In each of these cases, IMA® (Institute of Management Accountants) has you covered. Look to the IMA Management Accounting Competency Framework—and IMA’s CareerDriver® tool that’s based on it—to identify the skills you’ll need in today’s business environment and beyond.

Newly updated, the Competency Framework reflects the evolving skill set needed in today’s rapidly changing practice environment and helps management accountants prepare to be future-ready. The update of the Competency Framework is part of IMA’s ongoing efforts to ensure that its members and others in the management accounting profession possess the skills required to succeed in the workplace. It reflects both the evolving role of the finance function and the impact of technology on the global business environment.

THE CHANGING ROLE OF FINANCE AND ACCOUNTING PROFESSIONALS

Accounting and finance teams traditionally have concentrated on value stewardship, financial reporting, and compliance. Oversight and hindsight were the focus of these roles. Oversight includes resource allocation, ensuring a healthy financial profile for future investment, and more. Hindsight involves looking back to influence the future in a positive way using historical data for future projections. Oversight and hindsight will continue to remain key responsibilities of the finance function.

Yet research conducted by IMA and others has documented an ongoing transformation of the finance function in which it is becoming more strategically oriented, shifting to higher-value-added, strategic activities and away from lower-value-added, day-to-day operational ones. The evolving responsibilities of finance now include value creation, providing insight (turning information into intelligence) and foresight (anticipating the future), and serving as strategically oriented business partners. These are critical competencies and focus areas globally as organizations look to gain market advantage in an increasingly competitive and commoditized business environment where the speed from product launch to maturity is faster than ever before.

In order to succeed in this evolving role, management accountants will need to employ more sophisticated analytics. In the past, management accountants were asked to provide descriptive and diagnostic statistics. (Descriptive statistics describe what has happened; diagnostic statistics describe why it happened.) As shown in Figure 1, we must move to the higher end of the analytics continuum—to predictive, prescriptive, and adaptive analytics (which look at what will happen and what should be done).

In many organizations, finance is taking the lead in implementing leading-edge analytics and is now viewed as more of a business partner or business leader. This change has also been enabled by the greater efficiency of the finance function driven by the deployment of technology. The automation of lower-level, more routine tasks has enabled the finance function to deploy resources on higher-value-added, partnering activities.

IMPACT OF TECHNOLOGY AND DATA ANALYTICS

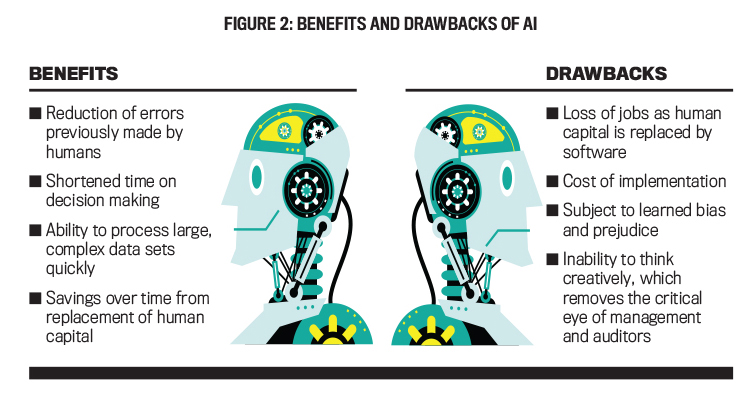

Accountants and finance professionals have always been at the heart of data-related work. Now, as the “Data Revolution” causes huge shifts in the data landscape, the very nature of the profession is being affected significantly. (See “The Data Revolution” from ACCA (Association of Chartered Certified Accountants) and IMA at http://bit.ly/2Eel2q9.) While technological change will provide challenges for management accountants’ careers, it also represents an opportunity for our profession.

Finance professionals increasingly will become free from rote, repetitive tasks such as billing, management reporting, and general accounting. They will be able to spend less time collecting and organizing financial data and more time evaluating, analyzing, and interpreting it. They will focus more on decision making, especially since they will have access to more and better data. Management accountants will be able to spend more time looking at trends, developing insights, and connecting with the upper echelon of leadership.

Technological advances are enabling companies to employ advanced analytical techniques that often are combined with the use of Big Data. Today, most organizations believe that enhancing their analytical capabilities is critical to their success and survival, so they’re working to implement such tools. Analytics is being implemented in key areas such as performance evaluation and strategy formulation and implementation, yielding substantial benefits.

Companies that are ahead of or on par with their competition in developing and executing strategy also tend to be better than their competition in their ability to make timely decisions. Organizations that are predominantly reactive to moves made by their competition aren’t agile in strategic decision making. A lack of analytical capabilities—including both taking too long to gather data and taking too long to make decisions once that data is collected—contributes to their lack of agility.

To help management accountants and other professionals keep up to date with these latest trends and more in technology and data analytics, IMA created a Technology & Analytics Center (http://bit.ly/2UZ3WC7). The Center contains a variety of pertinent educational and professional resources including webinars, articles, online courses, and research.

THE GROWING IMPORTANCE OF ETHICS IN THE DIGITAL AGE

As organizations deploy new technologies, ethical business practices will need to grow and evolve in step. Issues such as how much privacy employees and customers are entitled to in this Digital Age, the extent to which technology can be used to gain insights regarding competitors, and the extent to which employers should monitor their employees’ electronic activities are becoming increasing critical. In a time when organizations’ value increasingly consists of intangible assets such as brand value, the failure to prescribe and follow ethical practices increasingly has the potential to impact organizations negatively.

In keeping with finance’s traditional role of putting policies and procedures in place to safeguard organizational resources and of overseeing compliance efforts, the function is often viewed as an ethical leader within the organization. Technological advances will only increase the importance of this role as the integration of new technology gives rise to situations such as those just described, generating new ethical issues. As management accountants move away from compiling and reporting information and assume more strategic roles, they will increasingly encounter complex business situations that require an understanding of how to act in an ethical manner. Management accountants will need to conduct themselves in a way that reaffirms our profession’s ethical guidelines and values.

FUTURE-PROOFING MANAGEMENT ACCOUNTANTS

Again, the environment in which management accountants function is undergoing very significant change, and this will continue in the future. How well we respond as a profession to the coming challenges and opportunities will determine the relevance of management accounting in the future. As digitization continues to eliminate low- and (to some extent) mid-level positions, moving up the value chain by providing greater strategic and tactical insights to the rest of the organization will be key.

Few professionals will be left untouched by this change. In fact, a study by Forrester Research, Inc. (“The Future of Jobs, 2027: Working Side by Side With Robots,” April 3, 2017) predicts a loss of 72% of jobs in management, business, and finance by technology by the year 2020. But this doesn’t mean there won’t be jobs in management accounting. What it means for businesses and individuals is that, with this changing role, management accountants will need to upskill, acquiring new skills and proficiencies.

Many jobs today—and many more in the near future—will require specific skills, including a combination of technological know-how, problem solving, and critical thinking, as well as soft skills such as perseverance, collaboration, and empathy. As a leading management accounting association, IMA works to ensure that its members and others in the profession possess the skills required to succeed in the workplace by providing numerous resources, including its Management Accounting Competency Framework.

IMA MANAGEMENT ACCOUNTING COMPETENCY FRAMEWORK

With the changing of the business environment, IMA recognized the need to enhance its Competency Framework with additional skills. To ensure that the Competency Framework reflects the current and future competencies management accounting professionals need, last year IMA formed a task force that was charged with examining the changing practice landscape and proposing any necessary changes.

After a comprehensive process that included a review of primary and secondary research, focus groups, and extensive deliberation, the task force developed a revised Framework that was exposed for a 90-day comment period. Feedback on the Exposure Draft was incorporated into the updated Management Accounting Competency Framework that was just released. (It’s available at http://bit.ly/2S1bFO8.)

The new Competency Framework is accompanied by a mapping of the competencies to the content of the revised CMA® (Certified Management Accountant) exam that will be implemented in January 2020 as well as a list of select learning resources by competency domain.

ESSENTIAL KNOWLEDGE DOMAINS

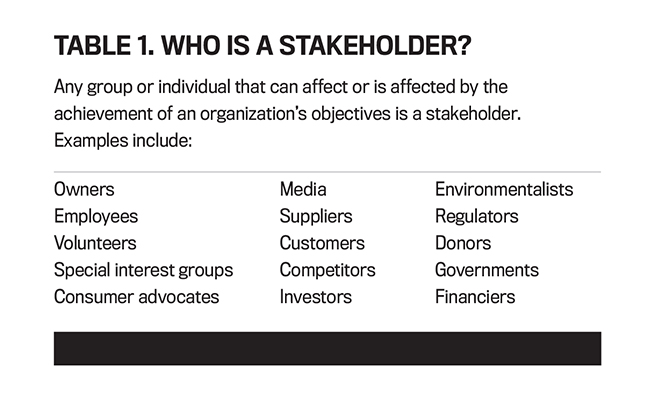

The updated Framework organizes the essential competencies for management accountants into six knowledge domains, which are areas of core skills that management accountants need to remain relevant in the Digital Age. (Figure 2 contains descriptions of the domains and their competencies. Table 1 lists the domains and their competencies.) These domains differ from those in the prior Framework in important ways.

Strategy, Performance & Planning

This domain contains the competencies required to envision the future, lead the strategic planning process, guide decisions, manage risk, and monitor performance. It includes competencies that were in the prior Framework’s Planning & Reporting and Decision Making domains. Pulling all the competencies related to strategic planning and performance together in one domain reflects the evolution of the role of management accountants and the increasing importance to them of mastering competencies related to strategy formulation, validation, and implementation.

In keeping with the increased emphasis on strategic management, the Cost Accounting and Cost Management competency in the Planning & Reporting domain of the prior Framework was split into two parts: Strategic Cost Management and Cost Accounting, with the former included in the new Strategy, Performance & Planning domain in recognition of the essential role that managerial costing plays in strategic decision making.

Reporting & Control

This domain includes the competencies required to measure and report an organization’s performance in compliance with relevant standards and regulations. As such, it relates to management accountants’ traditional role of providing oversight and hindsight. Yet even as the role of management accountants evolves, these responsibilities remain important and are themselves evolving.

While incorporating many of the competencies in the prior Framework’s Planning & Reporting domain, this new domain also contains new ones, including Tax Compliance & Planning and Integrated Reporting. This reflects the changing external reporting environment and the stakeholders’ demand for enhanced performance disclosures across multiple dimensions.

Technology & Analytics

The greatest change to the Competency Framework is the addition of the Technology & Analytics domain. While the prior Framework included a Technology domain, the rapid advances of technology and the deployment of advanced analytics required a complete reexamination of the domain.

This new domain includes the competencies required to manage technology and analyze data to enhance organizational success. It takes a holistic view of data and includes competencies related to data acquisition, data analysis, and the presentation of that analysis, all while ensuring the integrity and security of the data.

Management accountants will most need to learn new competencies in this area so they can succeed in the future. They must be able to successfully extract and analyze the immense amount of information at their disposal. They must acquaint themselves with the latest methods of data governance, query, analytics, and visualization. Combining knowledge of technology with strategic and leadership skills will enable finance and accounting professionals to decipher and communicate the story the data is telling.

Business Acumen & Operations

Included in the prior Framework as Operations, this domain has been expanded to encompass the competencies required to contribute as a cross-functional business partner, assisting in the transformation of company-wide operations. While an understanding of an organization’s operations remains a critical competency for management accountants, the scope of this domain has expanded.

In keeping with the advancing technological environment, management accountants will need to understand the impact technology will have on business risk, processes, and models. This includes how current and expected technologies will impact the manner in which business is conducted and measured. Management accountants need to be able to evaluate outcomes within the proper context by “asking” large amounts of data the right questions to form business decisions and make judgments and also to obtain better insight into the overall operations of a business.

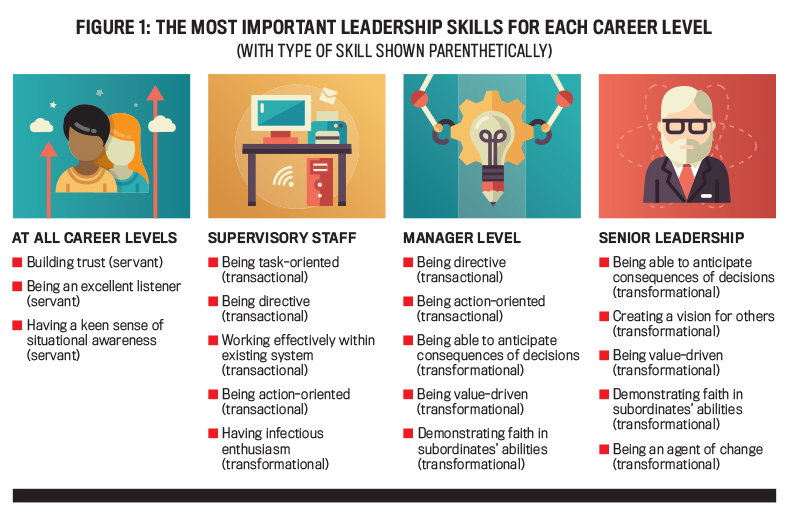

Leadership

Leadership encompasses the competencies required to collaborate with others and inspire teams to achieve organizational goals. Its standing as the only unchanged competency domain reflects the fundamental, enduring importance of this competency for management accountants. The ability to serve as an effective leader, both within the finance function and across the organization, will be an increasingly important competency as management accountants strive to become business partners within the larger organization.

Professional Ethics & Values

A major change to the Competency Framework is the addition of the Professional Ethics & Values competency domain. While Professional Ethics was included in the prior Framework as part of the Decision Making domain, the addition of this domain in the new Framework recognizes the critical foundational importance of professional ethics and values to the practice of management accounting.

The presentation of this domain in Figure 2 underscores the importance of competency in this area. Professional ethics and values need to underly and permeate all that finance and accounting professionals do. Their importance will only increase with time.

What does this competency domain comprise? First, it includes the ability to personally exhibit professional ethical behavior. We define this as the ability to comply with a set of guiding principles that govern a person’s behavior in the workplace. But Professional Ethics & Values is more than just this. It also includes the ability to recognize ethical conflicts and lapses in the workplace and take appropriate action. Finally, it includes the ability to execute an organization’s strategy with integrity, complying with the law, regulations, and standards in the regions in which an organization operates.

In order to recognize and resolve unethical behavior, management accountants need to be able to apply professional skepticism in the workplace. While the concept of professional skepticism is well established in public accounting, it’s a fundamental characteristic that’s applied in the work of all professional accountants, including those who work in business. Given their professional status and influence in the financial reporting supply chain, all professional accountants should apply professional skepticism regardless of where they are employed.

The importance of management accountants exhibiting professional skepticism has been noted by several International Federation of Accountants (IFAC) committees/boards. IFAC’s Professional Accountants in Business (PAIB) Committee notes that it “strongly believes professional skepticism is a fundamental ethical obligation applied in the work of all professional accountants including professional accountants in business, and is a key distinguishing element of the profession.”

Similarly, IFAC’s International Accounting Education Standards Board (IAESB) noted in an October 2018 issues paper, “Importance of Professional Skepticism to the Competence of All Professional Accountants,” that “Professional skepticism is an integral part of a professional accountant’s skill set and adopting and applying a skeptical mindset is ultimately a personal and professional responsibility to be embraced by every professional accountant.

As a result, IAESB members agreed that the concept of professional skepticism in the [International Education Standards] should continue to be interpreted to apply to the broader context of the role of professional accountants and not just auditors.” Finally, IFAC’s Small and Medium Practices (SMP) Committee “supports the concept that professional skepticism should be applicable to all professional accountants.”

As you can see, it’s time for accounting and finance professionals, especially management accountants, to make sure our competencies are at the highest level possible. Then we’ll be ready to forge ahead in any endeavor.

IMA’S CAREERDRIVER®

The IMA Management Accounting Competency Framework reflects the competencies needed to succeed in our rapidly changing practice environment. Which ones are best for you to work on? You can find out by using IMA’s CareerDriver (http://bit.ly/2DJmL5i).

IMA’s approach to competency building is unique in that it doesn’t stop at the Framework level in defining essential competencies, which is helpful at the broad level of the profession. Instead, IMA directly connects this Framework in CareerDriver to “what it means” at the individual job role level. The tool identifies the level of competency needed for 46 individual job roles for each of the 33 competencies in the Framework.

Newly updated to reflect the changes in the IMA Management Accounting Competency Framework, CareerDriver enables you to self-assess your current skills, identify short-term skills gaps or long-term learning opportunities, and fill those gaps with specific IMA and public courseware. Check out CareerDriver today to learn the skills you’ll need to progress in your career, use it to help you formulate a plan on how to achieve your career plans, and know that you are becoming future-ready.

March 2019