The pandemic exacerbated existing gaps between traditional controllership offerings and strategic business needs. Despite challenging circumstances and market uncertainty, controllers were met with increased demand for elevated strategic insights, real-time data, analytic tool integration, and more efficient and agile operations. This increased demand, driven largely by marketplace disruption and organizational strategic realignment, prompted considerable investment in people, processes, data, and technology to adapt with the shifting expectations of controllers.

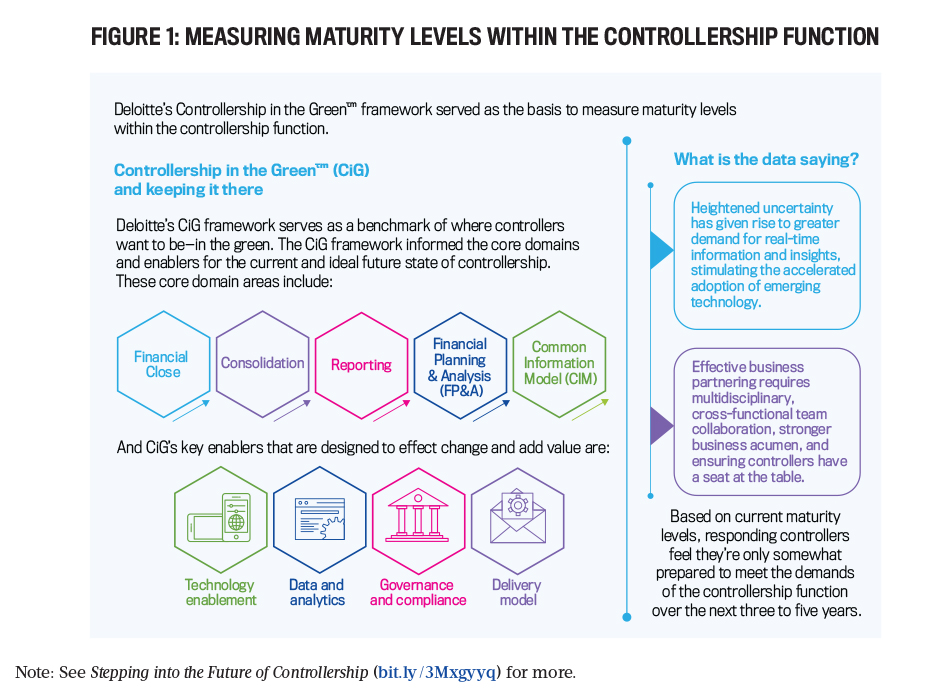

In fall 2021, IMA® (Institute of Management Accountants) and Deloitte & Touche LLP’s Center for Controllership™ conducted research that aimed to assess how prepared the controllership function is to meet future business demands and provide maturity benchmarks for leaders to consider. This involved a global survey of more than 1,300 finance and accounting analysts, managers, directors, controllers, and CFOs. To measure the maturity levels within the controllership function, the survey was structured along Deloitte’s Controllership in the Green™ (CiG) framework, which focuses on the core areas of controllership to drive maximum value and help controllers meet the increasing future demands of the function and role (see Figure 1). Following the survey, a series of interviews were conducted with experienced finance and accounting leaders to provide further context.

CONTROLLERSHIP OF THE FUTURE

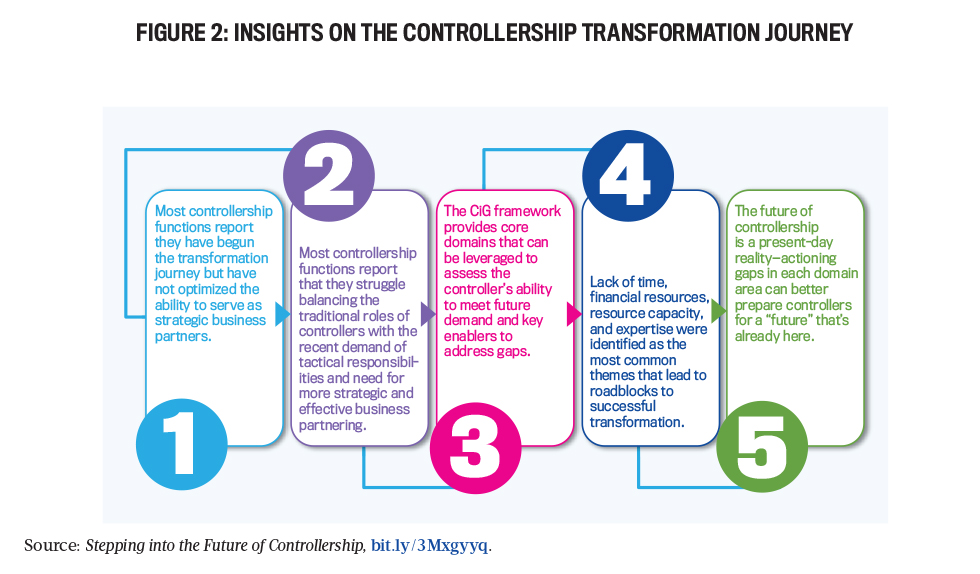

Combining the survey findings with thought leadership, the IMA and Deloitte report, Stepping into the Future of Controllership, provided deeper insights into the current state of controllership and the evolving expectations for the role of the controller. It covered a broad range of insights (see Figure 2), including:

1. Increasing expectations of controllers. Transformation journeys are underway, but controllers and finance professionals who participated in our survey report they aren’t yet able to maximize their role as strategic business partners—even as the need to do so continues to increase.

2. Preparing to meet future demands. The controllership role has a mix of strategic and tactical responsibilities. The challenge that most controllers face is striking a balance between both roles when real-world circumstances tip the scales in favor of strategic activities. Prioritizing the new demand for tactical responsibilities and reducing the focus on traditional core tasks might increase risk, compromise assurance, or weaken the control environment. Effective business partnering requires controllers to have both strategic and tactical roles. This is achieved through multidisciplinary, cross-functional team collaboration; stronger business acumen; and ensuring controllers have a seat at the table.

3. Defining controllership. Within the controllership function, most professionals feel only moderately prepared to meet the demands of transformation, at best, without a clear vision of a future state. The core domains and key enablers of controllership, from the CiG framework, were leveraged in design of the survey and provide a structure for users to identify gaps and focus resources on areas that will yield the largest impact to meet demands of the function.

4. Roadblocks to transformation. The top four barriers to successful transformation initiatives are a lack of time to devote to transformation, limited financial resources, limited resource capacity, and a lack of expertise to progress initiatives.

5. The future of controllership is now a present-day reality. The COVID-19 pandemic exacerbated gaps that already existed between controllership offerings and business needs. This disruption accelerated the need for critical skills, tools, and resources.

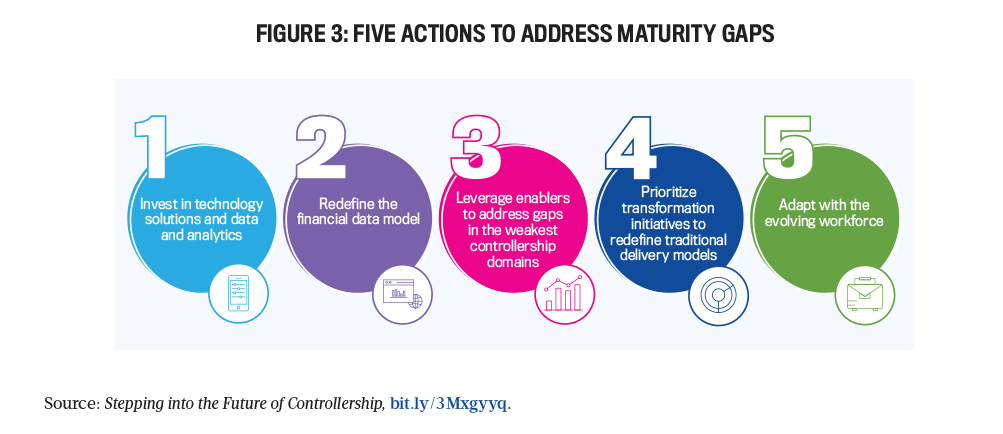

Given this context, there’s a series of strategies and actions that controllership functions can consider across each CiG domain area to better prepare for the future that’s already here (see Figure 3):

1. Utilize enabling technology solutions. Invest in new technology solutions to reimagine data and analytics. Enhanced planning and scenario modeling can drive agility, resilience, and more informed strategic planning for an organization.

2. Redefine the finance data model. Use transformation to redefine finance data and define a common information model. Develop agile forecasts with scenario planning to include a mix of drivers, internal and external information, and flexibility for unstructured and asynchronous data that supports both transactional processes and reporting requirements in finance.

3. Leverage enablers to address gaps in the weakest domains. Bolster governance and compliance, and prioritize financial close processes efficiency. Controllership teams can prioritize and improve the financial close by leveraging technology enablement with structured improvement programs that prioritize specific areas of the close for automation and reengineering. Cloud-based systems can also enable centralized data management, which could be transformational for close processes.

4. Prioritize initiatives for new delivery models. Leverage new delivery models and utilize automation tools to free up resources. Many controllership functions that have progressed along their transformation journeys have redefined their organizational structure to break down historical silos and introduce delivery models that leverage alternative talent models and process standardization.

5. Adapt to the evolving workforce. Keep the benefits from the remote workforce and explore alternative workforce models. The remote work model provides organizations with access to global talent pools, specialized resources, and alternative staffing models that may have been previously inaccessible. In addition, the talent strategy may adapt to a remote or hybrid environment by tapping into a dispersed workforce’s cost efficiencies, unhindered by location or timetables.

The report’s findings reveal that the current state of controllership is characterized by a broad recognition of the impetus for transformation, acceptance of the need to evolve, and commencement of transformation journeys. Consider these insights and actions to provide a starting point as organizations come out of hibernation and ask, “What’s next?”

BRIDGING THE GAPS

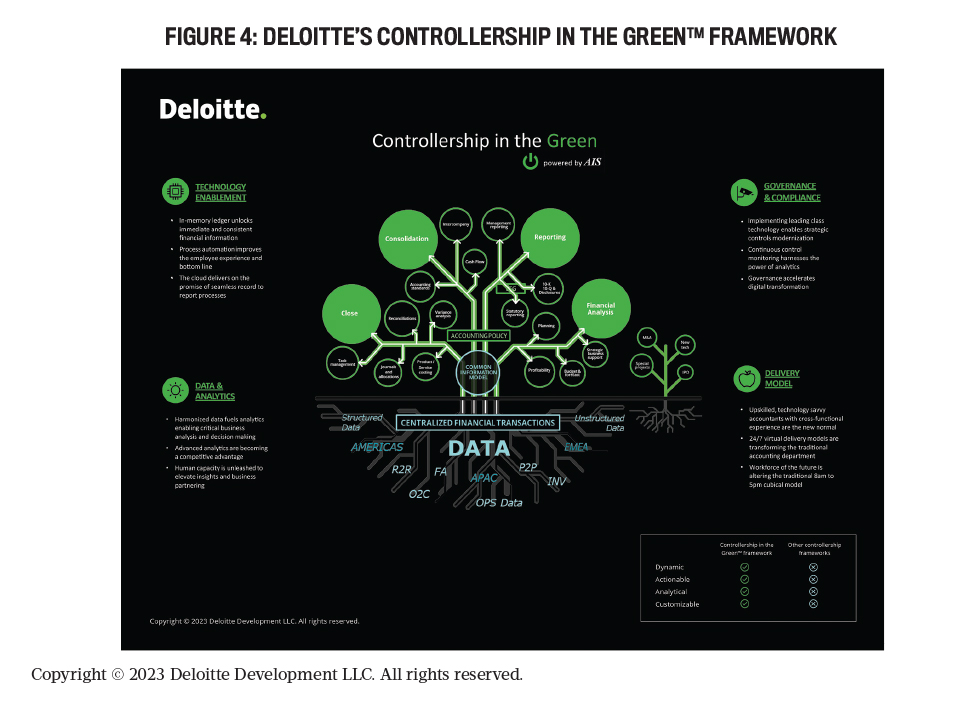

The CiG framework serves as a benchmark of where controllers want to be—reflecting financial health, business growth, and sustainability in this era of technological advancement (see Figure 4). The framework was the first time many participants had seen the controllership function outlined and defined by core domains and key enablers.

While most controllership functions have begun a transformation journey by strengthening core competencies and abilities through key enablers, there’s a long road ahead to the destination. Users can employ the CiG framework to measure where their controllership function is today compared to where they want to be in the future, diving into each domain area and enabler for the controllership function. Let’s look at a few areas where controllers might have maturity gaps and explore strategies that leverage the framework to focus efforts and move into the future.

Technology enablement. The CiG enabler with the largest maturity gap in the survey was technology enablement. Emerging technologies such as automation and cloud enterprise resource planning (ERP) management tools have had a positive impact for controllers, such as automating and accelerating close timelines and improving task management to name a few. While technology enablement is a key enabler in the changing role of the controller, technology requires strong and uniform data to drive meaningful insights.

The Common Information Model (CIM) is a CiG domain that creates a harmonized data structure that’s aligned with technological capabilities to unlock intelligent and real-time reporting and establish a single source of truth. A strong CIM supports the ability to automate processes effectively as it drives common master data and a uniform transaction repository. Therefore, additional technology enablement solutions such as purpose-built automation or bots don’t trip over bad data and are more effective to the task at hand.

A CIM also provides the ability to unlock analytics and reporting on the common architecture, which can improve efficiency, enable self-service, and wield power in getting the platform of a core system right. A defined CIM coupled with technology enablement solutions can be leveraged to help address gaps in the other key domains of controllership and enable the controllership function to meet current and future demands.

Corporate structure. More than two-thirds of survey respondents stated they didn’t feel prepared to meet the future demands of controllers. Questions arose around the design of controllership functions to meet current demand, what successful corporate structures look like, and how financial planning and analysis (FP&A) plays a role in the controllership function.

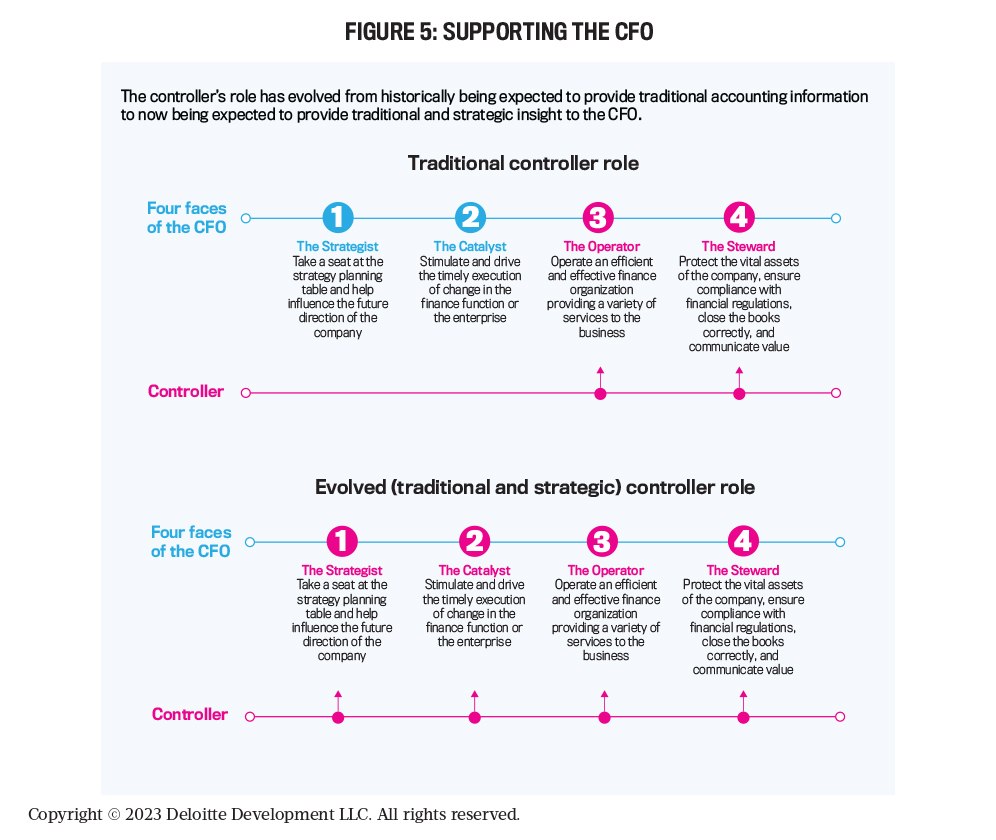

Deloitte’s “Four faces of the CFO” framework defines the CFO’s four different but interrelated roles: strategist, catalyst, steward, and operator (also see Seth Elliott’s “How CFOs Can Better Manage Strategy Execution,” Strategic Finance, February 2023). Historically, the chief accounting officer (CAO)—and, by extension, the controllership function—performed the steward and operator roles as part of the CFO agenda. The CFO’s responsibility as a steward is to ensure that the organization’s books and records are correct and that the organization is reporting to stakeholders in accordance with accounting principles.

The controller’s role to support the CFO’s steward responsibility is universally applicable, though priorities may differ by company size and industry. As an operator, the controller is responsible for operating an efficient and effective organization (consistent with other CFO direct reports). Accounting is the lifeblood of an organization and the language in which an organization’s performance is communicated. As such, the CAO/controller will always be critical to executing the CFO’s agenda successfully (see Figure 5).

The distribution of time a CFO focuses on each of the four faces varies by organization. If a CFO prioritizes more time as a strategist or catalyst and less time as a steward, the expectation of the controller’s role will shift. In this example, the CAO will typically take more responsibility as a steward and the CFO will require more support from the controllership function in other strategic areas to satisfy the strategist or catalyst role.

To achieve an evolved controllership function, there is an increased need for controllers to understand how actuals impact future plans and to provide perspective and optionality for organizations to consider based on historical outcomes and financial results. As Deloitte & Touche LLP Principal and Controllership Strategy Offering Leader Temano Shurland notes, “CFOs are looking for controllers to have an understanding of the financial statements and operations to help them achieve their plans and goals for the future.”

Adapting the controllership function to fit the organization. The controllership role varies based on factors such as organizational footprint, market involvement, revenue size, and lines of business. In general, greater complexity drives the need for more oversight and greater expansion of the controllership function. The controllership structure isn’t always linear; it can be embedded into different lines of business and is further impacted by complexity that requires greater financial oversight. With that said, there’s no singular controllership definition or organizational structure that fits every organization.

Blurring the lines of controllership and FP&A. Financial analysis is an important area in controllership. Over the past five years, we have seen a blending of the traditional FP&A function with controllership in the corporate structure. This is primarily driven by the failure of the historical view of financial statements’ ability to predict future activity or react to data in a time-efficient manner.

The controllership function has needed to take advantage of future-looking information to help the organization grow, adapt to change, and adjust course as needed. The siloed system traditionally found with the FP&A function and controllership, operating as fully separate functions, is breaking down, and it’s becoming more common to see a merger between the two.

Profitability analysis is a good example of a historical FP&A responsibility now having more involvement from controllership. In this scenario, controllership is getting more granular and uniform data as it can attain a CIM or single source of truth for data.

With enhanced data leveraging the CIM and transactional information, the controllership function can create more value in driving profitability analysis down to even the most detailed levels of product or service categories to determine which products drive higher margins or should be emphasized.

Skills for a successful controllership function. Are you ready for the controllership of the future? What skills do you and your team need to meet the demands of the role? There’s increased demand for the controllership function to serve as a strategic business partner, and the controller’s skills must evolve to meet this demand.

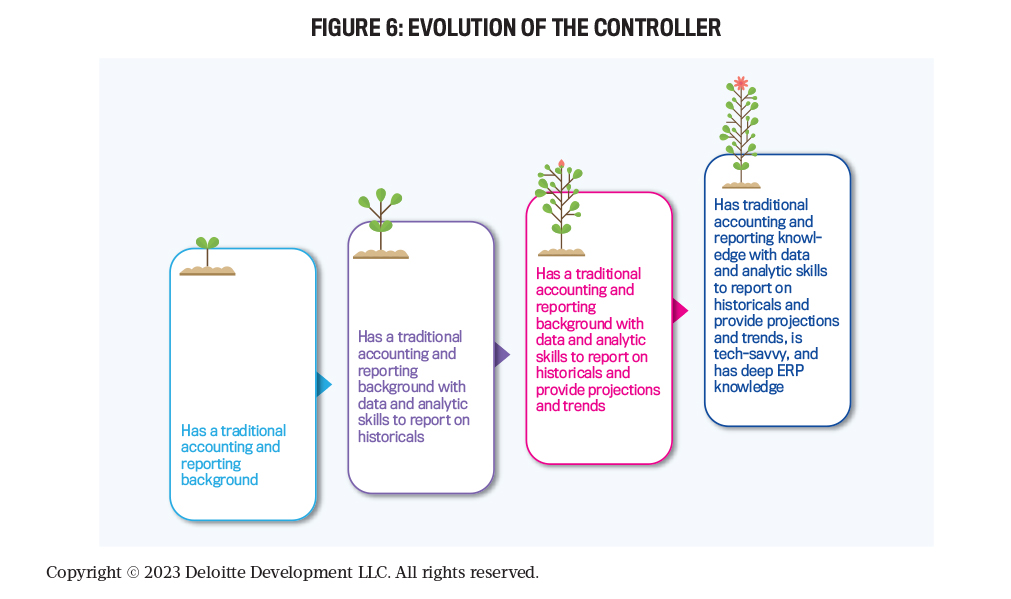

Traditionally, controllers (and those who report to them) require a standard accounting and reporting background to be successful. As the role has evolved, controllership teams are now expected to have technology and data analytic skills as well as understand underlying data structures and new automation tools that are more frequently being owned by controllership. These “tech-savvy” skills aren’t always prevalent within a controllership function, requiring a need to close the gap between traditional accounting skills and the technology and analytic skills required to meet the business demands of a controllership of the future.

With the power of these combined skills and sufficient middle management, the team under controllers may be self-sufficient. The controllership function can be positioned to bridge skills gaps and meet increasing business expectations with the right amount of technology training, access to different tools, and designated business system “superusers” (see Figure 6).

Controllers can consider the following actions to close the technology and analytic skills gaps. In the first wave of bridging the skills gaps, address the current system landscape by ensuring that there are training programs for onboarding new employees or upskilling existing employees with the tools and systems that they will most commonly use. Identify and designate system-specific “superusers” within the controllership function who have a deep knowledge of the system and oversee knowledge management. From there, incorporate cross-knowledge rotational programs and create formal dedicated trainings for new positions.

In the second wave of the transformation journey, implement a robust change management program that identifies users impacted from system replacements and enhancements. Ensure that these individuals have trainings to effectively use technology to combat gaps in system use knowledge or inefficiencies in technology capabilities.

THE TIME FOR CHANGE IS NOW

In order for controllers to realize the value in their role—and the wider role the controllership function plays in the organization—they will need to find a clear pathway on their transformation journey.

This means addressing the skills gap and leveraging enablers to address gaps in the weakest controllership domains. It means understanding the role technology plays (and will continue to play) in their role and investing in technology solutions and other solutions that redefine the finance data model.

Finally, it means understanding the changing role of controllership, how the function operates against the broader evolving organizational landscape, and prioritizing transformation initiatives that redefine delivery models and adapt with a new workforce.

The onus is on controllers, CFOs, and VPs of finance—as well as directors, managers, and analysts—to take action today that propels their function’s transformation journey forward. Elevating controllership into this new paradigm can present the undeniable value of the function’s role and drive a more resilient, efficient, and agile controllership into the future.

The authors would like to thank the following Deloitte & Touche LLP professionals—Kyle Cheney, Deloitte partner and controllership strategy offering leader (kcheney@deloitte.com), and Temano Shurland, Deloitte principal and controllership strategy offering leader (tshurland@deloitte.com)—for their contributions.

May 2023