The relentless pursuit of productivity and efficiency across the business world is having a negative impact on the workforce. In the United States alone, half of workers have suffered burnout in the past year, according to a 2024 survey by Grant Thornton. And the biggest pressure points for those people include emotional stress (63%), long hours (54%), and talent shortages (40%). Of course, none of this is news for accounting and finance professionals. Often buried in spreadsheets and data dumps, they can feel the crunch of all of those numbers.

Help is here. It’s AI.

With its ability to rapidly process and interpret boundless information, the advanced tech is providing overstretched finance teams a not-so-secret weapon that frees up more time for them to tackle higher-level tasks in the finance function—and increasingly wipes out the risk of spreadsheet fatigue.

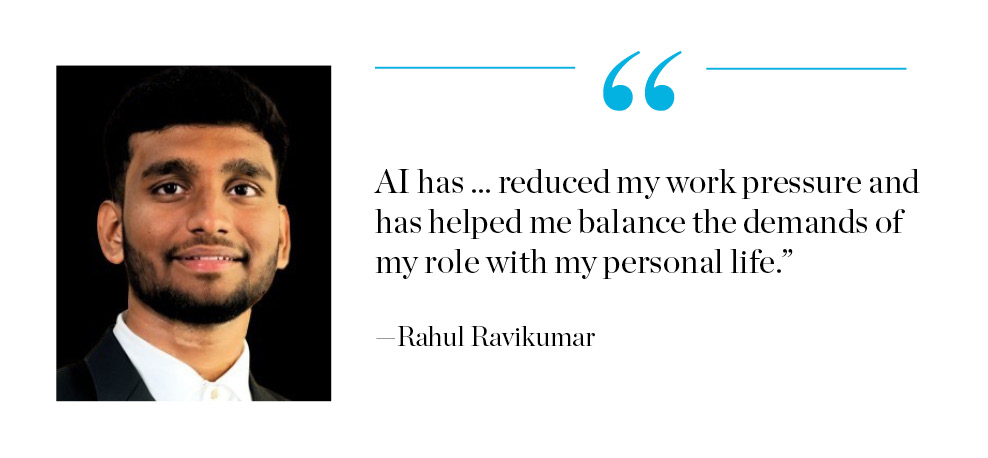

“Automating repetitive tasks with AI has allowed me to dedicate more time to strategic thinking, such as planning for the future, identifying growth opportunities, and contributing to organizational goals,” said Rahul Ravikumar, an associate at Finquest, Bengaluru, India. “Instead of focusing on cleaning data, I can now focus on extracting actionable insights from it to drive business decisions.”

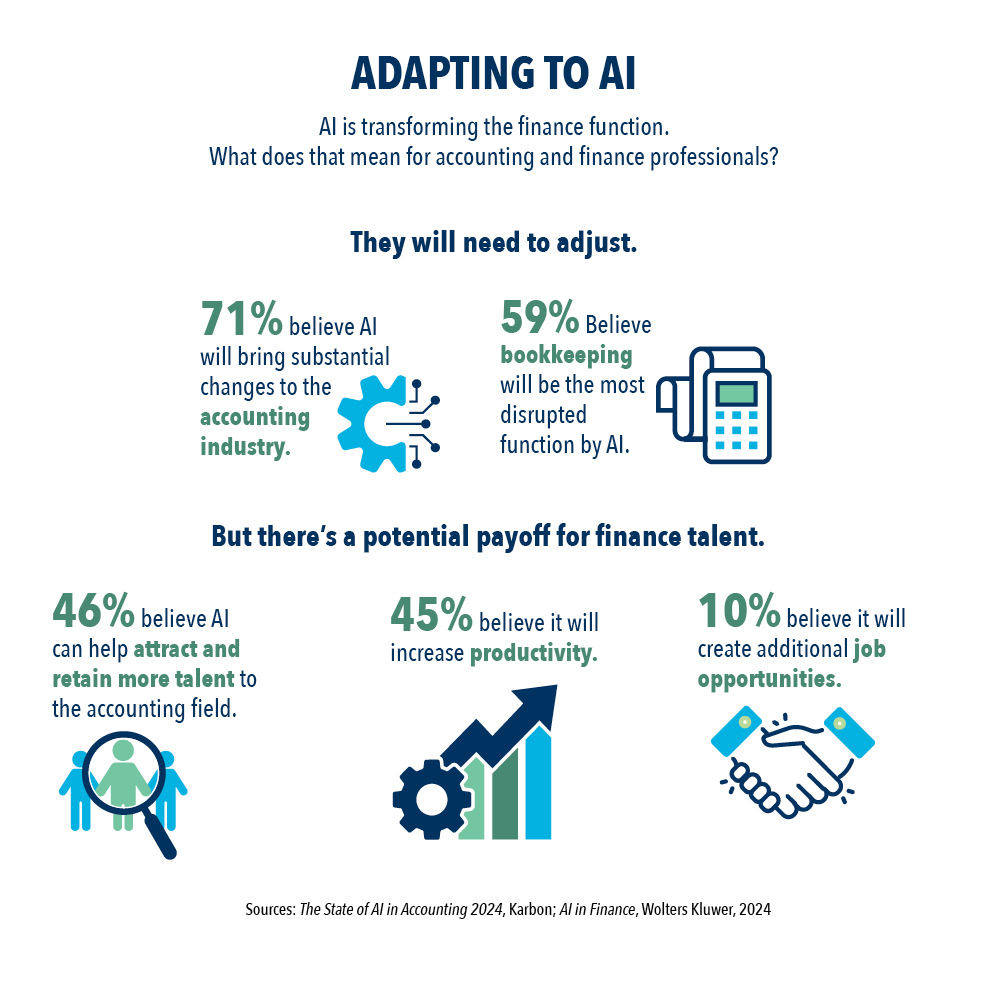

As the AI revolution continues and AI tools mature, accounting and finance teams will only gain more support from the tech in the months and years ahead. According to Bloomberg Intelligence, the generative AI (GenAI) market could grow to $1.3 trillion globally by 2032. And no company wants to be left behind: 68% of CEOs say GenAI is a top investment priority, according to KPMG.

Accounting and finance professionals who increase their AI acumen will not only gain a career advantage, but they’ll also reduce the time they spend on mundane, day-to-day tasks, helping them recharge in ways that will help companies achieve their desire to increase productivity and resilience.

Ways That Automation Can Boost Productivity

Indeed, the top benefit cited by CEOs in the KPMG survey was “increased efficiency and productivity through automating routine operations.” And nearly half identified finance and accounting as one of the top functional areas where they’ll be making AI investments in the next three years. Ravikumar’s AI experience is proof that those aspirations are increasingly becoming reality for finance functions around the world.

“AI has significantly transformed the way I work,” Ravikumar said. “Tasks that used to take hours, such as data reconciliation, report generation, and creating financial models, are now completed more quickly and efficiently through AI tools. This has allowed me to shift my focus from routine operational work to strategic, big-picture projects that contribute more to the organization’s long-term goals.”

Ravikumar uses AI to write scripts to automate day-to-day tasks, and he leverages AI-powered Excel plug-ins to help with data analysis, trend identification, and scenario forecasting. Among the ways AI has been a game-changer for him?

- Automating tedious tasks such as data reconciliation and report generation.

- Enhancing accuracy by flagging errors and inconsistencies.

- Providing smart summaries and visualizations that highlight key trends and insights.

- Streamlining decision making by presenting data in an easy-to-understand format.

- Improving efficiency and focus so he can concentrate on more creative and strategic endeavors.

AI’s benefits go well beyond spreadsheets, too, said Charles King, CMA, CPA, partner, advisory services, KPMG, Orlando, Florida. For example, in the past, a data entry clerk might input information from contracts or loan agreements, then pass those inputs along to a financial analyst to use in an existing model. Now, GenAI can examine those original documents and extract key features, King said.

GenAI is also much better than previous tools at spotting minor inconsistencies within documents, deviations that previously would have disrupted automation attempts, King said.

“If you look at traditional approaches for robotic process automation, those kinds of minor variations could easily break the automation, and it just wouldn’t work,” he said. “But generative AI’s ability to absorb semantic information is much more robust for those kinds of small permutations in our documents.”

At KPMG, King’s teams use GenAI to help with regulatory compliance and external standards or frameworks by finding gaps and redundancies across processes and documents. It’s also useful for running simulations to get an idea of possible outcomes of investments.

“You can have generative AI actually create some of those investment scenarios for you where you can say, ‘What if we thought inflation and supply chain costs go up 5%, and it goes up 10% — then what happens?’” he said. “I think all of those little things can just help make people’s lives a little bit easier and drive some consensus.”

How Can AI Banish Burnout on Finance Teams?

While AI is helping organizations and their finance teams work more efficiently, it’s also helping accounting and finance professionals reduce stress and find better work-life balance at a time when talent shortages can increase their workloads. Ravikumar’s use of AI has even allowed him to devote more time to upskilling, including expanding and fine-tuning his AI capabilities.

“AI has also reduced my work pressure and has helped me balance the demands of my role with my personal life,” said Ravikumar. “With the ability to complete tasks quickly and accurately, I have more time to focus on personal pursuits and professional development. AI has also helped reduce stress by ensuring data accuracy and providing a reliable system to work with, which has given me the confidence to deliver my work without constantly checking for mistakes.”

AI is even helping meeting-weary teams solve that age-old business riddle, “Couldn’t this have been an email?” For instance, some common collaboration tools use AI to generate meeting notes with key discussion points, action items, and follow-up tasks—meaning fewer team members need to be in the conference room or on the video call.

“Personally, the biggest use I get out of AI is that I go to far fewer meetings,” King said. “There are meetings where I need to stay up to speed with what’s going on, but I don’t have a lot to contribute to in the meeting. And people are often not consistent about writing minutes. But we’ve started to build a real culture of using AI to summarize meetings, so I find myself with more available time.”

Why It Makes Sense to Proceed With Caution

As with many breakthrough tech tools that emerge, AI is both a panacea and a potential pain point, such as introducing errors when it tries to synthesize overwhelming amounts of data. Nonetheless, 68% of CEOs expect to see ROI on their AI investments in three to five years, according to the KPMG survey. With such high AI expectations, teams need to learn how to maximize AI’s evolving capabilities.

For starters, AI is only as good as the data you give it, King said.

“For decades now, we’ve been talking about analytics and automation and workflow and all this stuff, and they all hit the same basic stumbling block, which is, your data is just not ready to be used by any of those tools,” he said. “I would say probably two-thirds to three-quarters of organizations, their data is not where it needs to be to get maximal, optimal output of generative AI. Which is not to say they can’t use it for anything, but it’s going to create headaches for them as they adopt it.”

Indeed, only one-third of CEOs surveyed by KPMG expressed confidence that their data will be ready to effectively integrate with GenAI. And just more than half (56%) are confident in deploying GenAI within robust governance frameworks.

To increase his AI rigor, Ravikumar conducts quality checks on the data sourced by his AI tools to confirm it aligns with financial standards, ensuring the outcomes he gets—and uses for key strategic decisions—are accurate.

Regardless of the potential speed bumps, the writing is on the wall for accounting and finance professionals: AI is here to stay—and it’s here to help them reenergize their efforts.

“AI is part of how we’re working,” King said. “So if you’re a skeptic who says ‘I don’t believe in any of this,’ that is not going to be a viable stand.”