Recognizing that the U.S. tax code is influenced considerably by intensive lobbying from big business, Congress established the Taxpayer Advocate Service (TAS) in 1997 specifically to give a voice to individuals and small businesses. As an independent organization within the Internal Revenue Service (IRS), the TAS offers a variety of support and advocacy. It can provide assistance on specific cases, often taking an adversarial role with the traditional IRS organization to help advocate for the taxpayer. It also uses a proactive customer service model to address systemic issues that affect multiple taxpayers. And a number of programs and services provided by the TAS can be used by small businesses.

CASE ADVOCACY

Individual taxpayers and small businesses may be eligible for help on their specific cases if they have a problem that’s causing them financial difficulty or if they believe an IRS procedure isn’t working as it should. While assistance isn’t guaranteed, there are four general categories for receiving help:

- Taxpayer financial difficulty, emergency, or hardship;

- Different IRS units are involved, with the TAS serving as a coordinator;

- The taxpayer tried to resolve an issue, and normal IRS channels appear to have broken down; or

- The taxpayer is presenting unique facts or issues, and the IRS is applying an inflexible “one-size-fits-all” approach.

One example of TAS assistance involves a small business taxpayer that was unable to pay its employees because of an IRS levy. The taxpayer had previously negotiated an installment agreement and was making the payments, but the IRS hadn’t released the federal payment levy. The TAS advocated to have the levy released and the proceeds returned to the taxpayer. There was some initial resistance from the IRS revenue officer, but with some persistence the advocate was able to help the taxpayer receive a beneficial outcome. Other examples of case advocacy, including assistance offered to small businesses, can be found at bit.ly/2HIi3rS.

SYSTEMIC ADVOCACY

Besides individual intervention, the TAS addresses systemic issues that affect multiple groups of taxpayers. One area focuses on the complexity of the tax code, which can add significant costs for small businesses. The effort to reduce that complexity is led by the Office of Systemic Advocacy. It involves study, analysis, and formal recommendations from subject-matter experts working with taxpayers in a nonthreatening, cooperative manner.

The Office of Systemic Advocacy also supports the Taxpayer Advocacy Panel (TAP), an independent panel of knowledgeable citizen volunteers whose mission is to listen to taxpayers, identify their issues, and make suggestions for improving IRS service and customer satisfaction. TAP members work on a variety of topics with an emphasis on those involving wages and investment as well as small businesses and the self-employed. There are six TAP committees empowered to work with the IRS to obtain information, provide observations, and submit recommendations on issues relevant to each committee’s focus area.

TAP annually publishes a website with issues and accomplishments (see improveirs.org). In 2017, TAP’s six core project committees submitted 35 referrals that contained 326 specific recommendations to the IRS for consideration. Of the 161 recommendations to which the IRS responded, 43% were adopted in whole or in part, which will result in improved service to taxpayers.

Nina Olson, the National Taxpayer Advocate (NTA), is the leader of TAS and submits several reports to Congress each year. The annual report contains a summary of the 20 most serious problems (MSP) encountered by taxpayers, recommendations for solving those problems, and other IRS efforts to improve customer service and reduce taxpayer burden. Almost every serious problem identified has an explicit or implicit impact on some small businesses.

A prime example from the 2017 annual report is MSP #14, “SHARING ECONOMY: Participants in the Sharing Economy Lack Adequate Guidance from the IRS,” which involved the “sharing” (or gig) economy (bit.ly/2VOcpZp). MSP #14 outlines the lack of tax guidance the IRS provides to participants in the sharing economy, such as Uber drivers and Airbnb providers, and analyzes the problem. This includes addressing their classification—as employees or independent contractors—and their tax filing and recordkeeping requirements.

OTHER RESOURCES AND SUPPORT

The NTA and related groups, such as the TAP, TAS, and the Office of Systemic Advocacy, participate in outreach events. TAS conducts Problem Solving Day events and taxpayer clinics in communities throughout the country. During these events, local TAS employees assist taxpayers in person with tax problems they haven’t been able to resolve with the IRS. For a list of upcoming Problem Solving Day events, see bit.ly/2TMKfBs.

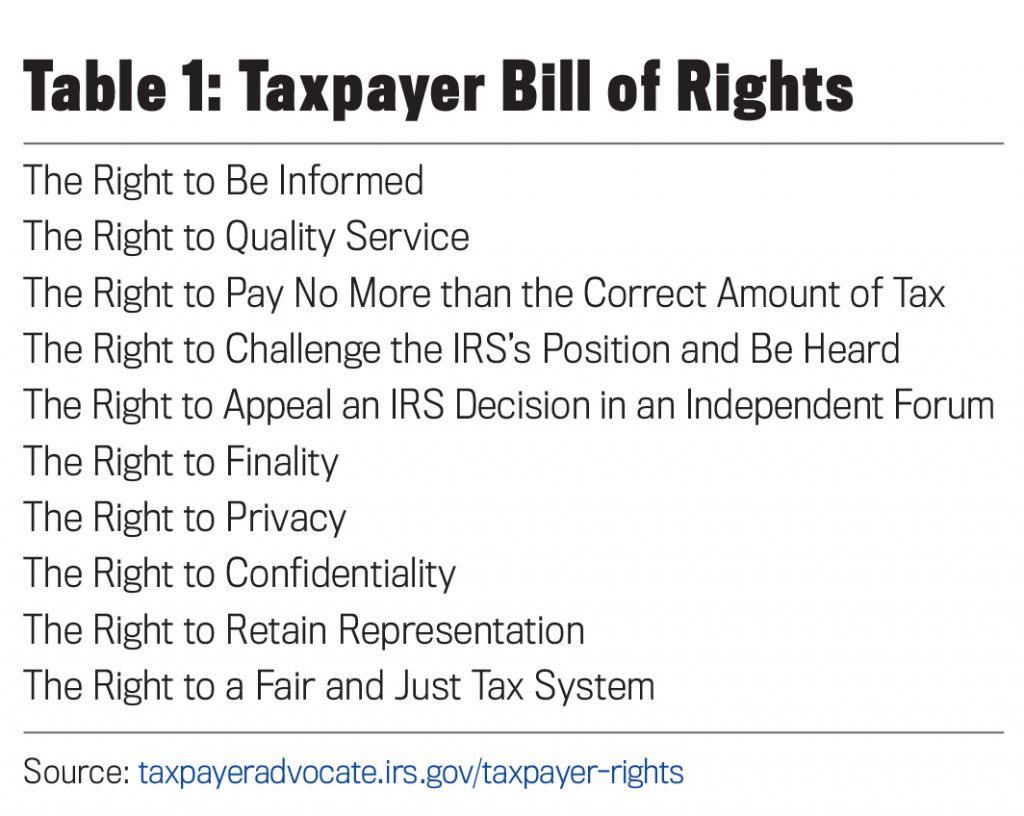

Following the lead of the NTA, the IRS has adopted a Taxpayer Bill of Rights (bit.ly/2JnqQlF). It groups the existing rights in the tax code into 10 fundamental rights and presents them in a clear, understandable, and accessible fashion. (See Table 1.) Recently, in her annual report to Congress, Olson noted, “Taxpayer rights should serve as the foundation for the U.S. tax system. While the IRS possesses significant enforcement authority, our system relies on taxpayers to file tax returns on which they self-declare their income and to pay the required tax. Clarifying that taxpayers possess these rights is not only the right thing to do, but TAS research suggests that when taxpayers have confidence the tax system is fair, they are more likely to comply voluntarily, which should translate into enhanced revenue collection.”

Small businesses pay a lot of taxes, and the complexity of the tax code adds significant costs. Engagement is key to making systemic improvements. The efforts discussed here are potential avenues that a small business can engage in. Since it’s the IRS, and the IRS loves forms, it’s no surprise that there’s a form for taxpayer engagement (IRS Form 14411, Systemic Advocacy Issue Submission Form, bit.ly/2Ofs4hF).

The TAS calls itself “Your Voice at the IRS.” To be effective, it needs to hear from you.

April 2019