The accounting profession is facing an existential threat. There’s a high demand for diverse accounting expertise, and yet, despite this, the accounting profession is grappling with a talent shortage. This shortage has been attributed to a number of factors: a lack of interest in the career path, higher salaries in other business majors, perceptions about lack of work-life balance, and not having the time or not wanting to invest in the additional hours for a Certified Public Accountant (CPA) license, among other reasons.

This pipeline problem only stands to grow as accounting professionals retire without enough graduates entering the field to fill these vacancies. This shortage has already been directly linked to accounting and operational issues, including material weaknesses in internal controls and reporting delays at firms such as Advance Auto Parts and Tupperware, as reported by the WSJ.

Firms, academics, and many accounting organizations—including the Institute of Management Accountants (IMA), American Institute of CPAs (AICPA), Center for Audit Quality (CAQ), and Illinois CPA Society—are actively working to address the pipeline shortage. Their initiatives include partnering with educational institutions, combating negative perceptions of accounting, attracting broader talent, leveraging technology, and piloting different ways to help students complete certification exams.

To complement the work that’s already being done, we studied why students are—or are not—choosing accounting as their major, since that decision is so crucial in tackling this shortage. To do this, we surveyed more than 200 business students with generous support from the Northern Illinois University Department of Accountancy.

We asked students about their perceptions of the accounting profession, the factors that are important to them in choosing their careers, and ways current professionals can help address the pipeline shortage. Here are some key takeaways:

- Students often associate accounting with public accounting and a CPA license. To address the lack of interest in the profession and boost accounting enrollments, students suggested showcasing the versatility of the accounting degree, the different career paths one can take (e.g., cost accounting), and certifications beyond the CPA license.

- We know accounting is more than just “number crunching,” but many students are unaware of the interpersonal and analytical skills that accountants need and the technology they use. We can generate more interest in the profession by dispelling outdated perceptions of working alone in a cubicle and highlighting the different skills needed and technology used.

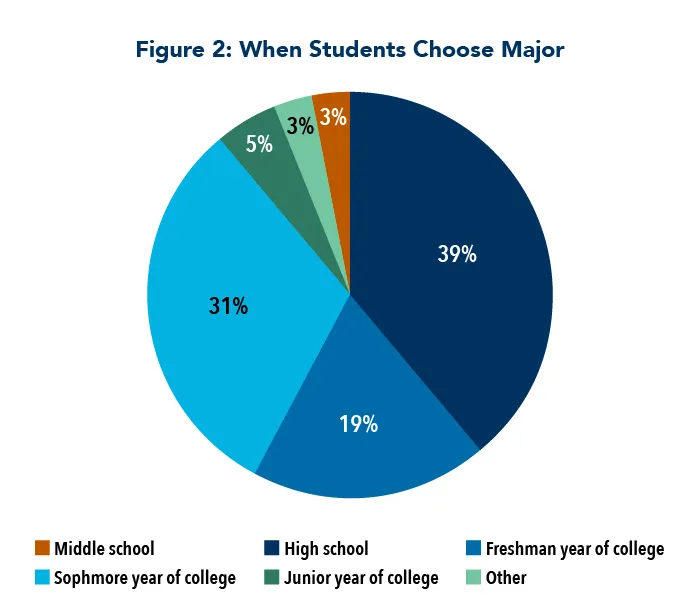

- Early exposure is key. Students often choose their major in high school or early in their college career, emphasizing the need for early outreach about accounting careers. Students' career choices are primarily driven by their own interests and understanding of a field. However, people within their network—such as parents, family, and educators—also play an influential role. Engaging with students early in their career-planning process could help students make more informed decisions, ensuring they have a well-rounded view of the exciting possibilities within accounting.

- Job security and the ability to find a job after graduation are rated as some of the top criteria for students when deciding on a major, so the accountant shortage presents a unique opportunity to emphasize the strong demand and high job placement rates in the profession. Other top criteria, which are unsurprising, include earnings potential and salary, work-life balance, and hybrid and flexible work opportunities.

- Professionals’ real-world experiences often best resonate and can hold significant weight for students in deciding on a career. To promote the profession, consider guest speaking in high school and college classes and student organizations, volunteering at career fairs and mock interviews, sharing positive stories about the profession on social media, and engaging with your network—including extended family members and students who are about to begin or early in their college journey. Don’t underestimate the influence your experiences can have in shaping students’ interest in the profession.

About the Survey

We surveyed 203 business students to explore factors influencing their choice of major and their perceptions of the accounting profession. We also studied factors that influenced their choice of major and factors that are important to their future employment. Our participants include students majoring in accountancy, finance, operations management and information systems, marketing, management, and business administration. (See Appendix A for a demographic summary.)

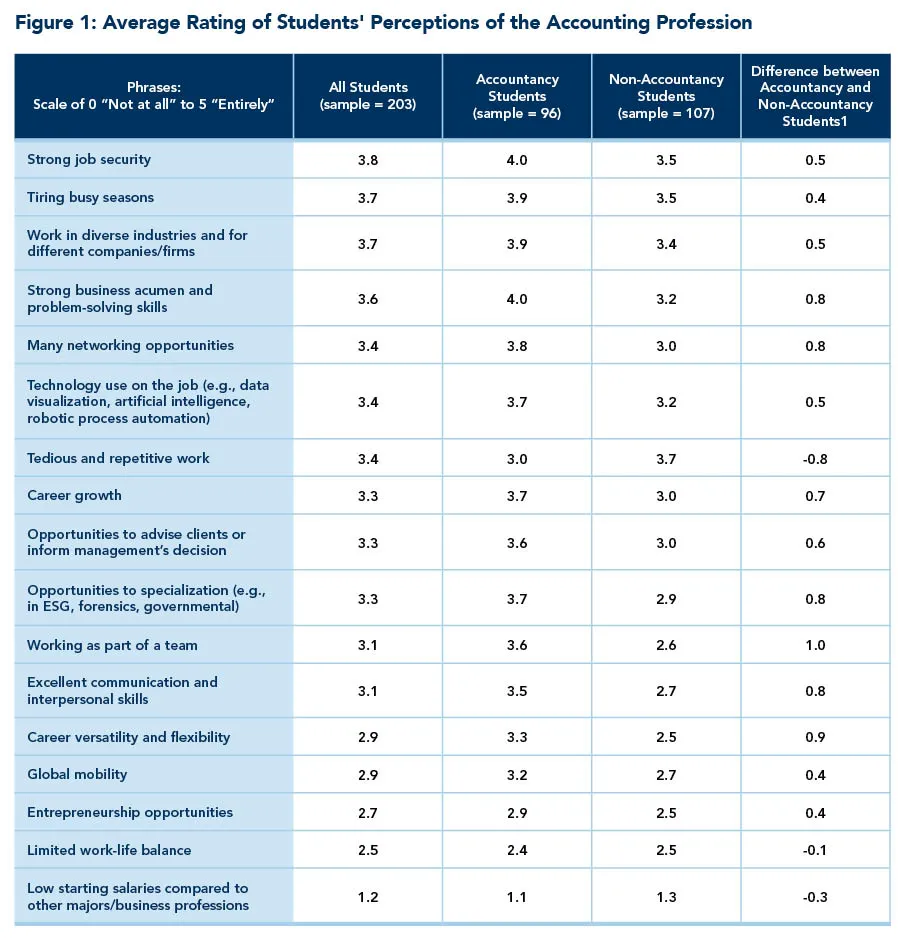

We measured students’ perceptions of the extent to which the phrases in Figure 1 represent the accounting profession (presented graphically in Appendix B). We developed the list based on prior research on this topic and our experience engaging with students. Phrases were presented in a randomized order to prevent order effects. We report our results based on all students' highest to lowest average/mean responses. The higher means mean students believe those phrases strongly represent the accounting profession; lower means are phrases not perceived to represent the profession. We also compared accountancy versus non-accountancy majors.

We included open-response questions to gather additional insight into students’ perceptions, such as why they chose their major and what could influence more students to major in accountancy. Students also reported why they decided on their choice of major and who influenced them. Finally, we asked students to rank their top three most important criteria for choosing their career and explain why those were important to them.

Figure 1

Our survey results revealed three overarching themes:

- We can do more to showcase the versatility and different career opportunities available in the accounting field.

- There’s a lack of awareness about the wide range of skills accountants need to be successful, and about the technology they use at work. Showing students that the job is more than just number crunching may drive more interest in the field.

- Accounting is perceived as an in-demand and secure career. We can use the pipeline shortage and job security as tools to attract students who are looking for a field where they can find a job after graduation.

Let’s explore each of those themes, and what we as accounting professionals can take from these learnings to attract more students to the accounting profession.

Theme 1: One degree with countless opportunities: Showcasing the versatility and diverse career paths with an accounting degree

Perhaps unsurprisingly, students studying accounting have different perceptions of the field than students who don’t study accounting. The green rows in Figure 1 show that some of the wildest gulfs between accountancy and non-accountancy students’ perceptions of the accounting profession are the career versatility and diverse career paths the profession offers. Such perceptions are key reasons why many business students don’t choose accountancy as a major.

Non-accountancy students often describe an accounting degree as working in public accounting and doing tax work, suggesting that the degree is limited to those areas. They seem to lack awareness of the many specialty areas one can work in with an accounting major (e.g., cost or managerial accounting, forensics, sustainability, governmental, and not-for-profit).

Here’s what a few of those non-accountancy students had to say about the perceived lack of versatility of the degree:

- “[More students would major in accountancy] if they felt like there was more flexibility with the major. It feels very limited.”

Student 54, Marketing major

- “I chose marketing since the degree could be used in such a wide variety of careers and is not a one-way alley.”

Student 85, Marketing major

- “The factors that influenced the choice of my major was the different variation of jobs that can come out of this field.”

Student 111, Finance major

Building on those perceptions, several students felt that highlighting that versatility could encourage more students to pursue accounting as a major:

- “I think if more people knew how versatile accounting is, they would be more willing to give it a try . . . many people think accounting is a very mundane career.”

Student 9, Accountancy major

- “A larger focus on displaying how an accounting degree can lead to different paths and careers. How it isn’t all taxes. Incoming freshmen know very little on how flexible and beneficial an accounting degree can be in the real world.”

Student 44, Operations Management and Information Systems major

Further, many students across different majors said they wanted to earn a credential beyond their bachelor’s degree. Yet, despite this, the perceived pressure to obtain a CPA license acts as a deterrent to pursuing an accounting major.

To improve the accounting pipeline issue, students need to be informed about the many career paths and valuable credentials available within the accounting profession beyond the CPA license. For example, other certifications—such as the Certified Management Accounting (CMA®), Certified Fraud Examiner (CFE), Certified Internal Auditor (CIA), and Certified Information Systems Auditor (CISA)—each offer unique and impactful career opportunities.

| Credential |

Focus Area |

|---|---|

| Financial and Managerial Accounting Associate (FMAA) | General accounting and financial management, finance statement preparation and analysis, planning and budgeting |

| Certified Management Accountant (CMA) | Financial management, budgeting, strategic decision-making |

| Certified Public Accountant (CPA) | Auditing, taxation, financial accounting |

| Certified Internal Auditor (CIA) | Risk management, governance, internal controls |

| Certified Information Systems Auditor (CISA) | IT audit, internal controls, technology, and security |

| Certified Fraud Examiner (CFE) | Fraud detection, prevention, and investigation |

| Certified Government Auditing Professional (CGAP) | Government auditing standards and procedures |

To attract more students to accounting, the students we surveyed suggested doing more to debunk the perception that a CPA license is the only avenue to pursue with an accounting degree. They also felt that highlighting some of these other credentials could spark more interest in accounting, as shown in the following quotes:

- “I think when students think of accounting, they think CPA and that can be intimidating or seem like the only route, when in reality there is a lot more that an accounting degree can offer.”

Student 73, Accountancy major

- “Lessen the importance of the CPA and show students there is a good career in accounting without the CPA . . . I feel like that pushes students away.”

Student 142, Accountancy major

- “Less focus on the CPA and more focus on the other certifications.”

Student 41, Accountancy major

Accountants can also pursue micro-credentials or badges, such as those offered by the IMA in topics like sustainability and data analytics and visualization. Informing students about these different certifications and certificate programs can broaden their understanding of the diverse avenues within the accounting field. This knowledge may also motivate non-accountancy students to pursue an accounting degree and recognize the value of these alternative credentials, expanding their horizons beyond the traditional CPA pathway.

Overall, these findings highlight the importance of informing students about the many paths one can take with an accounting degree, which could generate more interest in the profession.

Theme 2: Beyond number crunching: Highlighting different skills in accounting

The next theme we found was that showing the different types of skills accountants need and use could help attract more students to the accountancy major (see the orange rows in Figure 1).

Students who don’t study accounting often have negative, outdated perceptions of what the field encompasses. Case in point: Non-accountancy students highly associated the phrase “tedious and repetitive work” with the accounting profession.

This tracked too with their written perceptions of accounting, which often cited it as mundane, uninteresting, and merely about memorizing formulas and sitting behind a desk all day, crunching numbers and booking journal entries.

For example, the following quotes reflect these outdated images and negative stereotypes that are still present in the minds of many students:

- “Many people . . . see accounting as boring or a job that you will sit in a desk for 10 hours a day, crunching similar numbers over and over again.”

Student 112, Finance and Operations Management and Information Systems major

- “I think that when people hear about an accounting degree, everyone's first thought is always being in a cubicle making journal entries all day.”

Student 43, Business Administration major

Additionally, Figure 1 shows that non-accountancy majors recognize the strong business acumen and problem-solving skills needed in accounting. Yet, they lack awareness of the profession’s similar needs for strong interpersonal skills, including teamwork and communication, which are rated much lower for their perceptions of the accounting profession.

Interestingly, students who chose a major other than accountancy often cited teamwork, consulting and advising, working with technology, and critical-thinking skills as reasons for choosing the major they did. This implies they’re unaware that accountants also need those skills—along with skills in data analytics, risk management, and strategic thinking, all of which are crucial for navigating today's complex financial landscape.

As one accountancy major noted, “Accountancy is a versatile job, with loads of skills needed to be able to perform” our many roles and duties (Student 73). Making students aware of the blend of skills needed—from the technical to the interpersonal to the analytical—could dispel the “number-crunching” and “alone-in-a-cubicle” stereotypes, and attract more students to the profession.

Theme 3: Accounting jobs do not depreciate: Highlighting the demand and security of the profession

Figure 1 shows that “strong job security” is the top-ranked phrase associated with the accounting profession across all students (see the blue row). The current shortage of accountants presents a unique opportunity to highlight the strong demand and job security our profession offers.

Considering the important roles accountants play in organizations, the capital markets, and public trust, we know that accountants are more valuable than ever. Several students majoring in accountancy said that given uncertain economic climates, this demand—along with the security of the profession—had motivated them to major in accountancy.

Given the cost and investment of college education and the fact that other business majors may struggle to find jobs in uncertain economic times, we can leverage the strong demand for accounting graduates to propel some students to seek this as a major, as evidenced in the following students’ quotes:

- “The job security. I know so many people that graduate with other business degrees (marketing, management, operations management and information systems) that struggle to get a job after graduation. But with accounting, there are a lot more opportunities and we will always need accountants! . . . Knowing once I graduate I won't struggle to find a job is a big relief.”

Student 37, Accountancy major

- “Job security is what influenced me to choose accountancy over other majors. Before choosing accountancy, I was interested in other majors, but saw people struggling to find employment with those degrees.”

Student 160, Accountancy major

Early outreach leads to influential impact: Suggestions to reach students about accounting

Students often decide what to study earlier than you may think. As shown in Figure 2, most students determined their major before entering college, and almost all decided by their sophomore year of college, which complements research by the CAQ and Brink, Eaton, and Heitger.

Figure 2

Figure 3, meanwhile, shows that most students’ decision of their college major was self-determined, followed by influence from family members (including extended family members such as cousins, aunts, and uncles) and teachers/professors.

Figure 3

Together, these results underscore the importance of engaging with students about accountancy before they enter college and within our networks (e.g., extended family and family friends) to highlight the benefits and variety of careers with an accounting degree.

As an accounting professional, you can play a crucial role in sparking curiosity about accounting careers by sharing about your career journey and real-world experiences. You can do this by guest speaking in high school and early college classes, volunteering with mock interviews and at financial literacy programs (e.g., Junior Achievement), offering mentorship opportunities, presenting at your alma mater’s business-related student organizations, speaking at career fairs, or hosting networking events.

Professionals at all levels within a company or firm can have an impact on students. You don’t need to be a CFO to have influence. In fact, students often connect well with recent graduates and staff-level professionals who can share their experiences of transitioning from the classroom to the accounting profession. By providing students with authentic insights into different fields, professionals and accounting educators can empower students to make informed decisions about their futures.

Several non-accountancy majors also suggest that exposing students to accounting in high school could help increase interest in the profession and help students better understand what a career in accounting could entail. For example, the following quotes show the importance of the extended network beyond parental influence, particularly during their high school years:

- “I had a really good accounting teacher in high school. I understood the concepts that she taught and I realized that I actually enjoyed doing the work in that class.”

Student 161, Accountancy major

- “The success of my uncle…inspired me to choose accountancy as my college major. . . . [He] suggested I explore becoming an accountant when I needed to choose a college major back in high school. . . . I chose to major in accountancy [and] followed the footsteps of my uncle.”

Student 179, Accounting major

Additionally, the way that careers and professions are portrayed in the media and on social media can influence the majors students choose. To boost interest in accounting, students suggested that we should share stories or high-profile examples of our work that showcase the impact accounting expertise can have. In practice, this might mean sharing stories during guest lectures, at career fairs, or on social media that show how accountants contributed to key management decisions in a company or uncovered fraudulent behavior.

Students in our survey also suggested building a social media presence to increase the awareness and versatility of the accounting degree. Collectively, the various outreach methods in schools, through different organizations, and on social media can effectively showcase the versatility and real-world impact of accounting expertise to fuel interest in the profession.

What matters most when choosing a career

We asked students about the three most important criteria for them when choosing their future career. Across all majors, the findings were consistent: the most important criteria were earnings potential and salary (68%), work-life balance (61%), and job security and stability (37%).

Interestingly, Figure 1 shows that students did not perceive low salaries to be associated with the accounting profession. However, a 2023 study by the Illinois CPA Society showed that salary is the top reason why accounting and finance professionals voluntarily leave their employers. Therefore, the market needs to stay competitive when it comes to salaries and benefits, and to communicate the earnings potential of an accounting career to students.

It's not surprising that so many students highlighted the importance of work-life balance in their future careers. It does, however, present an opportunity to highlight the versatility of the accounting degree and profession outside of public accounting and the long-standing image of “the busy season.” As we’ve already discussed, when students think of an accounting career, they associate it with public accounting and audit and tax busy-season work.

Other accounting careers typically experience different busy periods—for instance, month end or quarter end—but this can have different intensity and workloads compared to the busy season of public accountants. Students who said work-life balance was important to them often cited family reasons, particularly when they start their own families, and that constantly working would lead to burnout or potentially no longer enjoying their career.

The importance of work-life balance is closely tied to the criterion that students ranked fourth highest in importance: a hybrid or flexible working environment. While many employers have been mandating a return to office, flexible work arrangements can offer professionals better work-life balance. A 2024 study showed that the number one in-demand remote or hybrid job is in accounting roles. To the extent employers are offering this option, it’s worth highlighting this possibility to students, while also communicating the expectations of remote and hybrid work to ensure adequate productivity.

Conclusion

Overall, our results provide further evidence of the need for the profession to engage with students early in their career decision process—particularly before college. We need to do more to highlight the versatility and diverse career paths an accounting degree offers, and the impactful skills used in accounting careers.

In other words: We need to show students it’s more than just number crunching.

Increasing the accounting pipeline is a big task. It requires a multi-pronged approach and a collective effort between educators, professionals, employers, and accounting organizations like the IMA. Are you ready to do your part?

Appendix A: Summary of Survey Demographics

Our sample includes 203 business students, comprising 96 accountancy majors and 107 non-accountancy majors (i.e., students majoring in finance, operations management and information systems, marketing, management, and business administration). Most of our students are in their junior and senior year of college (39% seniors, 40% juniors, 13% sophomores, and 8% freshmen). The sample is fairly balanced between females and males (52% female vs. 48% male). We also have a variety of different races and ethnicities (53% White/Caucasian, 31% Hispanic/Latino, 9% Asian/Asian American, 6% Black/African American, and 1% Middle Eastern/North African).

Appendix B: Graphical Depiction of Figure 1 (Average Rating of Students' Perceptions of the Accounting Profession)

Appendix C: Other Statements about Accounting (Brink, Eaton, and Heitger 2023)

In our study, we also asked statements used by Brink, Eaton, and Heitger (2023) who studied students’ perceptions of the accounting profession at the University of Miami Ohio. We find that our students’ responses to most statements have similar averages to their study. All differences are statistically different at p-values of < 0.05, except statement 7 (p-value = 0.331, suggesting the means are not significantly different between student groups). Most relevant, statements 8 and 10 show that non-accountancy students do not perceive accounting as a fulfilling or interesting career. Further, statements 1 and 4 show that non-accountancy students are unaware of the high versatility and career opportunities in the accounting profession. These are common themes we have throughout our study. Overall, these results in Appendix C provide replication and support for Brink, Eaton, and Heiger’s (2023) findings and complement our findings throughout our study. We also extended their findings as we asked additional phrases (see Figure 1) and included open-response questions to gather insight into why students have these perceptions.