The primary role of accounting and finance professionals is to analyze and interpret both qualitative and quantitative data. In the last decade, software tools have advanced significantly, helping teams automate several routine tasks. The advent of generative AI (GenAI) marks a new era where technology not only automates, but also analyzes data and draws conclusions. This raises a crucial question: Will AI replace financial professionals?

The short answer? No—not as long as we embrace our uniquely human skills. Let AI take over the mundane parts of our jobs while we embrace the time that this frees up to focus on what humans do best: creative development, critical thinking, and using and developing tacit knowledge.

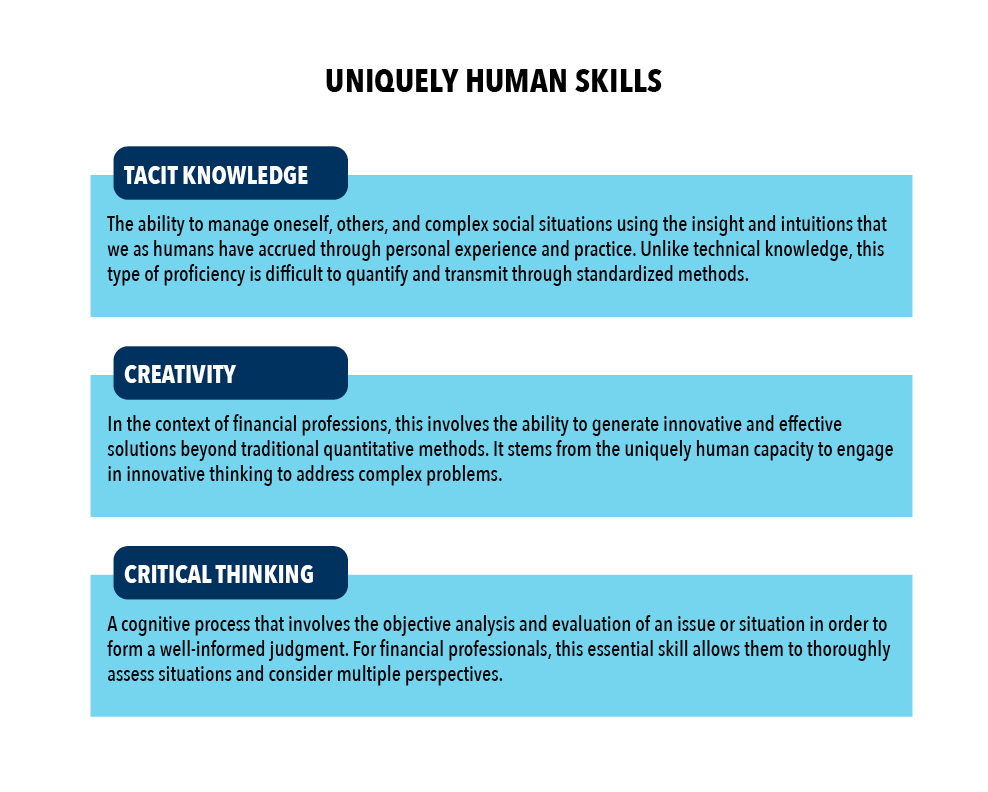

Uniquely human skills

To ensure that you capitalize on your human value, it’s essential to understand exactly what your uniquely human skills are—and how best to deploy them to your advantage.

Tacit knowledge. This refers to the ability to manage yourself, others, and complex social situations. Unlike explicit knowledge, tacit knowledge is an implicit understanding that’s challenging to articulate or pass on to others using conventional means like writing or verbal instruction. This type of knowledge usually isn’t gained through formal education. Instead, tacit knowledge primarily develops through experiential learning and imitating individuals who exhibit a strong grasp of such knowledge, particularly in intricate social contexts. Tacit knowledge is deeply embedded in one’s personal experiences, encompassing the skills, insights, and intuition garnered over time. Fundamentally, tacit knowledge equips individuals with the know-how, rather than just an understanding of the facts, emphasizing practical application and intuitive understanding.

An everyday example is how we approach cooking. Although a recipe can be documented, memorized, and followed, the outcome often varies based on a cook’s unique touch. Consider the attempt to replicate a traditional pasta dish experienced in Italy. The individual seeking to recreate it relies not just on the written recipe but also on their sensory memory—the specific texture, aroma, and overall feel of the dish as they remember it. This involves adjusting cooking times, ingredient proportions, and techniques based on a nuanced understanding that goes beyond the recipe’s instructions. They apply this knowledge subconsciously, adapting the recipe based on their personal experience and intuition.

The same thing applies to financial professionals, as tacit knowledge extends far beyond basic number crunching. Consider fraud detection, for example. When there’s a financial discrepancy, simply identifying the issue isn’t enough. It demands a financial expert who deeply understands both the people and the inner workings of the organization to form hypotheses about who might possess the means, motive, and opportunity for embezzlement. These professionals must rely on their tacit knowledge to pick up on subtle cues, starting perhaps by observing employee behaviors to filter potential suspects. By applying their nuanced understanding, they can detect patterns of behavior that might suggest someone is trying to hide their actions—like consistently resisting the implementation of new control systems.

This scenario demonstrates the vital importance of tacit knowledge in financial roles: It involves discerning the implicit and applying a wealth of experiential and interpersonal insight. These skills can’t be easily quantified or systematized, but they’re indispensable for making informed decisions and solving complex problems in the nuanced business world.

Creativity. This is often thought of as the fuzzy front end of innovation. It represents the spark of original thought that propels new initiatives and solutions, a trait distinct to human cognition. While often linked with product development or artistic endeavors, creativity is also a critical element in thriving financial careers. In the workplace, creativity hinges on the ability of employees to conceive novel and valuable ideas or problem-solving approaches. It involves thinking beyond conventional boundaries and generating innovative concepts that can significantly contribute to an organization’s growth and success.

Consider the context of investment firms, where financial analysts play a crucial role in developing investment strategies to manage risk and maximize ROI. The most successful analysts in these firms often exhibit a high degree of creativity. They innovate by developing unique data analysis techniques, sometimes employing unconventional sources like social media trends to assess market conditions. Additionally, they integrate insights from behavioral finance, ingeniously weaving in knowledge about cognitive biases and investor behavior into their investment strategies.

Critical thinking. This cognitive process involves the objective analysis and evaluation of an issue or situation to arrive at an informed judgment. It’s a disciplined manner of thinking that requires the use of logic and reasoning to understand and assess ideas or problems. It extends beyond mere problem solving, involving a structured, reflective approach to processing information and making decisions. The cognitive process encompasses various facets like inquisitiveness, skepticism, ethical consideration, and reflection.

Returning to the example of an investment firm, critical thinking is particularly evident in the work of financial analysts. After employing creativity to gather unique market insights—vital in an industry where staying ahead of the curve is key—analysts are then tasked with evaluating the intricate balance between risk and potential rewards. Here, their critical-thinking skills are crucial. They must carefully weigh these pivotal and often high-stakes factors, considering both the immediate impact and the long-term implications of their decisions. Furthermore, financial professionals must engage in systems thinking, which involves looking beyond direct outcomes to anticipate wider consequences.

For instance, an investment strategy that optimally manages risk and reward might also involve ethical considerations, such as dealing with an organization known for poor environmental, social, and governance practices, or specific human rights violations. Here, critical thinking enables financial analysts to not only assess financial parameters but also consider the ethical and societal impact of their investment decisions, ensuring a holistic and responsible approach to finance.

The evolving importance of uniquely human skills

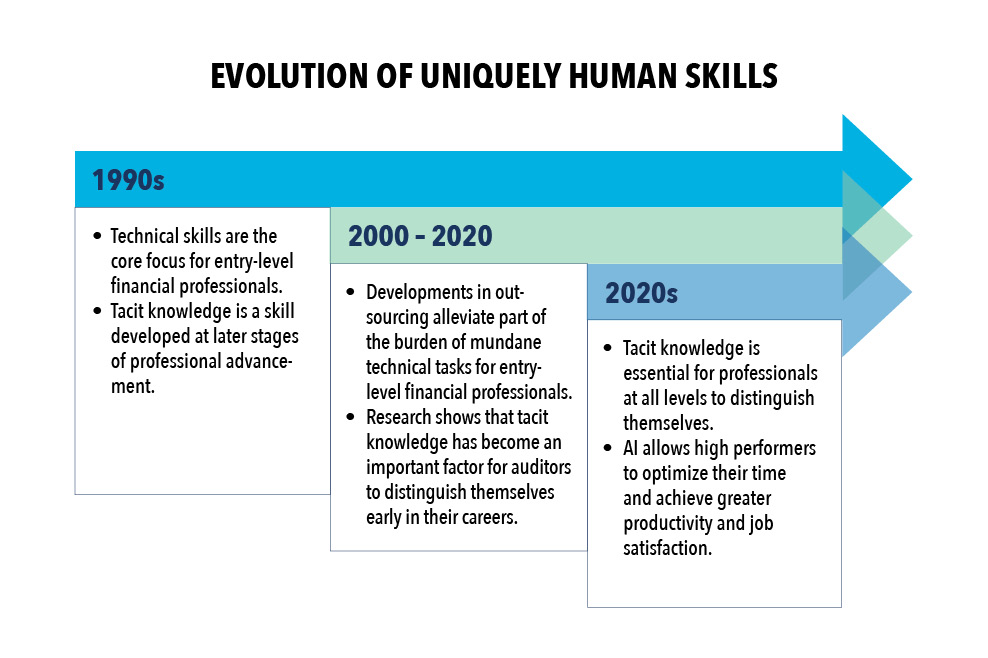

These recent technological advancements have by no means been the catalyst for researching what makes a good manager and which attributes allow financial professionals to advance within an organization. In fact, this topic has been a subject of academic inquiry for several decades, going back to the late 20th century. Studies have looked to identify the specific skills that enable financial professionals to excel and make a notable impact in their workplaces. Interestingly, the conclusions drawn from this research have not remained static over the years, reflecting changes in the industry and evolving professional landscapes.

1990s

In the 1990s, the criteria for hiring entry-level financial professionals heavily centered on their ability to apply technical knowledge, often gauged through academic indicators like college GPA and standardized test scores. Due to the absence of automated systems for tasks such as data entry or standard bookkeeping at that time, the core of their job description was deeply rooted in technical expertise. As a result, these entry-level employees spent considerable time and effort on manual tasks that are now often automated or outsourced. Being able to perform these tasks efficiently was a key measure of their potential for career advancement. During this era, there was a clear demarcation in what was expected and required of managerial roles versus subordinate roles. For entry-level positions, the focus was on technical skills, contrasting with the more nuanced skills of critical thinking, creativity, and tacit knowledge required at higher levels.

Tan and Libby1 shed light on the dynamic at the time. Their research revealed that while tacit knowledge was valuable for audit professionals, it did not significantly help entry-level employees succeed. These employees first needed to show that they were proficient in the technical aspects of their roles—tasks that were often routine or repetitive, but nonetheless essential, and, therefore, a prerequisite for advancement within the firm. Their findings, however, also highlighted that tacit knowledge gained significance at the managerial level. Once auditors reached that stage of their careers, those who possessed well-developed tacit knowledge and critical-thinking skills were more successful. So while tacit knowledge was recognized as important during this period, it was considered a skill set that auditors were only expected to develop and use later in their careers, particularly as they moved into managerial positions. This delineation underscores that in the 1990s, organizations valued different skill sets at various points in an auditor's career.

2000–2020

As the new millennium advanced, enhancements in software and data management systems—along with the rise of outsourcing—significantly lightened the technical workload that once dominated the responsibilities of entry-level professionals in the 1990s. This shift allowed these early-career professionals to stand out in different ways. Not only did the nature of their work transform, but so did the criteria that companies were looking for when making hiring and promotion decisions. In evaluating which employees were prime candidates, leaders started to look beyond mere technical proficiency, increasingly recognizing and valuing the uniquely human capabilities people could bring to the job.

In 2018, Bol, Estep, Moers, and Peecher2 conducted research to look into the evolving role of tacit knowledge in the audit sector, aiming to update what had been established by Tan and Libby in their seminal 1997 research. They found that tacit knowledge had become a significant factor in distinguishing auditors early in their careers. This shift aligned with the reduced emphasis on technical work for entry-level auditors, freeing up more time for them to do tasks previously exclusive to more senior positions. For instance, if an inconsistency arose early in the auditing process, even entry-level auditors would then need to decide whether to directly engage with the responsible party or escalate the issue to management if there were indications of potential fraud. Given that the technical knowledge required for auditing roles had become a prerequisite to get a job in this field, with standardized tests like the CPA exam primarily assessing these technical skills, inexperienced auditors often came on the job with comparable technical competencies. So it made sense that the unique value they brought to their firms expanded beyond just their technical knowledge.

2020s

The early 2020s witnessed groundbreaking advancements in artificial intelligence, with ChatGPT emerging as a pivotal development in both the tech and business worlds after launching in 2022. Unlike earlier AI systems like Siri or Alexa, which primarily automated programmed functions, ChatGPT and similar platforms introduced an element of independent analysis and interpretation, a capability previously thought to be beyond the reach of computers. With such widespread access to AI systems, many people are wondering about the skills they need to stay relevant and add value to their organizations.

In the context of accounting and financial professions, the role of AI is particularly intriguing. With the rapid developments in AI technology, the conversation has shifted from how to automate routine tasks to the possibility of AI handling responsibilities that require a degree of analysis and decision making—tasks traditionally associated with more advanced roles. This development challenges accounting and finance professionals to redefine their value and adapt to a landscape where AI is not just a tool for efficiency, but a potential competitor in the job market.

While having technical skills is essential to do a lot of today’s work, people need to also have uniquely human abilities such as creativity, critical thinking, and tacit knowledge to set themselves apart. For financial professionals today and in the future, being successful hinges not only on mastering these human skills—which remain out of reach for even the most advanced AI—but also on being willing to integrate technology into their skill set. In this decade, the career risk doesn’t primarily come from AI itself, but from the competition posed by other professionals who figure out how to use AI to automate routine tasks, thereby freeing up their time to focus on tasks that require uniquely human skills.

Leveraging AI to your advantage

Productivity & AI Integration

Embracing AI is a crucial step for accounting and financial professionals in adapting to technological progress. Those who view AI as a valuable asset or partner to be woven into everyday work processes will be able to leverage AI’s power more quickly and effectively. Consider the role of a financial manager. The tasks of hiring skilled individuals and handling the human resources aspects of team management can be cumbersome and time-consuming. CFOs and their counterparts can now use AI for tasks like creating job descriptions and drafting personnel-related communications. While the unique human capability to generate initial ideas remains crucial, AI can significantly streamline the process of turning those initial thoughts into structured documents. Using GenAI tools to formulate a set of predefined ideas and refining the output can transform a task that would typically take hours into a task that takes a matter of minutes.

This is why companies are increasingly including AI solutions in their business software budgets. Inventory management and accounting systems have become indispensable for businesses of all sizes. Many corporations are now recognizing AI as a crucial element for their future growth. For instance, KPMG has partnered with Mindbridge to harness AI, aiming to streamline operational efficiencies through technology. This AI-driven data processing significantly bolsters strategic decision making. Traditionally, companies depended on random sampling for evaluating operational processes such as cash transactions or client retention. AI, however, allows for an exhaustive analysis by processing an entire transaction history, enabling managers who analyze the AI output with a fuller understanding of the situation which again results in better decision making.

GenAI is making strides in customer service, even within sectors that place a premium on customer relationship management, such as the luxury goods industry. Here, major players like Kering are implementing AI solutions to meet the evolving needs of their flagship brands. JPMorgan is also using AI to automate routine tasks. The company’s application of AI in fraud detection has dramatically reduced the time team members spend on the tedious task of analyzing customer transactions. By taking over these routine operations, AI enables financial professionals to focus on areas where human insight is indispensable—creativity, tacit knowledge, and critical thinking—aspects of work where humans not only excel but also often find more meaning and satisfaction. Therefore, the real question becomes not just what AI can do for us, but what we can accomplish when AI liberates us from mundane tasks.

This concept is underlined by a study by Jia, Luo, Fang, and Liao3 that investigates how AI can augment employee creativity in the workplace. The study examines how AI, when used to complement human efforts, also has the potential to foster creativity in employees. The researchers hypothesized that in an organizational setting where tasks are divided sequentially between AI and humans, AI's assistance with repetitive tasks would not only boost creative problem-solving, but also enhance job satisfaction. To examine this hypothesis, the study compared sales agents who used AI with those who didn’t, evaluating both their outcomes and their problem-solving approaches. The findings indicate that AI assistance can reshape job roles, liberate employees from technical tasks, and enhance their cognitive and creative abilities—all of which can boost productivity and job satisfaction.

The impact on management structure & focusing on tacit knowledge

The increasing importance of tacit knowledge in the AI era calls for a focus on how to cultivate it among employees. For managers, AI is a call to action to lead by example—not just to learn how to leverage AI, but to encourage other team members to do the same.

By using AI systems to handle time-intensive numerical and technical tasks, managers can free up valuable time. This newly available time can then strategically be redirected toward human development. Such an approach could shift the emphasis from strictly meeting deadlines and achieving quantitative targets to cultivating stronger mentor-mentee relationships. This approach is likely to not only enhance the professional growth of employees, but also provide a more fulfilling experience for the managers themselves, as they engage in more meaningful developmental interactions.

At this point, it’s crucial to acknowledge the maintained significance of technical knowledge in the financial sector, even as we embrace AI. Despite AI’s growing ability to automate many technical tasks, the need for a solid foundation in technical knowledge remains undiminished. Similar to teaching children basic arithmetic despite the availability of calculators, financial professionals need a clear understanding of the underlying processes that generate the data and information they work with. Effective critical thinking is anchored in a thorough comprehension of these technical aspects. Without this foundational knowledge, even the most advanced critical thinking skills can fall short. So financial professionals must continue to prioritize and strengthen their technical expertise—not only as a basis for applying their uniquely human skills like creativity and tacit knowledge but also as a crucial element for their own professional growth and the success of their organizations. In a landscape increasingly shaped by AI, the combination of deep technical understanding with distinct human capabilities will be key to navigating the complexities of the financial world.

The real value of AI

The evolution of AI technology in the finance sector has by no means diminished the role of financial professionals but rather redefined it. As software tools and AI capabilities advance and evolve, the demand for uniquely human skills such as creativity, critical thinking, and tacit knowledge becomes more pronounced. AI can’t replicate these skills. When developed and applied properly, these skills distinguish financial professionals in an increasingly automated world. Indeed, the role of AI in the workplace isn’t one of replacement, but augmentation. AI frees up financial professionals from routine tasks, allowing them to focus on complex problem solving and innovative thinking. It’s also a tool that enhances productivity and creativity, leading to higher levels of job satisfaction and superior outcomes. However, the foundational importance of technical knowledge remains irreplaceable. Understanding the mechanics behind AI-generated data and the processes within the financial sector is crucial for informed decision making and effective critical thinking.

As we move forward, the synergy between AI and human intelligence is the key. Accounting and finance professionals who can integrate AI tools into their work while leveraging their uniquely human skills will be the ones to lead the industry. They will navigate the complexities of finance with a blend of technical knowledge, human insight, and technological understanding, ensuring their continued relevance and success in a rapidly evolving digital landscape.

The Case of Fantasy SportsAn interesting illustration of how AI predictions can sometimes fall short compared to human strategic thinking is evident in the world of fantasy sports. In these leagues, participants form virtual teams by selecting actual players, then earn points based on real performances, such as touchdowns scored or yards gained in American football games. Fantasy sports platforms typically offer AI-driven projections for each player’s performance in upcoming games, taking into account factors like past performance and current injuries. However, avid fans who have spent years closely following their sport possess a depth of understanding that AI lacks. They have insights into how players synergize with their teammates, the likely strategies coaches will employ in specific matchups, and how teams might adapt to their opponents. Therefore, those with extensive knowledge of their fantasy league’s sport, gained through years of observation and analysis, have an edge. When they combine their nuanced understanding of the game with AI-generated projections, they can achieve a more robust and informed strategy for their fantasy sports decisions, often leading to better outcomes than relying on AI predictions alone. This scenario highlights the uniquely human skills, especially in areas where understanding subtleties and nuances is key. |

1 Tan, H.T., R. Libby. “Tacit Managerial versus Technical Knowledge as Determinants of Audit Expertise in the Field.” Journal of Accounting Research 35 (1997).

2 J.C. Bol, C. Estep, F. Moers, M.E. Peecher, “The Role of Tacit Knowledge in Auditor Expertise and Human Capital Development.” Journal of Accounting Research, Vol. 56, No. 4 (2018).

3 N. Jia, X. Luo, Z. Fang, C. Liao, “When and How Artificial Intelligence Augments Employee Creativity.” Academy of Management Journal (2023).