In this article, we discuss how CFOs can take a leadership role in understanding and measuring the ROI of sustainability investments. In various industries, sustainability strategies have shown the ability to reduce costs and increase revenues if properly executed. One challenge is justifying investments in sustainability using traditional financial methods of ROI.

In this article, Mark L. Frigo is joined by Tensie Whelan, who serves as director of NYU Stern Center for Sustainable Business. Whelan is developing innovative approaches for measuring the ROI of sustainability investments using Return on Sustainability Investment (ROSI™). Today, ROSI is used by corporate leaders and investors to track the relationship between sustainability strategies and financial performance, with the aim of improving corporate enterprise value.

Part 1: The Challenges in Measuring the ROI on Sustainability Investments

In this section, we discuss some of the challenges for measuring the ROI on sustainability and how to overcome them.

Mark L. Frigo (MLF): My recent discussions with CFOs indicate that they recognize that sustainability strategies and investments have potential financial value, but CFOs often struggle with how to measure the value and ROI on sustainability investments. CFOs often believe it is easier to identify the costs associated with sustainability investments rather than identifying and measuring the financial value created by sustainability investments. In a 2021 Harvard Business Review article titled, “How to Talk to Your CFO About Sustainability,” (by Tensie Whelan and Elyse Douglas, a senior research scholar at the NYU Stern Center for Sustainable Business), you and your co-author described the challenges of measuring how sustainability strategies create financial value. You developed an approach for using an analytical approach called the Return on Sustainability Investment (ROSI™) methodology.

Tensie, in your recent work with executive teams, what are the primary challenges of measuring ROI of sustainability investments that you observe today, and how can these challenges be overcome?

Tensie Whelan (TW): Many companies do not currently understand the value creation levels that sustainability can unlock. Many of those that do are not tracking the financial returns associated with sustainability strategies. However, several trends require CFOs to begin to better track the financial returns associated with sustainability/ESG.

First, regulators are requiring higher quality ESG data, which is the CFO’s liability. Increasingly, CFOs are taking the ESG data collection away from the sustainability department and professionalizing it. Second, financial risk associated with material sustainability issues such as climate change impacts is growing, and the CFO needs to understand the probability and scale of potential risks to determine investment priorities.

Third, companies often decide that business as usual is less risky than engaging in the sustainability transformation required to navigate these issues. Finally, one major criticism embedded in the ESG backlash is that companies are wasting money on these initiatives. Tracking the returns will help to protect the company from those criticisms.

MLF: In your work, you cite industry examples of companies that have achieved significant sustainability-related saving. Tensie, please describe an example.

TW: We have worked with automotive, apparel, agriculture, healthcare, utilities, and other sectors to assess the Return on Sustainability Investment related to different strategies and practices. In automotive, for example, we found one company had net annual benefits of $235 million to the bottom line through its waste management strategy. Practices such as recycling paint and solvents mean the company is no longer paying for virgin products or waste disposal costs and is selling the leftover product. Reduction of waste is a significant operational efficiency. For McCormick (the spice company), we found that their sustainable sourcing program for a few iconic ingredients was contributing $6 million to their bottom-line (net). For REI, an activewear company, we found that its focus on sustainability and purpose was driving improved employee retention and productivity to the tune of $34 million annually (net), representing five percent of payroll.

MLF: These are impressive examples where companies have achieved significant positive financial impact with sustainability investments and across multiple industry environments. They can provide executive teams and boards with tangible examples of how sustainability strategies can create financial value.

Part 2: Return on Sustainability Investments (ROSI™)

In this section, we discuss the NYU Stern CSB ROSI (Return on Sustainability Investment) methodology and how CFOs can use the approach.

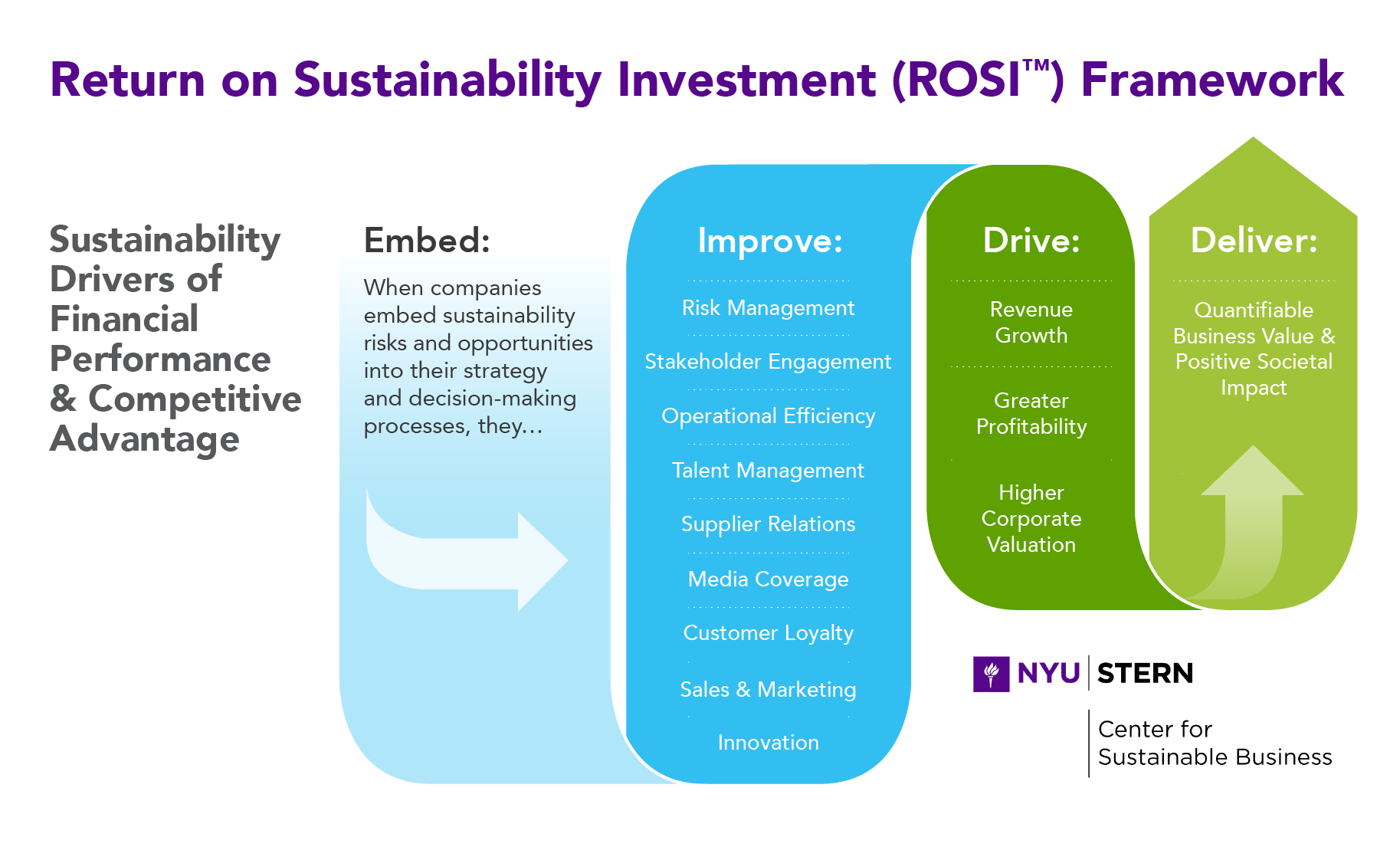

MLF: In the ROSI methodology, you identify nine factors: risk management, stakeholder engagement, operational efficiency, talent management, supplier relations, media coverage, customer loyalty, sales & marketing, and innovation.

Please describe the nine factors as you would to a CFO audience.

TW: The nine mediating factors that we have identified under ROSI can be unlocked by any form of good management. The real insight for CFOs is that sustainability IS good management that will drive improved enterprise value. Operational efficiency is a low-hanging fruit. In addition to the auto example, we found that moving to a green chemistry approach for a pharma company product reduced energy, waste, water, emissions by approximately 80% across the board— and also saved $1.5 million per 100 metric ton of product. A pulp and paper company we worked with, which does not pay much for water and is located in the Southeast of the United States, had a sustainability lead who was told by mill managers that water was not an issue because it was free. But he did an assessment and found that the sheer volume of the “free” water required $1.5 million per mill/per year to cover the costs of the energy that moved, heated, and cooled it, as well as the waste disposal costs.

We also found that sustainability-driven innovation can drive market demand and premiums. For example, our annual assessment of CPG sales in the U.S. finds that sustainability-marketed products are growing nearly twice as fast as conventional products at a 28% premium, on average. We find that sustainability can drive employee retention and productivity, that sustainable supply chains can improve supplier resiliency and reduce risk for the entire value chain, and that customers are more loyal to sustainable brands.

MLF: The nine factors provide a useful pathway for understanding how sustainability investments can be linked with good management. The connection with sustainability-driven innovation is particularly important for CFOs to drive financial performance and growth. The area of sustainable and resilient supply chains is consistent with the discussion in a recent article in this series, “Sustainability Accounting and Corporate Governance” by Mark L. Frigo, Bob Herz, and Ray Whittington. The improved employee and productivity are consistent with research on sustainable high-performance companies. The customer loyalty to sustainable brands is consistent with a recent article is this series as well, “The Financial Value of Brand” by Bobby Calder and Mark L. Frigo.

Part 3: How to Get Started with ROSI

In this section, we discuss the first steps CFOs should take to get started with ROSI.

MLF: Tensie, what are the first steps you would recommend to CFOs to get started with using a ROSI methodology?

TW: The process we use to implement ROSI varies based on where the company is on its sustainability journey and whether it wants to use ROSI as a backward-looking exercise to assess the performance of past investments, or a forward-looking exercise to make strategy and investment decisions.

- It starts with understanding which ESG issues are material for the company’s business strategy (e.g., climate change for property and casualty insurers) and designing strategies and practices to tackle corporate risks and opportunities, which is generally the role of the CSO with the rest of the C-suite.

- Based on the practices the company is implementing to tackle those issues, we apply the nine mediating factors to explore what the benefits might be. Questions we ask include, “Will this drive efficiency, employee engagement, customer loyalty?” Then we assess how to measure and monetize the benefits, which we can do for intangibles, such as employee productivity, as well as tangibles, such as sales. This can be done by the CSO/CFO and other key players who understand the potential benefits, such as procurement or HR leaders.

- Then the data needs to be collected and analyzed. For forward-looking assessments, one has to build out the model using assumptions, which can be built from past performance, academic research (we have a ROSI library), or looking at examples from other companies. For example, we look at the regulatory fines and stock drops associated with a company that was caught with a major sustainability problem in its manufacturing as a proof point.

We have ROSI open-source tools and cases on our website that CFOs and others can access to dig into themselves.

MLF: The flexible process described can be adapted to fit a company in terms of how it uses ROSI for performance of past investments as well as for forward-looking performance including strategy and investment decisions. This is very consistent with a recent article in this series, “Strategic Life-Cycle Analysis: The Role of the CFO” by Mark L. Frigo and Bartley Madden, where investments in R&D and sustainability can be viewed based on past performance as well as prospectively in terms of forward-looking strategy.

Part 4: The Return on Sustainability Investment Framework

In this section, we discuss the Return on Sustainability Investment Framework (see Figure 1), which is focused on Sustainability Drivers of Financial Performance and Competitive Advantage. The process is as follows:

- Embed: When companies embed sustainability risks and opportunities into their strategy and decision-making processes, they...

- Improve: Risk management, stakeholder engagement, operational efficiency, talent management, supplier relations, media coverage, customer loyalty, sales and marketing, innovation, and...

- Drive: Revenue growth, greater profitability, higher corporate valuation, and...

- Deliver: Quantifiable business value and positive societal impact.

MLF: According to the Return on Sustainability Investment Framework, the key step is to embed sustainability risks and opportunities into the strategy and decision-making process. This means taking a balanced approach to understanding both sustainability risks and opportunities for creating value.

Tensie, how have companies included sustainability in management processes of the organization?

TW: Currently, companies are beginning to embed sustainability risks and opportunities into their business strategy and decision-making process. However, very few are including the financial assessment of returns related to those strategies, which is unlike any other investment at a company. They will look at the costs of making changes, but rarely understand the full financial benefits, which often means companies are under-investing in the sustainability transformation needed to manage their risks and take competitive advantage in the market. This is especially true as CFOs do not track avoided costs, which are very significant in sustainability due to reductions in waste, energy, water, chemicals, etc. Nor are they tracking sustainability strategies related to innovation or sales back to the financial returns. As discussed prior, management needs to tackle this across silos and bring together a cross-organizational management committee to determine the biggest value creation levels and track them over time. Because most of a company’s valuation today is related to intangibles, intangibles such as risk mitigation, employee retention, supplier relations, etc., need to be included in the assessment.

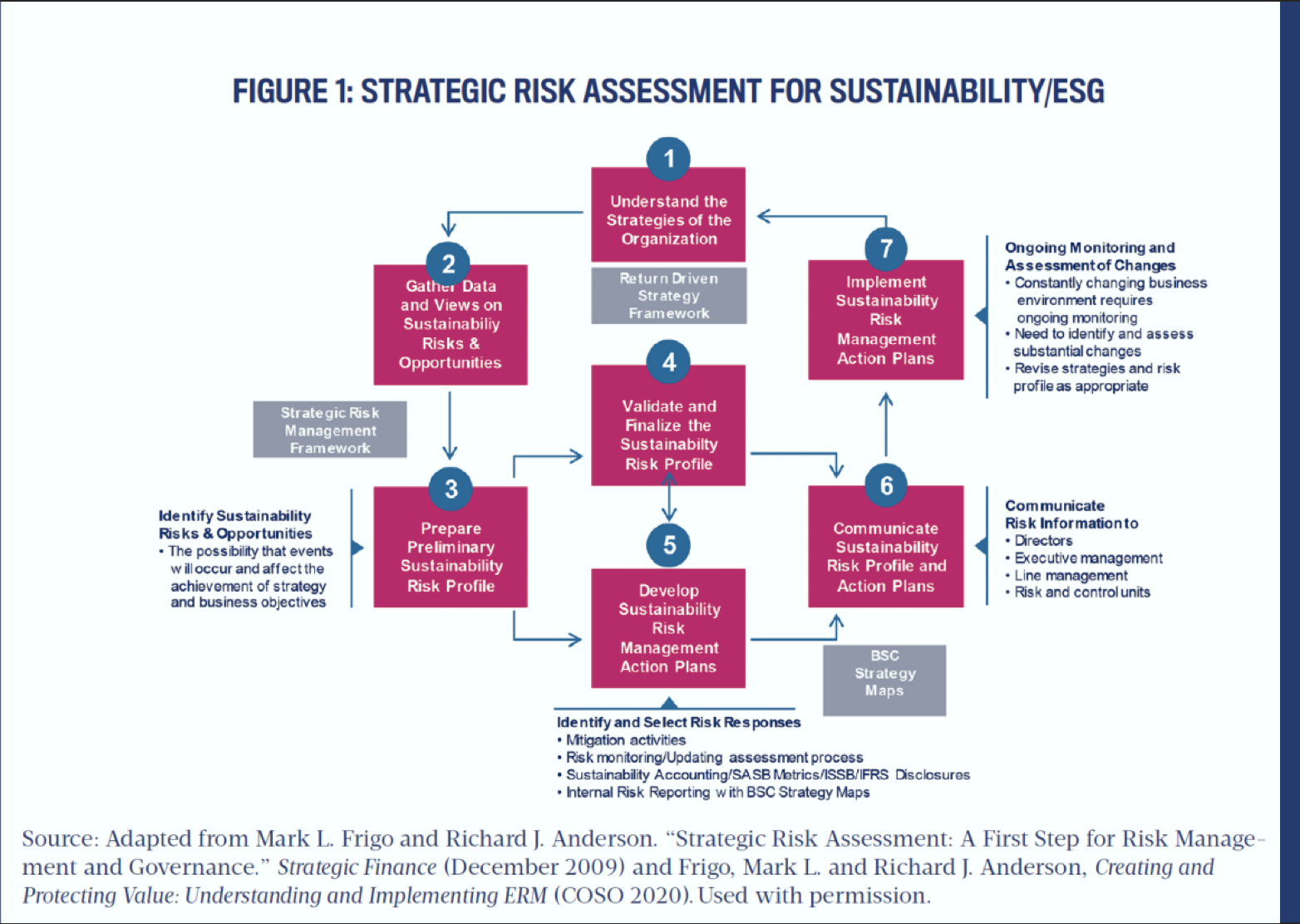

MLF: Taking a balanced approach to risks and opportunities is positive risk governance and is consistent with the strategic risk assessment process from the Committee of Sponsoring Organizations of the Treadway Commission (COSO), “Creating and Protecting Value: Understanding and Implementing ERM” by Richard J. Anderson and Mark L. Frigo and “The CFO and Strategic Risk Management” by Mark L. Frigo and Richard J. Anderson. Recognizing intangibles as creating most of a company’s valuation is consistent with other articles in this series, “Strategic Valuation in the New Economy,” by Mark L. Frigo and “Regaining Relevance in Financial Reporting,” by Mark L. Frigo with Baruch Lev.

Summary and CFO Action Plan

CFOs and finance organizations can take a leadership role to measure the ROI of Sustainability Investments using the ideas discussed in this article. Here is an action plan:

- Identify the challenges your company faces in measuring the ROI on sustainability investments.

- Include the Return on Sustainability Investment (ROSI™) methodology in your finance organizations skills set.

- Integrate the Return on Sustainability Investment Framework in your risk management processes.

- Develop an action plan to get started.

Addendum/Notes

Figure 1 Return on Sustainability Investment (ROSI™) Framework

|

This article is part of the Creating Long-Term Sustainable Value Creation series by Mark L. Frigo with Dominic Barton and part of the Sustainability Accounting & Reporting Initiative, in the Strategy, Execution and Valuation Initiative and Strategic Risk Management Lab at DePaul University, which focuses on leading practices in sustainability accounting and reporting to help corporate professionals, advisors, and investors create and protect long-term value. |

|

The NYU Stern Center for Sustainable Business (CSB)’s mission is to prepare individuals and organizations with the knowledge, skills, and tools needed to embed social and environmental sustainability into core business strategy. In doing so, businesses reduce risk, create competitive advantage, develop innovative services, products, and processes while improving financial performance and creating value for society. CSB implements its mission through activities in education, research, and engagement. |