positive effect on organizational performance and competitive advantage for the overall sample. The significant direct effects of traditional management accounting practices on organizational success counter the view that traditional management accounting practices have a diminished role in enhancing organizational performance since the advent of contemporary management accounting practices.

In addition, we found evidence of positive performance effects of traditional management accounting practices for two diverse strategies: prospectors, who are highly innovative risk takers, seek new opportunities, and provide new goods and services; and defenders, who focus on protecting current markets, maintaining stable growth, and serving current customers. For a prospector strategy, the exploration of innovative products and solutions requires more contemporary techniques. Yet our findings suggest that, without the effect of conscious cost controls on these exploratory activities, exhibited through the use of the traditional management accounting practices, companies may experience undesirable cost blowouts.

Alternatively, for a defender strategy, defending the existing market share requires an effective pricing strategy and preferably lower prices on the existing product and service offerings. These lower prices would very much hinge on cost savings made possible through traditional management accounting practices.

Further, we also found evidence of the positive performance effects of contemporary management accounting practices for both prospector and defender strategies. This result suggests that the contemporary practices used for scanning both the internal and external environment for opportunities and threats, and for identifying a range of critical success factors, are certainly conducive to a company’s exploration of new products and solutions and therefore facilitate the attainment of the objectives of a prospector strategy. These contemporary accounting practices can have a positive impact for a defender strategy because, in addition to the pricing strategy discussed earlier, a successful defense requires incremental improvements in existing product offerings. Such incremental improvements can originate from the use of contemporary techniques.

Lastly, we found that using both traditional and contemporary management accounting practices is effective in enhancing competitive advantage and organizational performance for analyzers, who attempt to maintain market share and be innovative. In respect to the reactor strategy, the least frequently used strategy that involves no consistent strategic approach, traditional management accounting practices were effective in enhancing competitive advantage, but no other positive associations were found.

Overall, the significant positive findings highlight the importance for organizations to use both traditional and contemporary management accounting practices to a greater extent.

MODERATING EFFECTS

Michael Porter’s Five Forces model specifies that five key environmental factors affect organizational effectiveness: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the rivalry among existing competitors, and the threat of substitute products or services. Based on their understanding of their competitive position, managers will adopt either the cost leadership and/or differentiation strategies to maintain their competitive advantage.

Yet there’s a gap in the understanding of the effect of these competitive pressures on organizational success and the role of management accounting practices in supporting effective strategy implementation. Accordingly, our study examined the effect of the intensity of the competitive forces (i.e., the combined effect of the five forces) on organizational performance and competitive advantage and the role of traditional and contemporary management accounting practices in influencing these relationships.

We found that the intensity of competitive forces exhibited a direct negative effect on both organizational performance and competitive advantage. Specifically, the higher the combined intensity of the five forces, the lower the level of organizational performance and competitive advantage. For instance, new entrants dilute market share and increase competition, thereby reducing existing companies’ profitability. Similarly, the bargaining power of the supplier may adversely affect business profitability as a powerful supplier may significantly raise input costs.

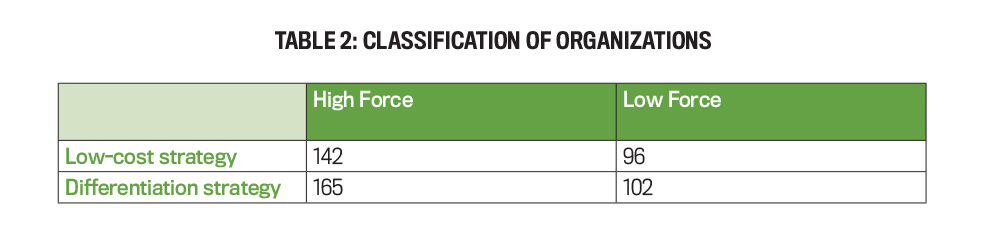

Given the direct and negative impact of the intensity of the competitive forces on organizational success, we then considered the role of management accounting practices in moderating or improving such adverse effects and hence facilitating effective strategy implementation. To do so, we added a dimension to the competitive strategy adopted and categorized the overall sample companies into four groups, according to a 2 5 2 matrix based on the competitive strategy adopted (i.e., low-cost or product differentiation) and the strength (i.e., low or high) of the competitive forces applied (see Table 2).

Specifically, we asked managers to evaluate the intensity of the competitive forces using Porter’s Five Forces model. We collected managers’ individual ratings about the threats of new entry, product substitution, power of the customers, power of the suppliers, and competitive rivalry using a scale of 1 to 7. We then aggregated these individual ratings and used the mean scores to split the sample companies into two groups: those that experienced high intensity of overall competitive forces and those that experienced low intensity of overall competitive forces. In addition, we asked managers to respond to survey items describing the nature of the low-cost and product differentiation strategies using a scale of 1 to 7.

We aggregated the managers’ ratings on the low-cost and product differentiation strategy items with the sample companies allocated to either the low-cost or product differentiation group based on the highest mean score achieved across these two strategies. For example, if the mean score for Company A for the low-cost strategy was higher than the mean score for product differentiation, Company A was allocated to the low-cost group.

Table 3 provides a summary of the results in respect to both the moderating effect of traditional management accounting practices and the moderating effect of contemporary management accounting practices on the association between the intensity of competitive forces and organizational performance and competitive advantage.

It shows that traditional management accounting practices exhibited a positive moderating effect on the association between the intensity of the competitive forces and competitive advantage when the intensity of the forces was low (for both a low-cost or product differentiation strategy). Hence, traditional management accounting practices are effective in managing the intensity of the competitive forces when these forces are low. Yet when the intensity of the competitive forces was high, traditional management accounting practices were found to exhibit a negative moderating effect on the association between the intensity of the competitive forces and organizational performance when a product differentiation strategy is employed or no effect when a low-cost strategy is employed.

In contrast, the use of contemporary management accounting practices appears to be more effective when the intensity of the competitive forces is greater. In particular, the contemporary management accounting practices were found to exhibit a positive moderating effect on the association between the intensity of the competitive forces with both organizational performance and competitive advantage when there was a high force (for both strategies). The use of contemporary management accounting practices was also found to positively moderate the association between the intensity of competitive forces and organizational performance but negatively moderate competitive advantage for organizations employing a low-cost (differentiation) strategy and subject to a low intensity of competitive forces.

PRACTICE TAKEAWAYS

There’s strong evidence that highlights the crucial role of traditional and contemporary management accounting practices in enhancing organizational performance and competitive advantage. The importance of adopting these practices is further highlighted by evidence of their role in mitigating the negative impact of the intensity of the competitive forces on organizational performance and competitive advantage.

In particular, we conclude that contemporary management accounting practices are effective in moderating such effects when organizations face more intense competitive forces, while traditional management accounting practices are more effective when the intensity is lower. The findings alert managers to the significant benefits associated with employing contemporary (i.e., activity-based management, balanced scorecard, value chain analysis, and strategic cost management) and traditional (i.e., capital budgeting, standard costing, variance analysis, and return on investment) management accounting practices. Contemporary management accounting practices, which are popularized as more recent and most consistent with the contemporary environment, are not substitutes for traditional management accounting practices; rather, they complement them. Thereby organizations should embrace both types of management accounting practices.

June 2023