When companies implement enterprise resource planning (ERP) systems, many fail to sufficiently plan for post go-live, succumbing to the common misconception that once the ribbon is cut, the hard work is done. However, system maintenance and support (M&S) is the longest and most costly stage of the ERP life cycle. Ineffective M&S hurts systems performance, prevents organizations from applying system updates or upgrading, and will most likely leave the ERP system vulnerable to security threats. Failure to consider M&S from the start can also threaten an organization’s ability to realize the entire value from its ERP investment.

M&S requires a long-haul commitment that involves activities ranging from software patches to system updates to user training to rolling out additional functionality. On top of that, ERP landscapes are becoming increasingly complex as companies deploy ERP modules both on-site and/or in public and private clouds. This requires integration with myriad solutions, including legacy systems, data warehouses, and intelligent automation.

In this environment, many companies lack the internal talent for ERP M&S, often outsourcing these activities to third-party application management service (AMS) providers. AMS providers perform the day-to-day M&S activities such as addressing help tickets and user administration. But the real benefit of AMS providers is their expertise in more value-added activities such as ongoing functional enhancements, technical innovation, and process improvements— just a few reasons why the global AMS market is exploding. A 2022 Allied Market Research report estimates the market to reach nearly $95 billion by 2030.

As AMS use continues to gain momentum, delivery models and service scopes will see changes with software as a service (SaaS) and cloud deployments playing a key role in its growth. And when it comes to contracting with and maintaining a relationship with AMS providers, there’s no doubt accounting, finance, and IT professionals will have a seat at the table.

To better understand the current state of using AMS for ERP M&S, we collected survey data from 70 professionals whose responsibilities include one or all of the following: negotiated their company’s AMS contract, managed the AMS vendor relationship, or helped plan for the future of the AMS relationship. We relied on each of our networks in the ERP space to identify a population of professionals across various industries, company sizes, and AMS providers.

We organized the survey into three sections:

· Companies’ business cases for using an AMS provider.

· Challenges of transitioning M&S to an AMS provider.

· Post-transition outcomes, challenges, and future plans for the continued use of an AMS partner.

Respondent and Company Information

The largest segment of our respondents had the title of director (34%) followed by chief information officer (31%), manager (20%), and vice president (13%). Most worked in North America-based companies (77%), followed by Asia Pacific (13%) and Europe, Middle East, and Africa (10%), and most companies are manufacturers (70%), with 56% having more than 1,000 employees. In terms of revenue, 30% of companies have more than $1 billion in sales, though our respondents worked for companies within a wide revenue range.

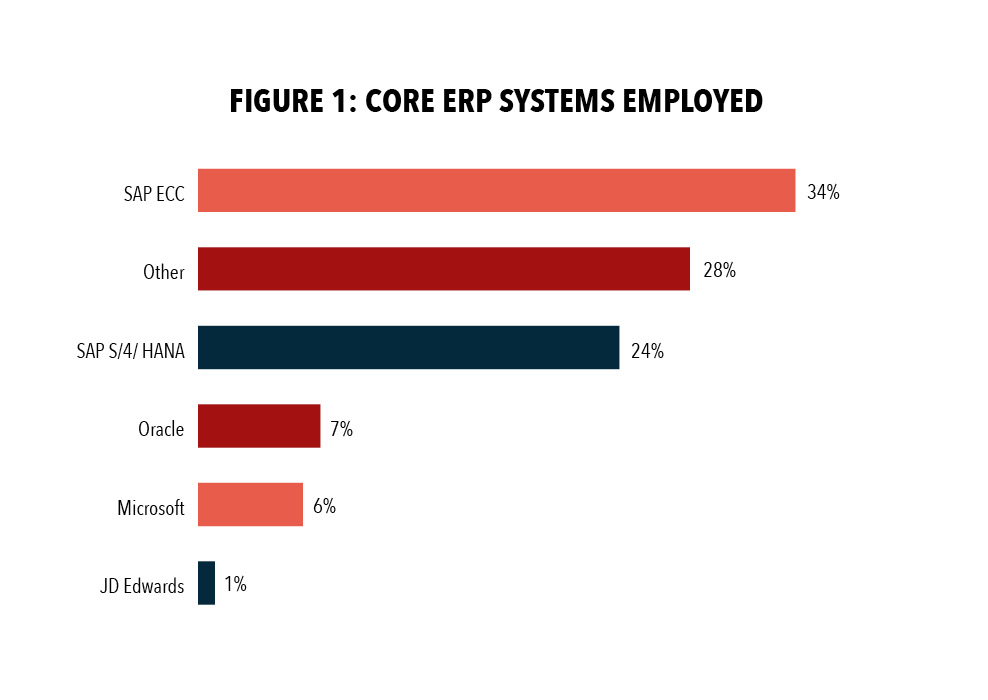

Respondents use various ERP systems for their core processes. Most companies use SAP ECC (34%), followed by “other” (28%), then SAP S/4 (24%) (see Figure 1). Other ERP systems mentioned within the “other” category include Sage, Infor, Epicor, Syspro, and QAD. The breakdown between SAP ECC and SAP S/4 reflects the slow pace at which SAP ECC customers are moving to the new S/4 version. A Gartner study revealed that 69% of SAP ECC customers still hadn’t purchased a license for S/4, while an SAPinsider study found that only 29% of SAP customers are currently using S/4.

When asked about the scope of their AMS support, 48% of those surveyed use AMS for “moderate complexity” activities, while 41% use AMS for “high complexity” activities and 11% use AMS for “low complexity” activities. In our survey, low complexity is level 1 support, which includes basic ERP help desk activities such as user administration (e.g., creating new accounts and password resets) and routing service calls to the appropriate support group. Moderate/level 2 support encompasses more business-focused activities such as minor software enhancements and master data updates. High-complexity/level 3 support is the most mission-critical work such as projects and additional/new ERP functionality. The survey results indicate that respondents place a great deal of trust in their AMS partners to provide whatever level of support is required.

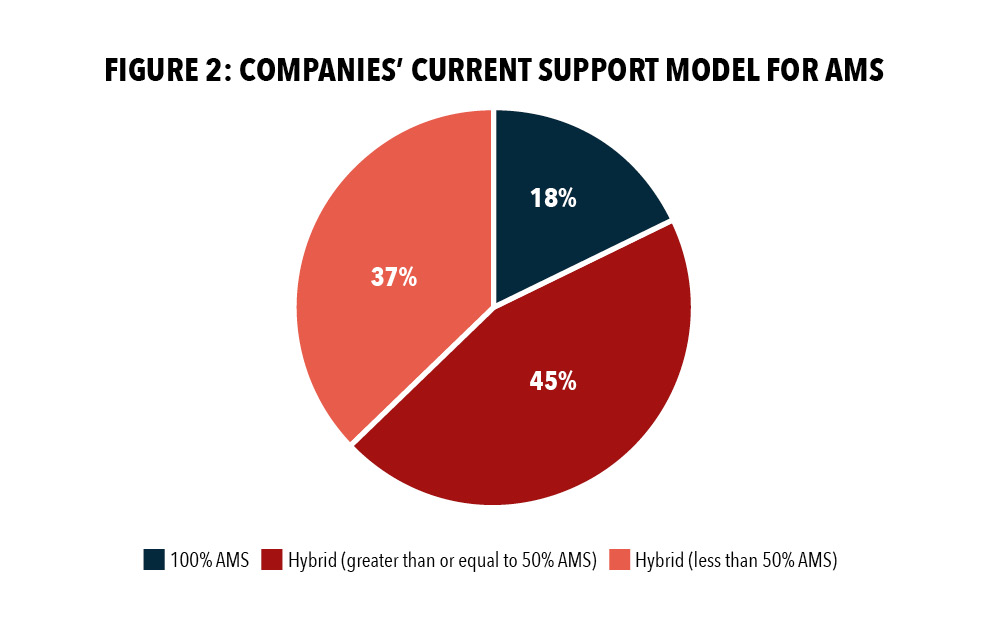

Looking at Figure 2, when companies use AMS for ERP M&S, they tend to keep some functions in-house and outsource the rest to the service provider. This hybrid approach involves a core internal support team with expert knowledge of both systems and business processes supplemented by AMS, allowing a company to retain this knowledge. Plus, it avoids the likely brain drain that can occur when a company becomes excessively reliant on external staff for ERP systems support. The largest segment of responding companies (45%) use AMS for more than half of their M&S activities, while 37% use AMS for less than half of their M&S activities. Only 18% outsource all core ERP-supported functionality to an AMS provider, although as AMS grows, these proportions could likely change.

The billing model for AMS contracts is typically some combination of a bucket of hours and hourly billed work (time and materials). Most respondents (59%) negotiated a combination billing model. A pure bucket of hours approach, which provides a set number of hours for the agreed scope of work, is used by 24% of responding companies with a rollover of unused hours and additional charges for overages. The remaining 17% of companies have an hourly contract with their AMS provider.

Business Case for AMS

According to a Deloitte white paper, there are two approaches for using an AMS provider. One is a keep-the-lights-on mentality, which means contracting for AMS with a business case consisting of the most basic requirements of cost reduction and the service level agreement (SLA). The other, more aspirational approach, is value-driven, meaning the business case for AMS seeks higher-level benefits such as process improvement and technical innovation. For this study, cost reduction and meeting the SLA are considered keep-the-lights-on reasons for AMS. All others are considered to be value-driven.

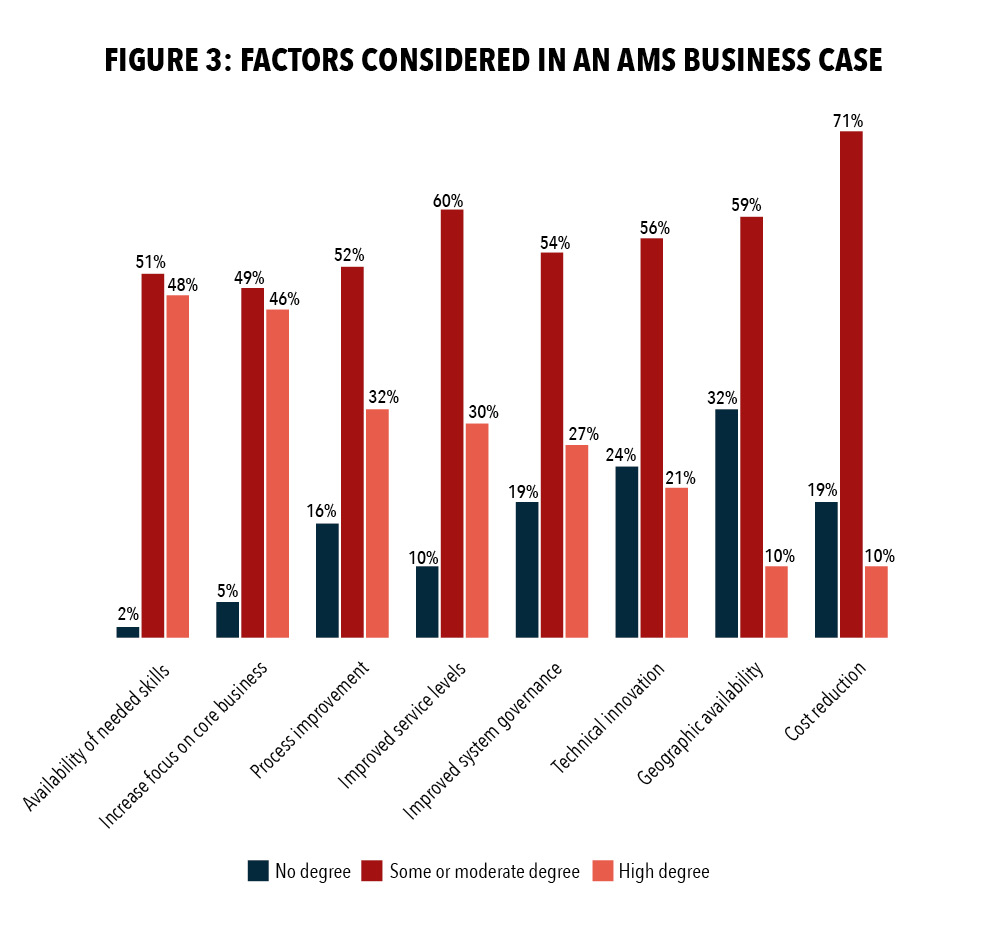

Figure 3 presents the degree to which various criteria contribute to a company’s AMS business case (sorted by high degree in descending order). The primary factor in an ERP AMS business case is availability of needed skills (98%), followed by the ability to increase focus upon core business (95%) and process improvement (84%). Availability of needed skills is also ranked “high degree” by 48% of respondents, which highlights the challenges of attracting and retaining the talent needed to maintain and support an increasingly complex ERP system landscape. AMS is a key enabler in this area, shifting the burden of finding and acquiring the necessary skills from the customer to the service provider. Similarly, 46% of respondents stated that being able to focus on their core business factored into their business case to a high degree. By offloading the work of maintaining and supporting the ERP system to a service provider, companies can focus on their core competencies. Improvement happens when the AMS provider suggests ways to redesign the outsourced processes for maximum efficiency and effectiveness. All these top-ranked factors are value-driven approaches, indicating that our sample companies are seeking more than basic service when contracting with their AMS providers.

Conventional wisdom suggests that outsourcing is mainly a cost-saving tactic often accomplished through labor arbitrage where companies position the work in geographical locations with lower labor costs. While 81% of respondents view cost savings as key to an AMS business case, only 10% said they factored it to a “high degree.” Also, only 22% of respondents use offshore providers, indicating that labor cost is not always the main driver in respondents’ decision to use AMS. (Respondents in North America demonstrated the most preference for onshore providers.)

As for the SLA, 90% cited that meeting the agreement is important to their business case for AMS, yet only 30% considered this “high degree.” Figure 3 shows that an AMS partnership isn’t just about cost savings and improving the SLA (a keep-the-lights-on mentality). Companies are seeking additional value from their AMS relationship that may not be feasible if the M&S is performed by internal staff.

AMS Transition Experience

Companies face many hurdles when transitioning their ERP M&S to an AMS provider. As Figure 4 shows, the two top challenges (sorted by high degree) are organizational change and knowledge transfer.

With any type of outsourcing, the move to AMS support can create considerable stress on business users and internal support staff. For example, internal support staff might view the new M&S arrangement as a job threat. Also, the end user community, used to getting answers from an internal support team, are now relying on external support. And the external support could be in another country with limited visibility into the customer’s operations and culture. So company leaders need to manage employee morale and communicate the benefits of AMS to ensure a smooth transition.

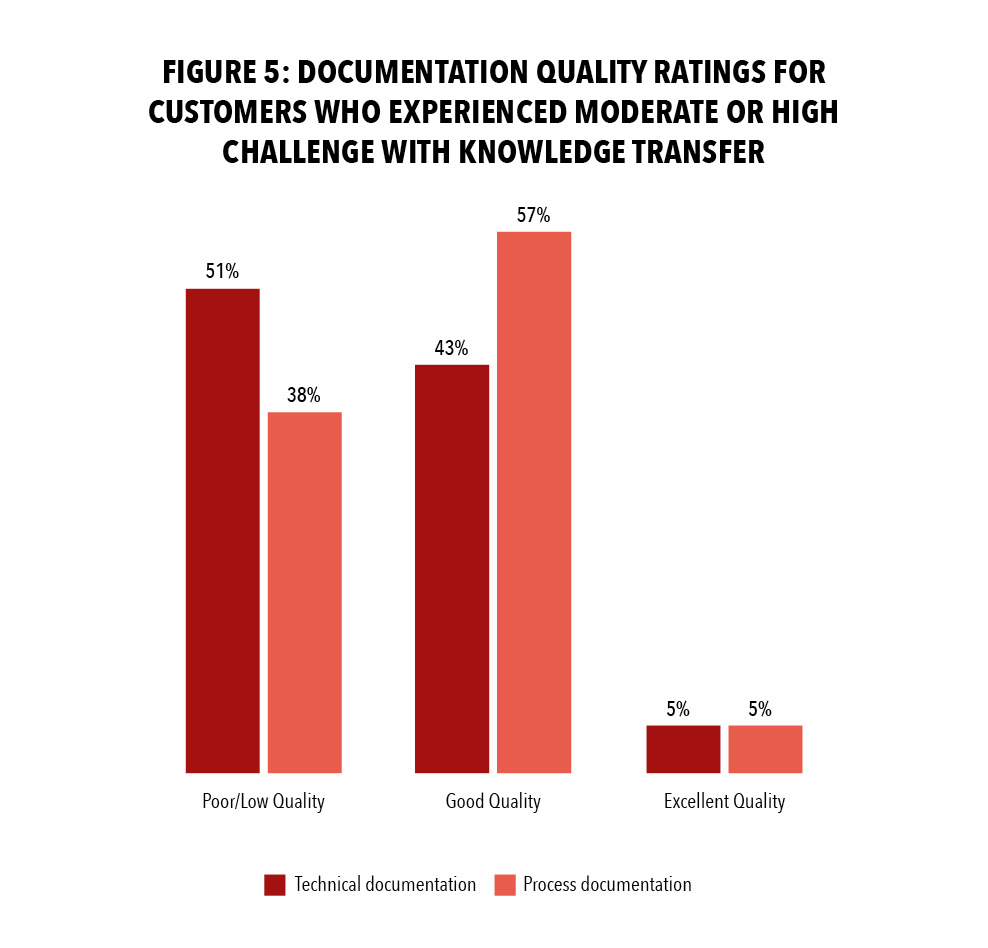

Successful knowledge transfer can depend on multiple factors, with documentation being a priority when helping a new AMS partner get acclimated to their customer’s business processes and systems. Respondents were asked to measure the quality of their technical documentation (ERP system setup and customization) and process documentation (the flow of the business processes). Among those who experienced a moderate or high challenge in knowledge transfer, 51% rated their ERP technical documentation as poor or low quality, and 38% rated their process documentation as poor or low quality (see Figure 5). Only 5% rated their technical and process documentation excellent, reinforcing the importance of delivering quality documentation to the AMS partner when transitioning.

Post-transition Benefits

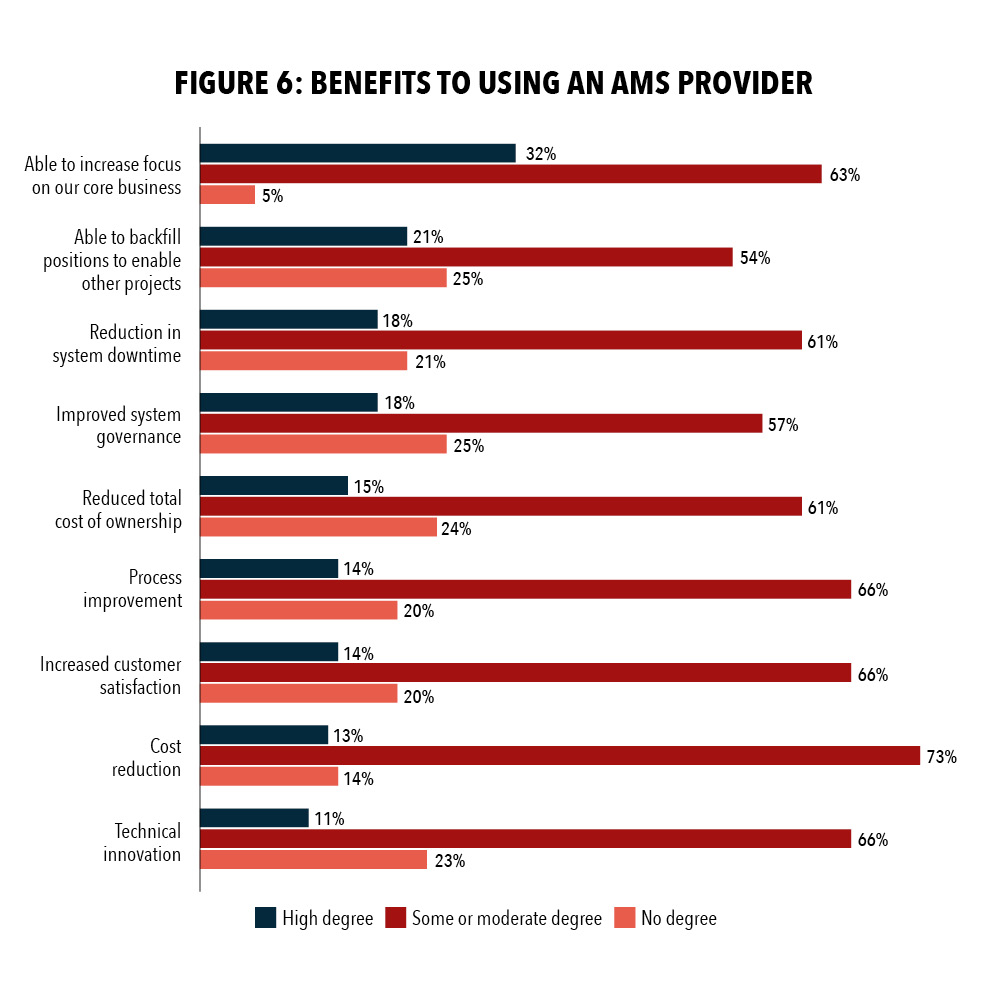

Allowing third parties to handle ERP M&S can ensure companies have the bandwidth to prioritize other issues. Respondents ranked “able to increase focus on our core business” as the leading post-transition benefit (95%) with 32% citing it as a high-degree benefit (see Figure 6). Being able to offload nonbusiness core activities likely contributes to the next highly ranked benefit, “able to backfill positions to enable other projects.”

Cost reduction is also a highly ranked benefit for AMS (86%), reinforcing the usual value proposition espoused by AMS providers. However, only 13% of respondents stated they realized cost reduction from the arrangement to a “high degree.” Most highly ranked benefits were those adopted as value-driven benefits. Meeting the SLA was a high-ranked benefit (in terms of system downtime, a key metric for the SLA). Overall, those who use AMS are realizing additional benefits from the arrangement beyond the primary advantages.

Post-transition Challenges

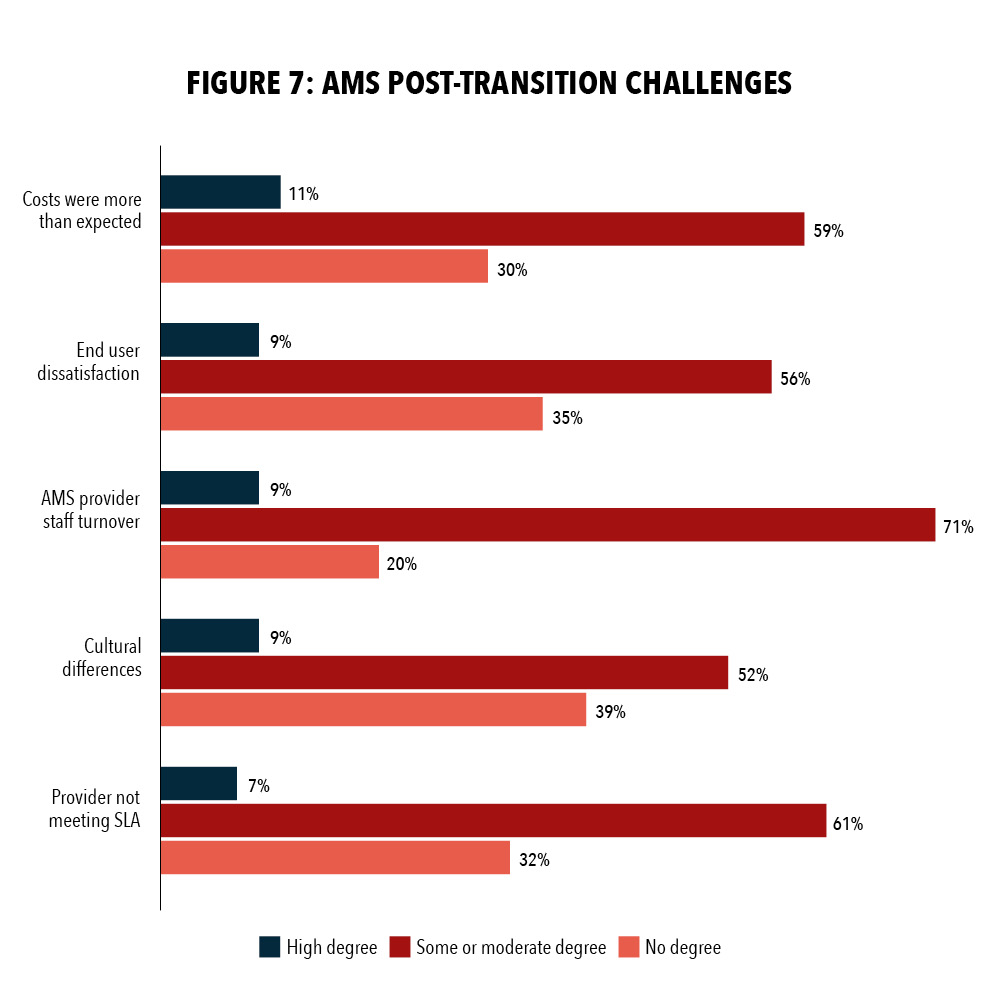

AMS provider staff turnover is the main post-transition challenge, according to respondents (80%)—although only 9% rated it as a high-degree challenge (see Figure 7). Figure 3 revealed that customers use AMS because they’re lacking the skill sets needed to maintain and support their ERP systems. However, the same skills shortage can affect AMS providers.

Another challenge companies experience after transitioning to an AMS provider is that costs can exceed expectations (70%), although only 11% of respondents thought it a critical issue. Although many factors can contribute to increased costs, the structure of an AMS contract can often be the culprit. For instance, our data reveals that 82% of companies negotiated a hybrid contract with their AMS provider to have a set number of support hours plus an hourly time-and-material cost for work outside of standard support tasks. Companies that contract for an hourly rate for work performed might find that the AMS provider needed more time than expected to complete the M&S work. This indicates that while AMS usually drives some level of cost reduction, the actual savings can be less than anticipated.

Additionally, end user dissatisfaction was noted by a combined 60% of respondents as a transition challenge, suggesting that at least some level of that resistance spills into the post-transition phase. Fears and concerns early in the new AMS relationship can create an internal bias that’s difficult to overcome in the long run.

Sometimes cultural differences are found when using offshore providers, and this has been the experience of some companies that outsource business functions to remote locations. While more than 60% of companies encountered cultural differences, our data did not reveal any relationship between AMS provider location and cultural challenges post-transition, revealing that other factors likely contribute to the problem.

Changing AMS Providers

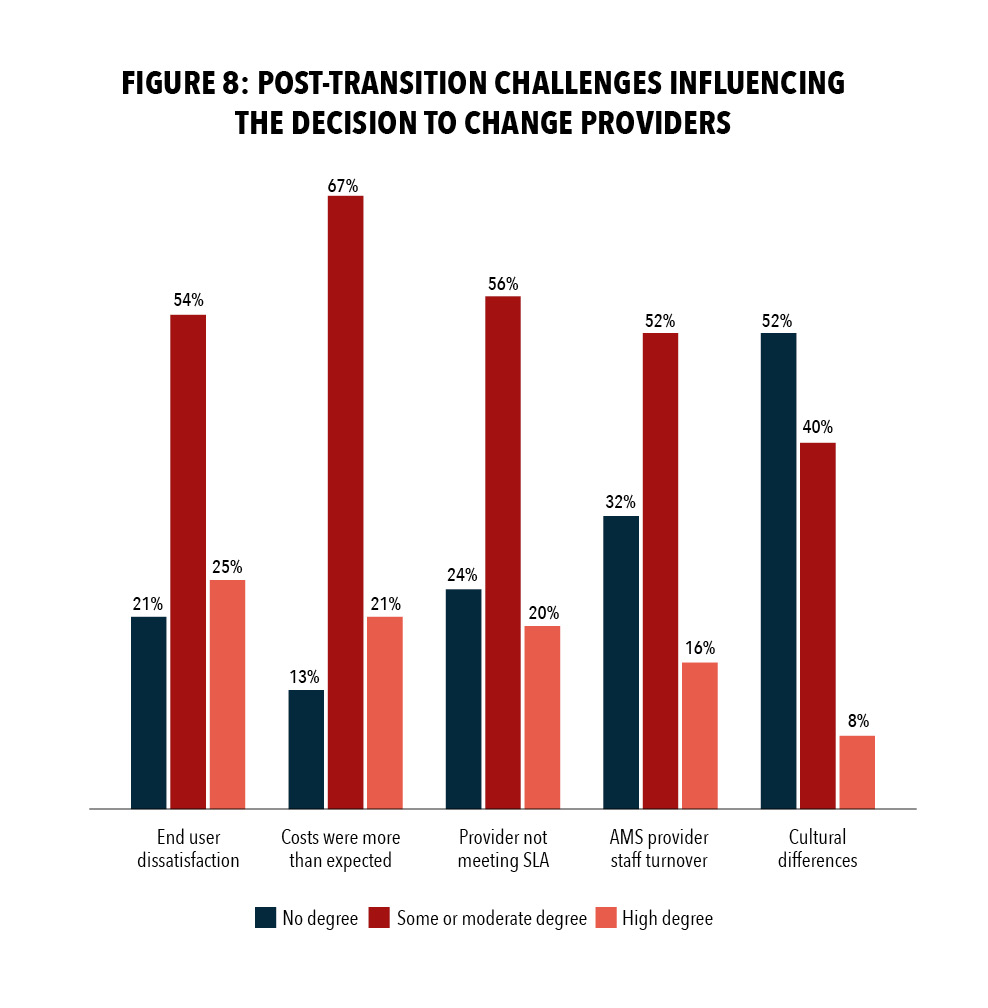

Over time, an AMS provider becomes integral to a company’s overall support strategy, making it very difficult to switch providers. A major decision like this would usually only be made after repeated shortcomings in the provider service. Despite the potential business disruption, nearly half (45%) of respondents reported that their company had changed AMS providers. The main reason companies changed providers was unexpected higher costs (88%), reinforcing that anticipated savings don’t always materialize. End user dissatisfaction is another big factor in changing providers (79%), highlighting the importance of strong organizational change management to build and maintain an effective working relationship (see Figure 8). Other reasons why companies change providers include an AMS provider not meeting the SLA contract (76%) and frequent AMS staff turnover (68%).

Quality of Support and Future Plans

Looking at the big picture, most companies are pleased with the quality of their AMS support, with 84% rating the support as good or excellent, according to our survey. This sentiment is reflected in companies’ future plans for using AMS, with 32% of respondents stating their company is pushing more work to the provider and 46% maintaining the status quo. Thirteen percent have plans to bring work back from AMS, and only 9% have plans to change providers.

AMS has become an integral part of successful M&S for ERP systems and will continue to grow alongside the cloud, the rising number of providers, and the complexity of companies’ IT landscapes. An effective AMS partnership can cover the entire spectrum of routine to complex support, providing the skills, flexibility, and added focus needed to help organizations achieve a greater return on investment.

Based on our research and survey, here’s what we found to be most interesting about AMS:

· Cost reduction. While a large majority reported achieving cost reduction as a benefit, many also reported higher than expected costs as a post-transition challenge and a key decision point in changing AMS providers.

· Knowledge transfer. Respondents identified knowledge transfer as the greatest challenge when transitioning to a new AMS provider, reinforcing the importance of quality documentation to this process.

· Satisfaction. The majority of customers were very satisfied with the quality of support received from their AMS providers. This gives customers the confidence to send even more work to their AMS partner, further establishing AMS as a critical component of a successful ERP support strategy.