In the United States and Europe, CFO organizations integrate management accountants and certified financial professionals into financial planning both at the corporate and business-unit levels. In Japan, CFO organizations are responsible primarily for accounting and treasury activities and are involved in setting strategy but not leading nor owning such activities. Instead, financial planning and management control are delegated to nonfinance departments, and, generally, business units allocate their own staff to manage profit forecasts and conduct analyses with no direct reporting lines to the CFO.

All of this raises some key questions: Has the failure to include qualified financial professionals in planning and strategy contributed to the spate of fraud and ethics cases at Japanese companies? Further, is there any relationship between low profit margins and the structure of the CFO teams in Japanese companies? Can these structural differences provide any insight into the impact that CFO teams have on profitability in companies worldwide?

To help understand the issues, we surveyed members of the Japan Association for Chief Financial Officers (JACFO). Based on the survey, conducted in the fall of 2017, we argue that there’s a relationship between profit margin and the structure of CFO organizations. Companies that directly involved CFO teams in management accounting and strategic financial planning saw increased profit margins compared to companies that left financial teams out of strategic roles. Furthermore, we’ll suggest three actions that global CFO teams can take to add the most value to their company.

WHO DOES WHAT, WHERE

CFO organizations in many Japanese companies tend to focus solely on accounting and treasury roles, leaving other functions—such as “Keiei Kikaku” or corporate planning departments—to oversee mid- and long-term strategy planning as well as the current year’s budget setting and forecasting. In comparison, CFO teams in U.S. and European companies generally serve as business partners to the CEO and are increasingly in charge of strategy, financial planning, and budgeting in addition to assuming accounting and treasury roles.

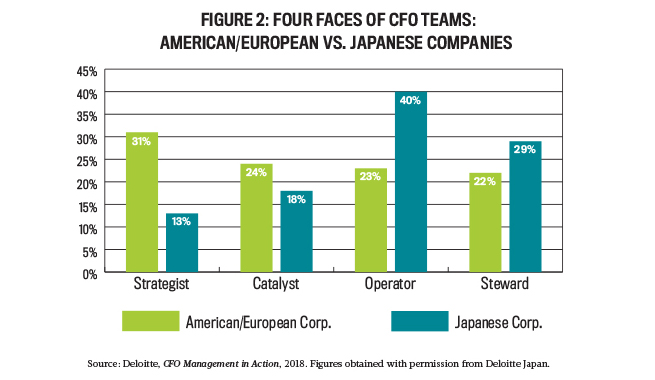

In Figure 1, Deloitte sums up the various potential roles of today’s CFO. In CFO Management in Action, which Deloitte published in Japan in 2018, the professional services firm surveyed CFO teams working for global companies of American and European origin vs. Japanese companies. The results show that CFO organizations of Japanese companies skew toward steward and operator roles (69%) while largely avoiding catalyst and strategist roles (31%).

In contrast, most CFO teams in the U.S. and Europe have evolved to become catalysts and strategists (55%) vs. 45% that see themselves as stewards and operators (see Figure 2).

There’s also a difference in how finance and accounting resources are allocated to business units. In American and European companies, finance and accounting team members who report to the corporate CFO are allocated to each business unit, sales team, manufacturing site, and so forth to support business leaders in their mission to grow sales and profitability. Over their careers, these people rotate through different finance roles across business units or organizations so that they can develop additional skills. The most talented of these employees may rise to CFO positions as true business partners in support of CEOs.

By contrast, CFO teams in Japanese companies tend to be located solely at the corporate site, leaving business units—which often don’t include certified financial professionals or anyone with any deep finance and accounting knowledge—to make their own financial decisions. Consequently, Japanese CFOs aren’t able to ensure the appropriateness of the day-to-day financial decisions made at each business unit, and they only review and approve significant decisions at later stages.

OUR SURVEY

We surveyed members of JACFO between late October and mid-November 2017 and received 220 responses. Nearly nine in 10 CFOs (89%) belonged to either a Japanese holding company/parent company or a subsidiary of a Japanese company; only 11% worked for a subsidiary of a foreign-based company. Therefore, most of the responses were from members who are part of CFO teams at Japanese companies.

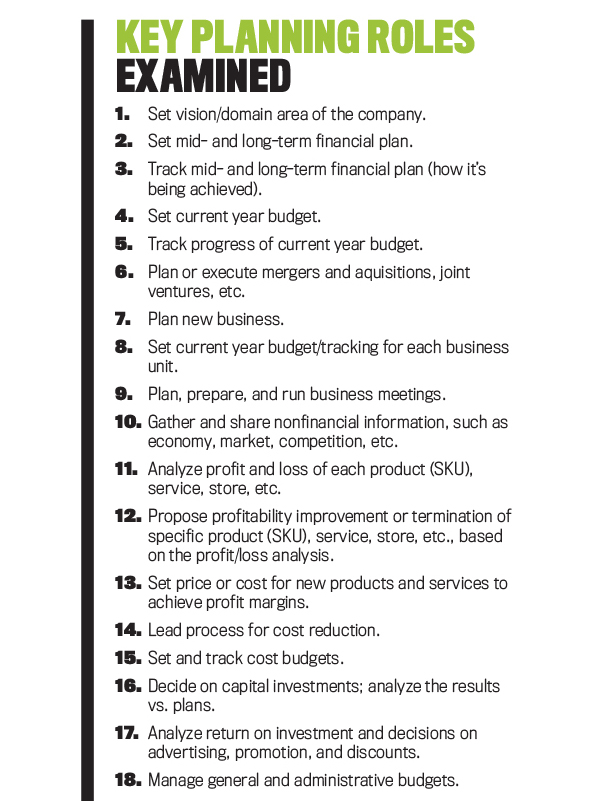

For the study, we included 18 kinds of corporate and financial planning functions (see “Key Planning Roles Examined”), which are based on a previous study conducted by the Japan Research Institute in 2016 to examine the roles of corporate planning departments (Keiei Kikaku) of Japanese companies. For each function, we asked CFOs whether they were (A) performing such functions as owners, (B) involved to some extent and supporting other organizations, or (C) not performing these planning functions at all, as in cases where other divisions, such as corporate planning departments or business units, handled such functions.

Each of the 18 functions and their relationship to profit margin improvement were examined. Responses were divided into two groups: those who reported that company profit margins had improved in the last three years (55.5% of the total) and those reporting that the profit margin of their companies had stayed the same or decreased in the last three years (44.5% of the total).

THE BENEFITS OF BEING HANDS-ON

To better understand the effect each function had on profitability, we broke down both groups of CFOs to see their level of involvement with each function and ranked each function. Using the t-test, we verified a statistically significant causal relationship between the involvement of CFO teams in the top-ranked functions in our study and the financial performance of the company.

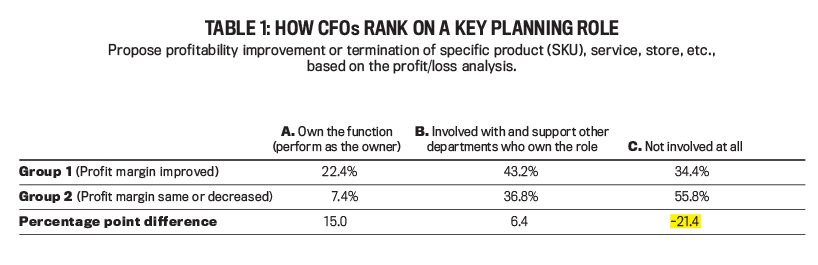

Consider the differences between the two groups of CFOs when it comes to proposing profitability improvement or termination of specific product (stock keeping unit, or SKU), service, store, etc., based on the profit/loss analysis (function 12). As shown in Table 1, 22.4% of CFOs in Group 1, where profit margin improved, reported owning this role. In contrast, only 7.4% of CFO teams in Group 2, where profit margin stayed the same or decreased, said they own this function.

Nearly two thirds (65.6%) of the CFO teams in Group 1 companies either own the function or are involved in it (both A and B). For the Group 2 companies, only 44.2% of the CFO teams own or are at least involved in this function. Out of the 18 functions we examined, this difference of 21.4 percentage points was the largest between Groups 1 and 2.

The conclusion to be drawn from this may seem obvious: The operating profit of the total company is the accumulation of profits from many products, services, stores, etc. Therefore, improving product profits would naturally contribute to boosting the company’s overall profitability.

Yet many Japanese companies have historically focused on sales goals and market share. Thus, in this type of scenario, little attention was paid to the profitability of each product, service, or store. In addition, product profitability was left to business unit leaders, who tended not to want to terminate laggard products, services, or stores even if doing so would help shift resources to more important, profitable products.

Another key planning role was setting the price or cost for new products or services to achieve profit margins (function 13). In companies where the profit margins improved, the CFO teams were responsible for or at least involved in this function. For those Japanese companies where the profit margin stayed the same or decreased, business unit leaders were responsible for determining pricing and costing of new products or services, and finance personnel weren’t involved.

We also found that participation of CFO teams in analyzing return on investment (ROI) and decisions on advertising, promotion, and discounts (function 17) also correlated with improved profit margins. Business units spend significant amounts of money on selling initiatives, such as placing ads or giving promotional discounts. Therefore, it’s obvious to expect financial employees to be involved in ROI analyses so that companies make the correct decisions on investments that generate the most returns for the total company.

In many Japanese companies, these functions are implemented by nonfinancial employees located within the business unit. The problem, however, is that these individuals usually don’t have sufficient finance and accounting knowledge and could easily become compromised by other interests, such as business unit objectives. Companies will get better results when qualified financial professionals who report to the CFO are involved in these functions and are validating the results.

CFO TEAMS AND PROFIT MARGINS

While our survey results show a strong relationship between the role of CFO organizations and profitability, how do our theories compare with actual successful cases? To get a sense of this, we conducted interviews with a few Japanese CFOs.

The CFO of a consumer goods manufacturing company told us that, through the finance team’s support of a corporate-wide major profitability initiative, its operating profit margin increased from 2% to 9%. In addition, after the CEO of the company announced to his management team a new policy of improving profit margins, the CFO team supported the business unit leaders to help calculate profits of each SKU and terminate unprofitable ones. Both sales and profits grew as a result.

Thus, the survey responses and interviews both confirm that there’s a relationship between the roles of CFO organizations and improved profit margins. Since Japanese CFO teams generally devote most of their time and effort to functions that don’t contribute to profit margins, they have had less influence in positively impacting profit margin growth, compared with American and European companies. This leaves their business units and companies with less-than-stellar profitability and potentially opening the door to fraud.

In light of this new evidence, we hope that CFO organizations in Japanese companies will reexamine their remit and become involved in functions that clearly contribute to greater profitability. Further, by involving certified financial professionals with sound ethical training as strategic business partners at all levels of the company—from the CEO to business unit leaders—Japanese companies may avoid some of the lapses in governance and management oversight.

The takeaway for the management accountant or finance professional remains the same, however: Proactively and strategically partnering with business departments to provide objective analysis for improved decision making will help ensure profitability, growth, and, ultimately, a strong and trusted presence in the marketplace.

CASE STUDY: GREE, INC.

To further illustrate the benefits of finance’s involvement in planning functions at Japanese companies, we spoke with Shozo Mizuno of GREE, Inc., a gaming, advertising, media, and live-entertainment company with 1,700 employees. Mizuno joined GREE in October 2013 as executive officer, chief director of Business Administration, responsible for finance, accounting, and controlling.

Before joining GREE, he worked for Panasonic Corporation and oversaw finance, accounting, investor relations, and audit. At Panasonic, the CFO organization was aligned to the American/European model, where the CFO team allocates resources to business units and supports them for business decisions, unlike the protocols at traditional Japanese companies. Therefore, Mizuno gained this strategic mind-set and was accustomed to the CFO team supporting business decisions.

Mizuno joined GREE just when the company’s sales and profits started to decline as a result of too-rapid growth after its start-up phase. He discovered that GREE reviewed only top-line growth (total company financial statements) but didn’t have a system in place to understand the financial performance of its business units. Together with IT, Mizuno set up a system so that business units can implement the Plan, Do, Check, Act (PDCA) cycle. The result? GREE closed its 2018 financial year with sales of more than JP¥77 billion, enjoying positive growth after a steep decline in sales and profits.

The following interview with Mizuno has been lightly edited for clarity.

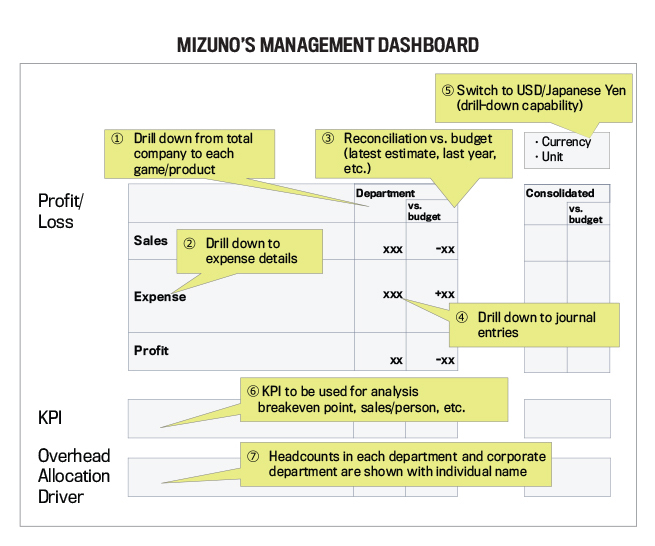

SF: Could you briefly describe the project where you oversaw a recent initiative to improve internal management reporting through IT?

Mizuno: The goal of the management dashboard project was to enable each business unit owner to be accountable for the profitability of their own business. With this IT tool, they can easily check sales and expenses by drilling down to the details by themselves, reconciling vs. the original budget, or even reconciling against any other updates, including the current plan or other forecasts. Business units can now update their future plans in a timely manner so that they can quickly take necessary business actions, such as fixing issues, cutting expenses, or investing more to grow sales. Thus, the company can execute the PDCA cycle rapidly and take actions for improvement using the IT tool. Also, the management team can transparently review KPIs [key performance indicators] for each business unit and their achievement.

SF: How else is your management dashboard helping the company improve its overall financial performance?

Mizuno: The management dashboard is improving our speed and quality of management control and helps us to properly estimate, approve, and control investments for creating new games. Thus, we can manage sales and profit of our main game business, which is volatile by nature. The company is now investing profits from the main pillar of its game business in the second pillar (advertising and media) and the third pillar (live entertainment) for the further future growth of the company.

SF: Can you share more in terms of how the finance team at GREE is contributing to the profitability of the company?

Mizuno: When I first joined GREE, the CFO team working at the corporate level was mainly focused on accounting. I spent significant time on training and developing people, guiding them to be able to help business to take actions. Now I’ve transferred finance resources to each business unit/subsidiary so that such finance resources can directly support the business unit, like the CFO organization that I experienced at Panasonic. Our credo is that the finance and accounting teams exist to support business to take actions for profitability improvement.

November 2019