Corporate treasuries have faced unprecedented challenges in recent years—from inflation to interest rates to geopolitical disruptions. Amid these macroeconomic pressures, operational efficiency and cash forecasting capabilities have become key differentiators when optimizing liquidity and achieving growth.

To meet these objectives across the treasury function, teams are increasingly turning to automated solutions and centralized data and processes. Harnessing disparate internal data, advanced analytics, and connectivity are required to complete cash forecasts. But establishing this crucial structure is not without significant challenges. Indeed, PwC research reveals that nearly 50% of treasurers described cash forecasting as “somewhat” or “extremely” difficult.

As the strategic role of corporate treasurers has grown, liquidity planning has increasingly become a priority for the office of the CFO. Treasury teams are well positioned to take the lead on creating forecasts needed to make sure the company has sufficient liquidity and the cash available to meet business needs. This requires data, oversight, and collaboration across enterprise-wide business units and funding life cycles. As a result, the finance function must be digitally transformed to forecast liquidity needs accurately and in a timely manner.

The trend is increasingly driving the centralization of data and technology in the interests of efficacy and efficiency, and the tremendous volume of data to study and process for payment flows and cash behaviors. It’s also redefining the role of the treasury function as an influencer, since its increased purview over payments and data impacts the entire business. Technology investments in treasury management systems (TMS) have become pivotal for corporate finance teams, enabling treasurers to make data-driven funding decisions.

Centralizing treasury management, or at least standardizing processes, is core to deploying a successful TMS. Organizations with a TMS benefit from enhanced efficiency, accurate cash management, risk mitigation, and improved decision making, among other benefits. All of which begs the question: Why don’t all corporations have a centralized treasury solution?

What’s holding corporate treasurers back?

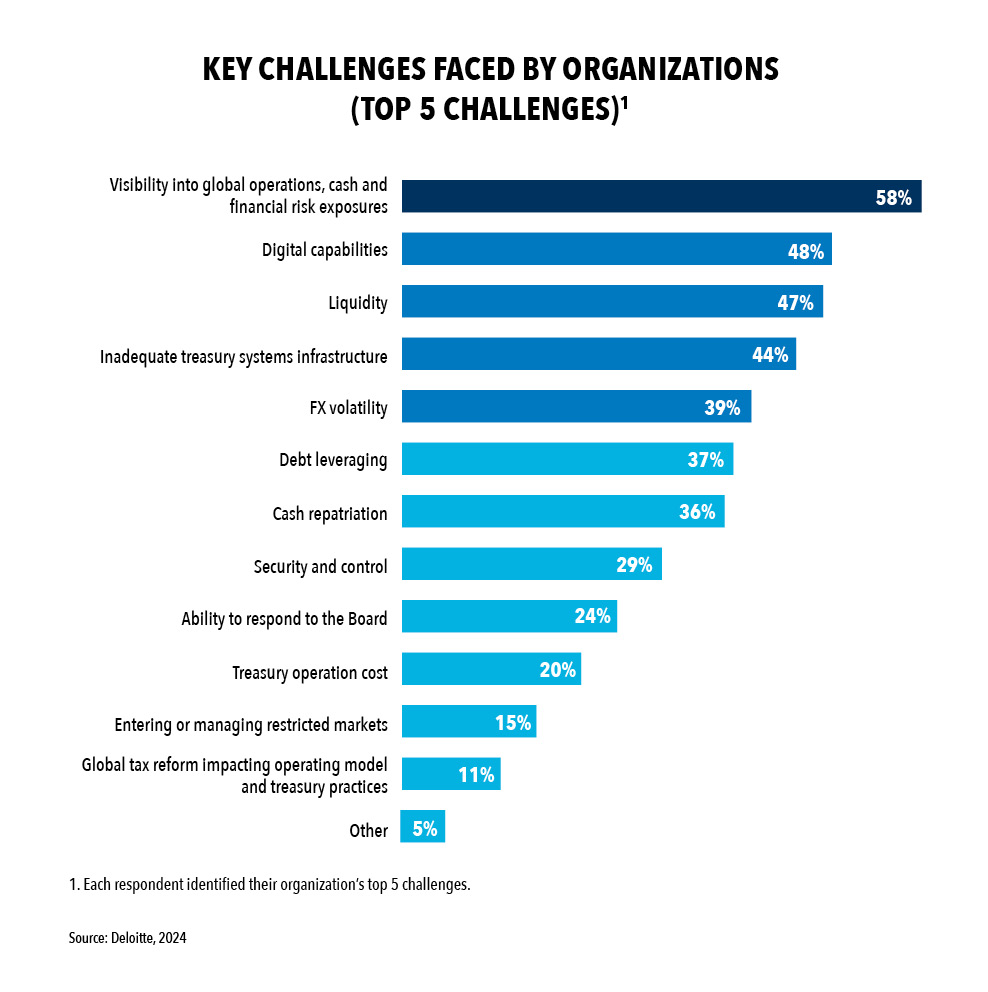

Despite the obvious benefits of centralized treasury solutions and automating processes, many companies still have a long way to go to transform their operations digitally. According to 2024 data from Deloitte, 58% of companies say visibility into global operations, cash, and financial risk exposure is continuing to be cited as the most challenging and time-consuming area for treasurers year-on-year while 48% state digital capabilities as a challenge. There are a few reasons for this.

A significant obstacle often preventing companies from centralizing their processes is the lack of adequate technology infrastructure, skills, or resources to support a centralized treasury model. For example, processes might vary for valid reasons, and the technology might not be flexible enough to support the various permutations. While many inconsistent processes can be aligned to a standard model, there are nearly always exceptions. Without flexibility, processes are managed outside the system, require more manual work, and lack robust controls.

Also, centralizing cash management, liquidity, risk management, and funding functions can be extremely complex. As with any significant structural change, it comes with potential risk. For example, centralizing a function that supports a decentralized business requires major change management and shifting reporting lines.

Attention must also be paid to accounting standards, regulations, and compliance considerations throughout the centralization journey, which vary across different regions or countries. While compliance with regulatory regimes is a requirement for any business, it can be daunting for corporations to navigate these while undergoing significant structural changes.

From a cultural perspective, there is often resistance and reluctance of local subsidiaries or business units to relinquish control and autonomy over their cash and risk management. Decentralized processes can give individual units a sense of control over their finances. So, centralization might be perceived as a loss of autonomy.

These are not insignificant challenges. However, Deloitte research published in 2024 indicates that 44% of organizations polled consider inadequate treasury systems infrastructure as one of their top challenges (See Table 1). The time to change is now.

The benefits of centralized processes

For any company experiencing growth, what used to be effective for managing treasury processes might suffice as the company expands. The case for centralizing processes is more powerful than the few challenges. Implementing the correct TMS will help alleviate some of the problems that Deloitte’s study rated as the other main challenges organizations face, such as visibility into global operations, liquidity, and foreign exchange volatility.

Enhanced visibility is a cornerstone benefit of centralizing treasury processes. By consolidating execution and oversight of multiple treasury functions and activities, the team has a global view of the company’s cash position, which helps it focus on forecasts. The greater visibility empowers more informed decision making that optimizes working capital, investment strategies, and sources and uses of capital aligning with the company’s liquidity requirements, risk tolerance, and ROI expectations.

Moreover, centralization could drive reduced fees and complexity as the need for multiple bank accounts and currencies might no longer exist, and automating reporting and reconciliation saves time. Ultimately, optimization conserves valuable time and resources and enhances the timeliness and precision of financial information.

Another advantage is the reinforcement of control. Centralization ensures a consistent and effective implementation of treasury policies and procedures throughout the organization. This guarantees that all treasury activities align with the company’s strategic objectives and are compliant with relevant regulations and standards. It also improves the governance and compliance of treasury activities, such as managing foreign exchange exposure, hedging strategies, and counterparty risk. This, in turn, mitigates the potential for losses—and safeguards the company against reputational damage arising from adverse market movements, operational errors, or fraud.

Efficiency is a third benefit. Centralization reduces operational costs and complexity by eliminating redundancies and enabling treasurers to capitalize on economies of scale. This leads to lower transaction fees as well as better pricing and margins for the company. Moreover, centralization can make treasury staff more productive by allowing them to redirect their focus toward more strategic and value-added tasks. These tasks include analyzing market trends, optimizing capital structures, and exploring new business opportunities.

Centralization also contributes significantly to risk management. It helps mitigate a spectrum of risks associated with liquidity management, spanning currency fluctuations, interest rate variations, credit default, and fraud. That’s because it’s a holistic and integrated approach that monitors, measures, and manages the company’s exposure to different types of risks. Additionally, centralization facilitates access to alternative sources of funding and liquidity, such as internal cash pooling, intercompany loans, and capital markets. This bolsters the company’s financial flexibility and resilience, particularly during stress or uncertainty.

While the frontrunning benefits are cash visibility and control, treasurers might decide to centralize based on one, some, or all these reasons—all of which are equally valid.

Importance of technology and a sustainable partner

A solid technological foundation is fundamental to successful centralization. In treasury, this involves addressing data integration, automation, and controls. To facilitate centralization, businesses must ensure that their various financial systems and data sources can interact and share information seamlessly. Integrating sophisticated tools is essential to streamline processes and reduce manual intervention, enhancing efficiency and accuracy.

By centralizing these critical areas for finance teams, CFOs can establish and test a set of controls over the treasury operations, leading to greater efficiency. However, it is a multifaceted process with potential challenges that span technology, risk management, security, and regulatory compliance. Addressing these considerations thoughtfully allows organizations to navigate centralization successfully, minimizing disruptions while optimizing their financial operations.

When carefully planned and considered, centralized processes can be extremely beneficial for the business.

Additionally, it is important to identify the right technology partner for your centralization journey. The investment in technology is one that is made with a long-term view. So, due diligence is critical.

Technology partners invested for the long run will ensure treasury teams receive the right support model beyond implementation and offer services to reinforce value from their technology. A strong partner will work with you every step of the way to help find optimal solutions for specific pain points. Technology partners will also bring fresh perspectives—and experiences from other firms that have moved to a centralized model.

Incorporating experiences from other organizations can be valuable, bringing new ideas, opportunities, and trade-offs to consider. It’s also important to strike the right balance between designing processes to fit the systems and customizing the systems to fit a process. The technology partner is best informed about their solutions while the organization knows best about its business, which is why this partnership is crucial.

The future of the treasury

A key driver of centralizing treasury processes is the convergence of responsibilities across the office of the CFO, with lines blurring between the CFO and other C-suite members. This means that the quality and quantity of data available for a CFO to leverage is pivotal to driving strategy—and centralization can help. Streamlining the treasury processes and ensuring that clear, organized data is accessible in one place puts the CFO in a unique position to drive business strategy.

Alongside this, the increasing use of application programming interfaces (APIs) is set to enable tighter integration between various financial applications. This seamless connectivity will facilitate the real-time flow of data and transactions for CFOs and treasury teams, ultimately enhancing the speed and accuracy of finance decision making.

On-demand insights will be a cornerstone of the future of centralization. Treasury teams will have unprecedented access to data and analytics, empowering quicker and more informed decision making. This real-time aspect is particularly valuable in managing cash and liquidity. Coupled with the data benefits, it ensures investment, capital structure, and risk decisions are grounded in the most current information. By taking a forward-looking approach to risk management, businesses can proactively address potential challenges, further solidifying their competitive edge.

The rapid evolution of artificial intelligence (AI) will also open new opportunities for treasury. Increasingly, AI-driven algorithms will automate routine tasks, optimize cash management, and identify patterns and anomalies in financial and payment data, providing valuable insights for more efficient and data-driven risk identification and decision making. Machine learning models will also contribute to enhanced liquidity forecasting and investment strategies.

Digital transformation aims to link processes more tightly, with data underpinning a decision support revolution for the office of the CFO. This shift brings about convergence across multiple finance functions, real-time insights, predictive analysis, and payment centralization enabled by advanced technology. The results empower organizations to operate more efficiently, make data-informed decisions, and manage risks effectively. These trends collectively enhance their financial performance and competitive position, ensuring that centralization remains a dynamic and evolving strategy.

Centralizing data management and processes is rapidly gaining popularity—and it’s clear to see why. If CFOs haven’t started the transition already, the time for action is now.