Amid any global economic uncertainty—ranging from inflation to interest rates—CFOs must demand more frequent, accurate forecasts and reporting to stay ahead of volatile conditions. Such efforts can drain resources and lead to ineffective data, controllership, and budgeting/planning. There’s also a growing gap in the skills needed to complete capital management, financial planning, and analysis tasks.

That’s why CFOs need to invest in the right strategies and technologies. They must be able to support robust, self-service processes, and ensure their companies don’t lose efficiency or critical knowledge—especially when others leave or move on to new roles. Finance teams also must learn how to leave more time for collaboration, preparations, and forecasting, alongside promoting flexible solutions. How? Proper leadership and effective tech integrations.

Diving deeper into disruption

High interest rates and inflation will likely persist through at least 2025, according to the International Monetary Fund’s most recent global forecast. And with tighter budgets slowing down hiring, finance teams need to maximize resources. CFOs must incorporate digital tools that can help existing teams increase productivity and offload mundane tasks—both of which can improve job satisfaction and talent retention.

Of course, most finance teams have recent experience with uncertain markets and are familiar with doing more with less. But as we approach 2025, the “do” portion can be more targeted and proactive as companies seek to modernize and mature finance team processes.

This leads to the critical question: How can my team achieve predictability amidst uncertainty? The key is to be nimble enough to adapt quickly to any market changes. For this year and beyond, finance teams can develop agility that drives resilience.

Finance team challenges

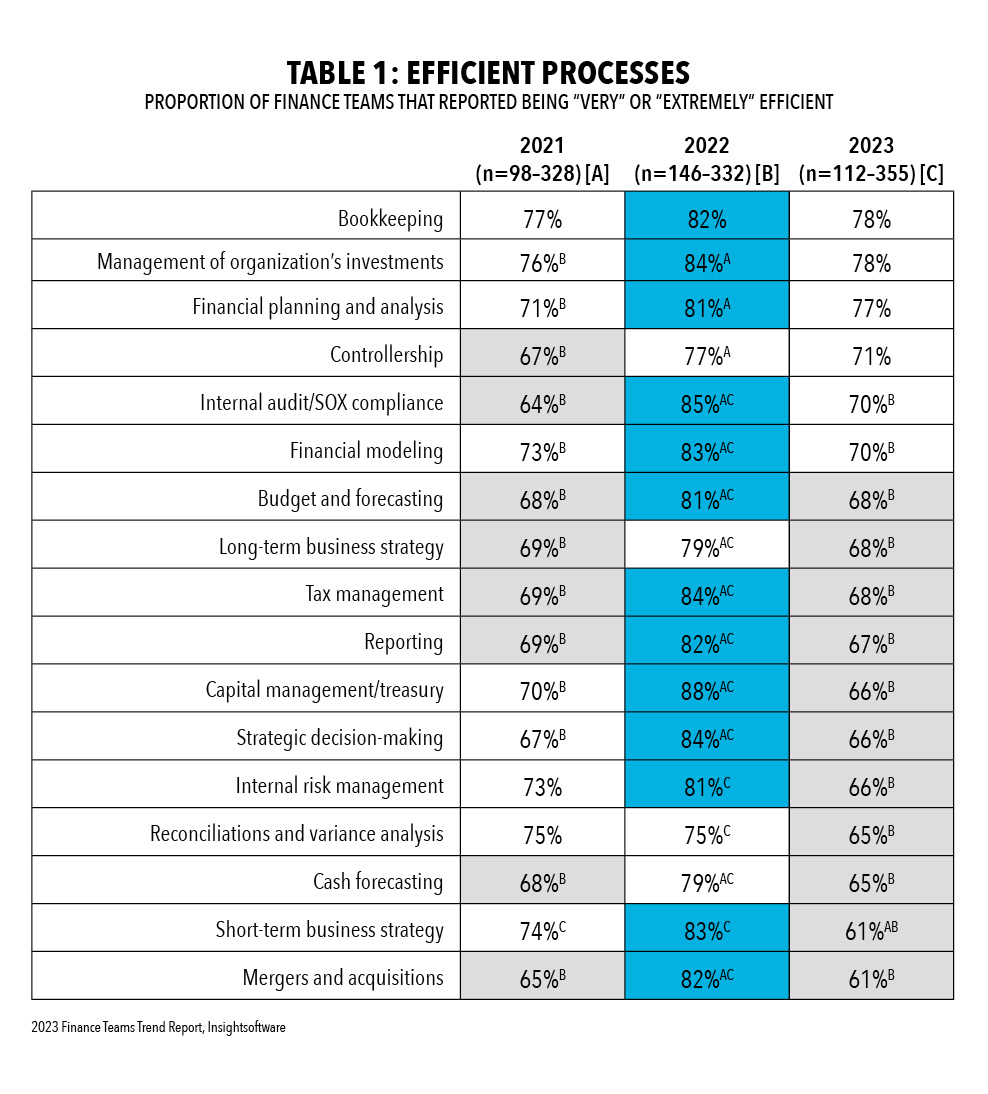

Today’s finance teams are battling myriad obstacles as they strive to maintain productivity levels. Despite efforts, a 2023 survey by insightsoftware found teams are less efficient across all their responsibilities in 2023 when compared to 2022, as shown in Table 1:

- Economic disruption (48%)

- Interest rates (42%)

- Skills shortages (41%)

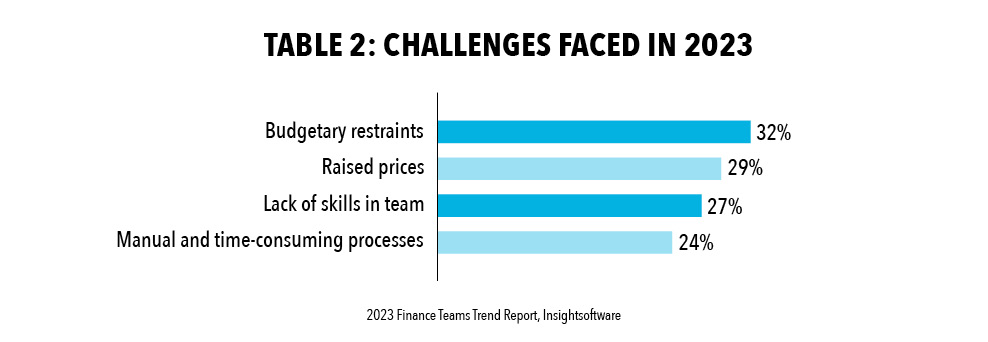

However, adding more resources to counteract these deficiencies isn’t necessarily an option. The survey indicates only 64% of respondents expected to grow their finance team in 2023— compared to 73% in 2022. The lack of human capital means finance teams must find creative ways to maintain productivity with fewer people, as shown in Table 2:

Unfortunately, current efforts are proving unsuccessful: More than one-third of finance leaders report their teams are unable to specifically execute financial planning and analysis tasks (42%) and capital management/treasury-related tasks (41%) due to such skills shortages, according to the survey.

Staffing issues can be attributed to reduced hiring, the use of contractors and temporary hires, and, of course, layoffs. All of these factors contribute to increased workloads and burnout rates across finance and IT departments. This means finance leaders will need to help team members preserve their work-life balance so staffing issues aren’t exacerbated by higher turnover rates.

New regulations will also strain the bandwidth on financial teams by requiring them to perform more efficiently.

For example, this year, Pillar Two of the Base Erosion and Profit Shifting 2.0 initiative took effect in many countries. This imposes new data reporting requirements and additional global tax compliance challenges for every multinational business with revenue greater than €750 million. This will add another layer of complexity to tax calculations, analysis, and compliance —increasing tax department workloads where standalone spreadsheets and manual reporting will no longer be an efficient choice.

In addition, a 2023 SEC guideline change increased regulatory reporting responsibilities for an already-overwhelmed CFO office. So it’s no surprise that in a 2023 Deloitte survey, 43% of finance chiefs cited increasing regulations and working with regulators as one of their top challenges related to managing enterprise risk. Whether it’s the SEC guidelines or other new reporting requirements, CFOs need to access reports quickly and draw conclusions on potential breach impacts even faster —adding more pressure to their finance teams.

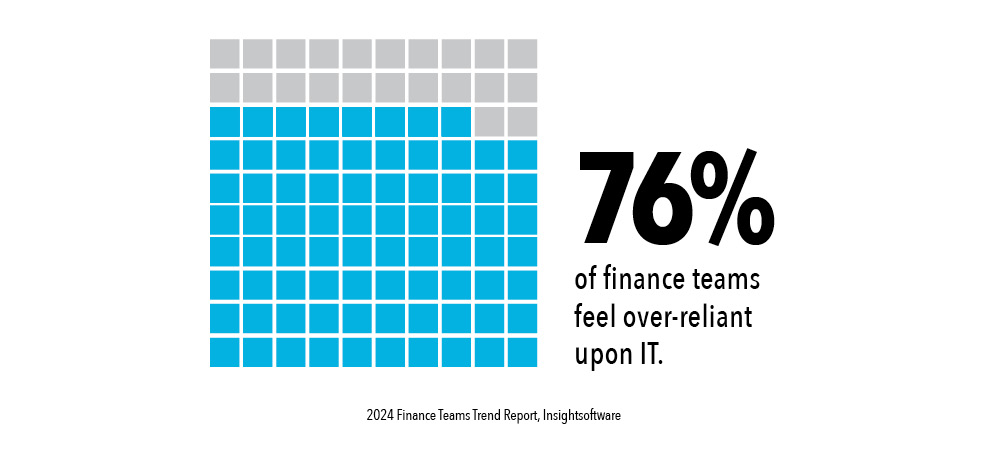

These challenges also impact how the financial department collaborates with other areas of the business. When stakeholders ask a question only a custom report can answer, finance teams have no choice but to rely on outside IT teams or consultants with technical expertise to run them. As a result, the IT department is increasingly responsible for managing and integrating financial data. Results from the 2024 insightsoftware Finance Team Trends survey found 76% of finance teams felt over-reliant upon IT, a significant increase from 66% in 2023.

Data integration is the cornerstone of efficient financial operations, powering everything from reporting to budgeting, planning, close, consolidation, tax, and regulatory compliance. While the challenges of managing disparate data sources and overcoming the limitations of out-of-the-box reporting tools are well understood, traditional reliance on IT for data-driven insights is hindering business agility. Overdependence on IT creates bottlenecks and slows decision making.

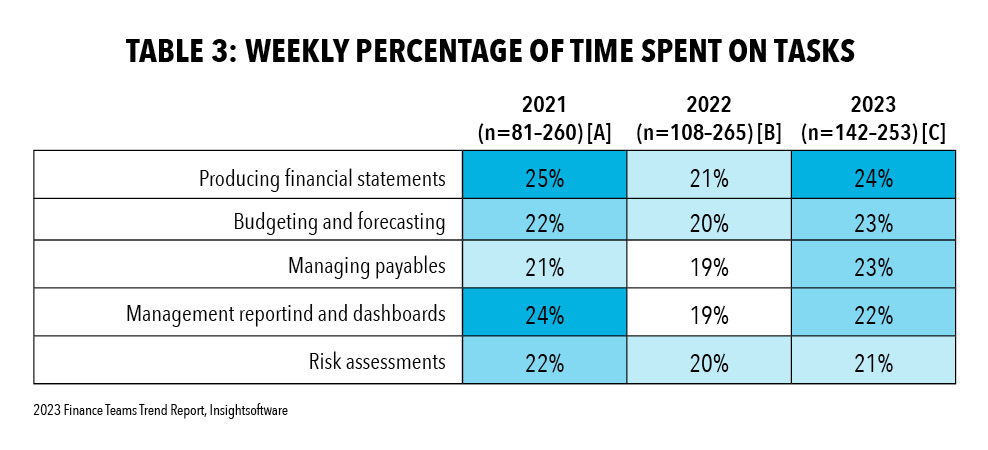

According to the 2023 insightsoftware survey, more than two-thirds of IT and finance professionals spend a day each week on operational reports (see Table 3). Why? Because far too many finance teams are still using basic ERP-native reporting, which isn’t customized to meet the specific needs of an organization. Using ERP-native reporting alone makes it almost certain that teams will need to adapt included reports in some way by involving IT or outside consultants. Additionally, nearly 60% of organizations with 1,000 or more employees still use spreadsheets across teams, according to the insightsoftware survey. This can lead to siloed, error-prone data that’s time-consuming to pull. Plus, that data will likely need to be reformatted for analysis and cross-checked. All that work results in static data that’s outdated and no longer accurate.

A CFO can’t operate on revenue and expense numbers alone. They also need to know what the status of those numbers means, which will only increase the need for further reporting including these top-level reporting tasks.

As these challenges become increasingly formidable, CFOs will need additional support to meet demands.

The CFO's response

Today’s CFO roles are rapidly evolving beyond accountant or financial analyst. CFOs must now be creative thinkers who can see the big picture. This is achieved when CFOs and their teams aren’t siloed from the rest of the company. They can work to elevate collaboration by understanding where it’s needed most.

For example, smart collaboration can increase productivity. A good CFO knows how to create processes that benefit all teams across the enterprise. This requires keeping everyone in the loop on the company’s financials. But colleagues outside the office of the CFO don’t have time to trudge through data. CFOs need to share the most important information with the right people at the right time to keep the company agile.

The modern CFO must also walk a fine line when it comes to risk. Their efforts to reduce risk shouldn’t stifle innovation or the pursuit of growth. Collaboration can help drive innovation by bridging diverse viewpoints across the company in a low-risk environment. This means operations and finance must collaborate to achieve company goals. Open communication and information sharing between the CFO and other executives and their offices creates access to key financial information and inspires strategic decision making.

Establishing these practices will allow a CFO’s colleagues to feel confident they’re receiving consistent financial perspectives, while non-finance executives will be reassured that they’ re being sufficiently updated on organizational priorities and challenges. But CFOs should also remember that collaboration goes both ways. Being open to suggestions, even if they come from outside the financial department, can lead to fresh perspectives and unique insights.

To make the CFO office a well-oiled machine, every individual, no matter their title, should be working together to contribute to the larger goal. By encouraging their team to share ideas, knowledge, and new skills, CFOs can forge a united front that will help the day-to-day tasks run more smoothly.

Integrating improved solutions

Implementing the right automated tech can also help companies and their finance teams accomplish more with less. As financial technology evolves and improves, CFOs must keep up with the most recent innovations. The right tech tools can offset skills gaps through automated processes, freeing up time for team members to do more analysis to improve decision making. This involves eliminating as many manual processes as possible to save time and resources for all finance professionals.

To accelerate the transition to new automated technologies, CFOs should look for tools that use familiar interfaces. Doing so reduces the learning curve so teams can quickly generate reports and efficiently present useful information to the entire organization.

Automation can free up time and resources in other business areas as well, especially IT. The right self-service reporting technology can eliminate the need for IT-driven report creation. It puts the business user in control by enabling them to access the information they need to satisfy pressing questions. It also helps IT regain valuable time—and increases confidence that business users can now access accurate, up-to-date, and consistent information.

For example, when fitness facility and equipment company Thomas Wellness Group (TWG) relocated and consolidated operations, it was faced with growing complexity and struggled with manual processes that consumed valuable staff time. However, leadership knew that investing in the right technology systems would drive new efficiencies. By implementing a solution that allowed TWG to automate some internal processes and design custom reports, the company was able to meet all needs with a single solution implementation.

This transformation gave internal users constant access to sales backlog reports and inventory status. At the same time, executive managers could access accurate, real-time budget reports and sales gained access to order reports. All of this kept teams informed about the state of the company’s future revenues.

More specifically, TWG was also able to:

- Report on live Dynamics data from within Microsoft Excel

- Drill down to transaction-level data from any report

- Publish reports to the web quickly, easily, and securely

TWG’s finance team estimates it has saved at least €3,500 per year, just based on its ability to automate reports. The operations department estimates saving about 15 hours per month on reporting. Moreover, the ERP project manager noted that “it has changed the way we do business, and today, most of our team cannot imagine going back to the old ways of doing things.”

This is just one example of how inserting the right automated technology can create more opportunities for reporting, publishing, and data analytics. By evaluating the main challenges, CFOs can look to integrate automation tools that allow team members to spend more time on analytics and high-level priorities.

The future of finance

Do more with less. That mantra will drive finance teams for the foreseeable future. Those that leverage strategic collaboration along with automated financial reporting and planning tools can streamline workflows and buy back hours of precious time previously spent on tedious manual processes.

Although access to more sophisticated data collection, reporting, and modeling tools is a game-changer, it’s still up to finance teams and their CFOs to turn those numbers into a story. This means that with the right combination of technology and leadership, CFOs can enable real-time reporting, deep-dive analytics, and faster decision-making needed to elevate agility amid any market uncertainty.