The devastating effects of climate change are everywhere: Wildfires. Hurricanes. Floods. Unprecedented soaring global temperatures—with 2023 the warmest year on record, according to the Copernicus Climate Change Service.

Businesses are feeling the heat, too. Companies are increasingly being held accountable for their contribution to greenhouse gas (GHG) emissions—and their efforts to reduce carbon footprints. All of this is driving the need for organizations to strengthen their carbon accounting.

Carbon accounting quantifies how much GHG emissions an organization generates. By using accounting methods, tools, and processes, teams can identify, collect, record, report, disclose, analyze, and monitor their company’s climate data. Internal and external stakeholders analyze all this information to support decision making.

There’s just one problem: When it comes to capturing the information needed for a robust carbon accounting system, many organizations fall short. Why? Because they aren’t applying the same standards and systems they use to measure other elements of business performance.

Management accountants can address this issue. By applying their tested practices and tools, they can ensure that a company’s climate change and reporting initiatives measure up. Of course, that’s easier said than done. So, let’s explore carbon accounting and examine its emerging challenges.

Shifting Standards

Global regulators and others that set sustainability reporting standards are racing to develop mandatory disclosure guidelines focused on carbon dioxide emissions. The European Union (EU) Corporate Sustainability Reporting Directive (CSRD) stands out as a global leader. The principal goals: achieve net zero emissions in the EU by 2050 and reduce GHG by 55% by 2030 (compared to a 1990 baseline). About 50,000 publicly listed and large companies (including non-listed large companies) must comply. Reporting requirements are phased in and U.S. companies with EU subsidiaries are included under certain circumstances.

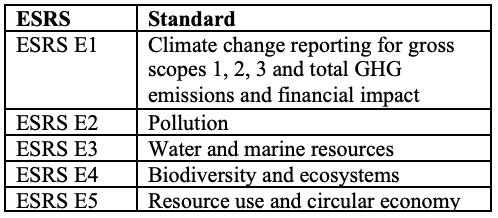

Compliance includes European Sustainability Reporting Standards (ESRS) disclosure requirements. These standards are the foundation of CSRD rules, ensuring interoperability with other prominent global sustainability reporting standards. ESRS 1 summarizes the directive’s general requirements and is supported by five environmental topical reporting standards, ESRS E1 through ESRS E5 (see Table 1).

Table 1: European Sustainability Reporting Standards

Source: Commission Delegated Regulation (EU) 2023/2772

The disclosure also requires a discussion of how a company is transitioning to a sustainable business model and contributing to the EU’s Green New Deal, an ambitious policy for Europe to become the first carbon neutral continent. In a company’s first reporting year, limited assurance by an independent third-party auditor is required. Reasonable assurance sometime in the future is under consideration. Companies also must develop a management report that discloses its double materiality.

For sustainability double materiality, companies must disclose material risks, impacts, and opportunities. They also must discuss the basis of the materiality assessment. The double materiality disclosure lens addresses two dimensions, financial and impact, where the materiality threshold for both represents severity or likelihood of occurrence. Impact materiality adopts an inside-out approach, addressing the company’s impact on the environment. Financial materiality adopts an outside-in perspective where environmental issues affect the company’s cash flow.

However, the global reporting landscape is unbalanced. The U.S. Securities & Exchange Commission (SEC) adopted new rules in March 2024 that will be phased in starting in 2025. Although the final rules are in line with the Task Force on Climate-related Financial Disclosures (TCFD), they aren’t as stringent as EU standards—or even those in U.S. states like California. Compliance with the U.S. mandates requires some companies to report and disclose their GHG emissions, data that’s not part of traditional enterprise resource planning (ERP) systems because it’s based on nonfinancial metrics. This illustrates the complex world of carbon accounting—and why management accounting professionals are uniquely suited to navigate it.

The GHG Effect

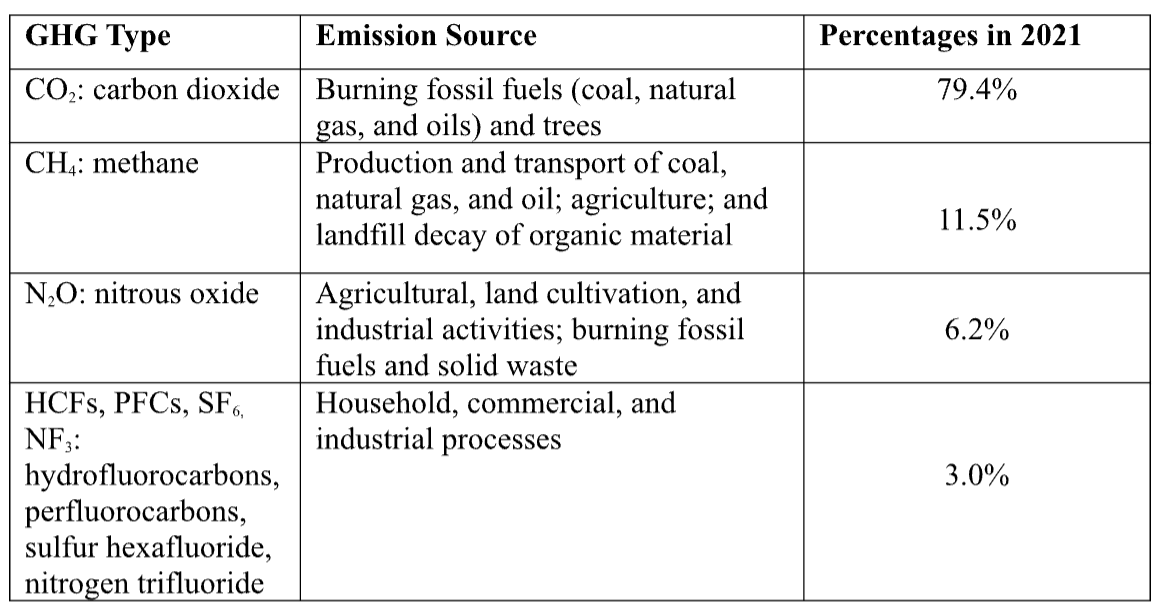

Carbon accounting also requires understanding GHG emissions and setting up an accounting system to quantify their use. In the past 30 years, GHG emissions from human activity have soared. Table 2 explains the seven most common emissions sources and their prevalence in the United States in 2021. According to the United Nations Environment Programme, human activities are causing the surge in carbon emissions. When those trapped emissions can’t escape into space, global temperatures rise. Carbon accounting reporting mandates require quantifying an organization’s carbon emissions within the company and across its supply chain.

Table 2: GHG Type and Emission Source

Source: U.S. Environmental Protection Agency

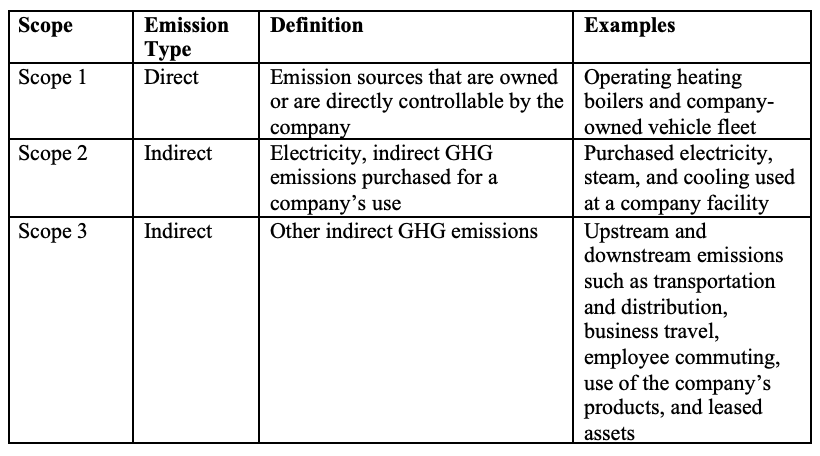

In 2001, the Greenhouse Gas Protocol issued A Corporate Accounting and Reporting Standard (revised in 2015). It provides corporations and organizations guidance for measuring and reporting the seven GHGs discussed in Table 2. As the gold standard for GHG emissions reporting, the GHG Protocol rules are the environmental counterpart to financial reporting standards issued by the Financial Accounting Standards Board (Generally Accepted Accounting Principles) and the International Accounting Standards Board (International Financial Reporting Standards, or IFRS). GHG Protocol rules are based on the principles of relevance, completeness, consistency, accuracy, and transparency, where organizations are required to identify their consumption of direct (Scope 1) and indirect (Scope 2 and Scope 3) emissions. Table 3 details emission scopes and examples.

Table 3: Explanation of GHG Emission Scopes

To classify direct and indirect emissions, companies assess boundaries such as direct control over key decisions or an equity structure based on its investment share. Delineating boundaries helps prevent emission double counting during the consolidation process. From there, companies must quantify the carbon emissions inventory. This step allows organizations to achieve the following ESG goals: manage risks, identify opportunities to reduce emissions, participate in mandatory and voluntary emissions reporting, and join carbon trading or other markets.

Identifying, collecting, and reporting GHG emissions is a tedious task requiring companies to invest in new processes and systems to measure GHG inventories. The GHG Protocol has guidance and tools to support companies when they calculate and report GHG emission inventories, including detailed compliance-focused templates for countries, industries, and sectors.

A Framework for Alignment

Companies also need to operationalize their carbon accounting to align with financial reporting—and that can be a formidable challenge. The TCFD defined a framework to achieve this goal based on the concepts of governance, strategy, risk management, and metrics and targets. Although the TCFD was disbanded in October 2023, its charter to monitor companies’ climate change disclosures was transferred to the IFRS Foundation. By applying the TCFD’s framework and management accounting methods, a company can develop a carbon accounting system.

The framework is designed to ensure that companies disclose climate-related risks and opportunities for each element in their annual financial reports. Risk management disclosures help companies evaluate and assess climate risks. Strategy disclosures represent actual and potential effects of climate-related risks on a company’s business, strategy, and material financial impact. Governance addresses a company’s processes for climate risks and opportunities. And metrics and targets ensure material information is disclosed with appropriate metrics. Table 4 maps the TCFD’s framework to management accounting tools and their application to carbon accounting.

Table 4: TCFD Framework Mapped to Management Accounting Tools

Management accounting tools can be aligned with the TCFD framework elements to support carbon accounting:

Risk management. Start by performing a comprehensive carbon risk assessment using the Committee of Sponsoring Organizations of the Treadway Commission (COSO) Enterprise Risk Management—Integrated Framework. Applying it identifies sustainability risks and potential opportunities to provide the organization with a clear enterprise view of factors—from supply chains to competitors—that can be ranked by importance and potential impact. The results can then prioritize initiatives, including decarbonization actions. When risk assessment and management become an ongoing process, companies can update existing risks and identify new ones. This builds a strategic foundation for measuring sustainability goals and identifying material climate and carbon risks to be disclosed. Additionally, COSO issued supplemental internal control guidance for sustainability reporting—Achieving Effective Internal Control Over Sustainability Reporting (ICSR). ICSR can be used to develop, implement, and monitor a company’s sustainability risk.

Strategy. Establishing a sustainability strategy is a key element of the TCFD framework. And it doesn’t need to compromise financial performance. Let’s examine Ball Corporation, the world’s largest producer of recyclable food and beverage containers. After the company pivoted its strategy to a sustainability focus, revenue and earnings have grown steadily over the past decade. According to a company report, the sustainability strategy focuses on circularity and closed-loop recycling. It looks like this: reused aluminum generates 94% fewer carbon emissions during the manufacturing process, according to The Aluminum Association. So, with aluminum packaging at the core of its business, Ball sets and meets its recycling targets to achieve carbon reduction goals.

Management accounting tools that can facilitate sustainability strategy development include strategy maps, balanced scorecards (BSCs), and strategic control systems.

- Maps and BSCs. After defining a sustainability strategy, the next step is developing sustainability perspectives for the BSC. This could look like sustainable product innovation, supply chain partnerships that minimize the carbon footprint, and lowering the carbon impact of manufacturing processes—followed by identifying objectives and measures to achieve these targets. Creating a stand-alone sustainability BSC followed by a strategy map is also an option. The visualization tool depicts the cause-and-effect relationships of the objectives, showing how they align to the goals and measures of the company’s strategy.

- Strategic control system. Any sustainability strategy must be measured, evaluated, analyzed, monitored, and adjusted to ensure accountability and accurately track progress. Workiva’s ESG Explorer and SAP’s Sustainability Footprint Management are examples of automated systems that track and report carbon accounting.

Governance. Oversight of a company’s sustainability initiatives is critical. The first component of the COSO ICSR, control environment, provides a company guidance for establishing sustainability governance. It stresses the importance of integrating the sustainability function throughout an organization, starting with a clear structure of sustainability responsibilities established by the board of directors. Likewise, companies should appoint a chief sustainability officer and create a sustainability board committee to oversee and monitor initiatives, ensuring accountability with company goals. Many companies are even appointing an ESG controller to coordinate sustainability initiatives. For instance, Ball Corporation created an ESG and sustainability council that reports to its board of directors. Establishing such oversight ensures that the board’s audit committee is involved in any government-required sustainability disclosures.

Metrics and targets. A company needs to establish relevant metrics and measurable targets in order to effectively track its climate change actions and decarbonization progress. Several management accounting tools support these objectives including the BSC for performance measurement, nonfinancial metrics, activity-based costing (ABC), and activity-based management (ABM).

- BSC. A sustainability BSC (or adding a sustainability perspective to an existing BSC) can assess whether the company is successfully achieving its goals and targets.

- Nonfinancial metrics. Many climate change metrics and KPIs are nonfinancial and prescribed in regulatory mandates. A company might need to develop additional nonfinancial metrics to represent climate initiatives specific to the company. Because several mandates require disclosure of the financial impact of climate change, companies might need to convert nonfinancial metrics to monetary amounts.

- ABC. GHG emissions and other climate change impacts are indirect product costs. Under traditional product-costing methods, the cost of climate change (CoCC) is not allocated to products. ABC can achieve this objective to show a product’s true cost by creating CoCC indirect cost pools and identifying the drivers to allocate the product costs. Because many climate change metrics are nonfinancial, it’s necessary to convert the metrics into a financial cost. The focus on cost drivers helps organizations uncover insights into the levers driving carbon emissions.

- ABM. This can be applied to manage carbon emissions and climate change impacts. The true value of ABM is it allows a company to analyze the cost drivers and processes in the manufacturing or service activity. This in turn helps identify opportunities to reduce a company’s carbon footprint through innovation or reengineering. ABM can also help a company adjust its product mix to help achieve emissions targets.

The Role of Management Accountants

Climate change is raising the stakes for companies around the world—and business and government leaders agree there’s an urgent need for action. “Unless we rapidly repair and restore nature’s unique economy, based on harmony and balance, which is our ultimate sustainer, our own economy and survivability will be imperiled,” King Charles III declared last year at the 2023 United Nations Climate Change Conference (COP28).

Management accounts can play a critical role. With access to many powerful tools that elevate a company’s carbon accounting, professionals who report and manage carbon accounting can strengthen their organization’s sustainability initiatives.

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Air Force, the Space Force, the Department of Defense, or the U.S. Government. Distribution A: Approved for Public Release, Distribution Unlimited:

PA#: USAFA-DF-2024-50.