In today’s tough business climate, it’s more important than ever for CFOs to be strategic partners within their organizations. They must move beyond the numbers to guide critical decisions about how scarce capital gets allocated.

Simultaneously, automation and AI tools are more widely available than ever —and have become an essential part of how best-in-class finance organizations work. While finance leaders have long had theories and models to help them predict risk and performance, AI allows them to make those theories real, applying them accurately and effectively. Today, both ends of that equation are coming together, allowing CFOs to turn raw data into instant value and accurate insights.

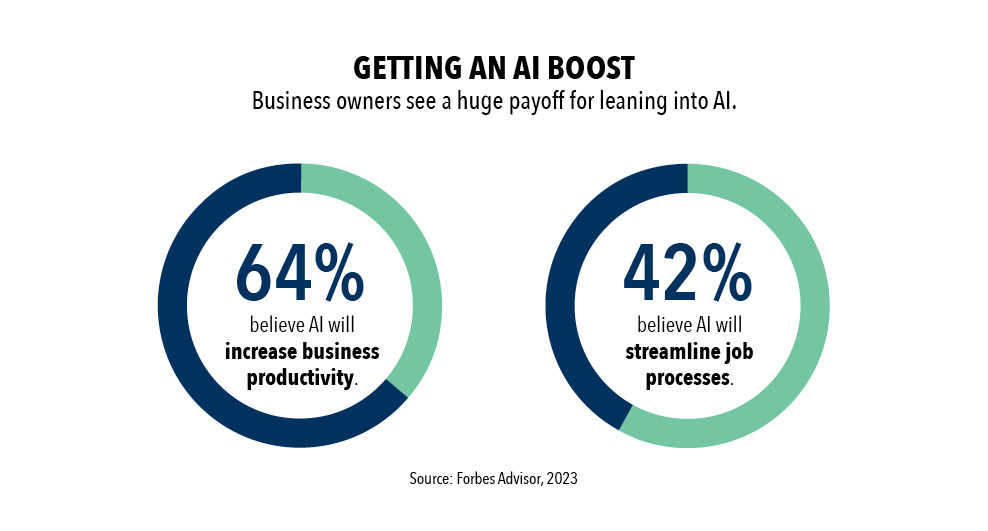

And there’s a huge payoff for implementing AI in the form of increased productivity and the ability to streamline workflows, according to 2023 Forbes Advisor research (see Graphic 1).

Across the finance industry, I’m hearing from CFOs who are already engaging smart technologies to uplevel their businesses. Here’s how they are using AI today, how they plan to use AI in the future, and how they are measuring the success of these tools within their businesses.

How are finance organizations using AI today?

CFOs are leveraging AI to maximize growth and profitability, with an eye toward transforming the flow of financial data within their businesses and helping to foster informed decision making.

Before generative AI even came on the scene, CFOs had been deploying other AI tools to automate their processes. AI can convert unstructured data into structured data and reconcile that data. It can handle ambiguity, meaning you don’t need to have one data point be identical to another for AI to recognize that they are most likely the same. AI can also reorient entirely different forms of data so teams have a consistent view.

Accounting teams, for example, are adopting AI into their accounts payable (AP) workflows to run tasks autonomously and help manage volatility as they scale. These tools raise organizations’ level of confidence around financial decision making, because now they have a layer of real-time intelligence that comes from a system that helps handle and shepherd the transaction flow. At the same time, the system provides a level of intelligence to spot anomalies and engage the team to review.

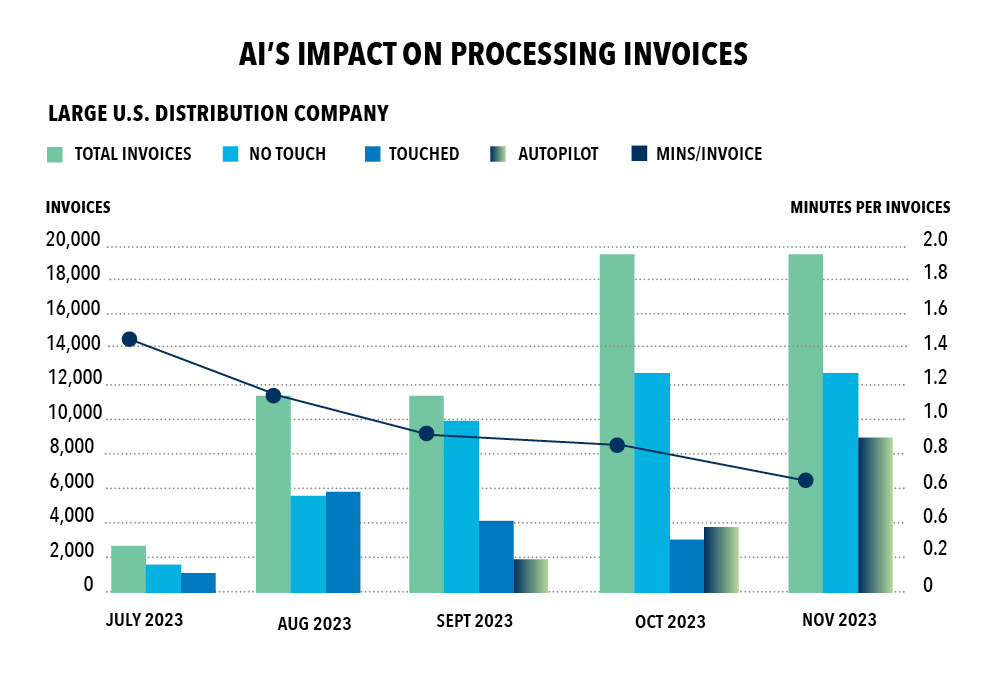

For example, one of our customers, a large U.S. distribution company, has seen 99% accuracy in invoice coding and classification while simultaneously shortening the AP financial close process from four to three days, reassigning three FTEs to focus on higher-value departmental activities. Within six months of implementing AI in their AP approval workflow, they saw a significant drop in invoice processing time while simultaneously increasing the number of invoices processed (see Graphic 2).

With generative AI, there are two primary use cases I’m hearing about from fellow CFOs. First, of course, is to ask the tool a simple question and get a very detailed response. But even more useful in finance is AI’s ability to do the opposite: to feed AI a huge amount of data and ask it to pull out the information that is most valuable to the organization.

This allows us to take unstructured data— whether that’s an invoice or contract— and immediately pull out or synthesize the most important pieces of information. For example, AI can read a sales contract, ingest salesforce and billing data, link those sources, and ensure the data is populated and validated before running a revenue recognition workflow to the journal entry.

This ability also benefits stakeholders across the organization, including marketing and sales, who might be interested in pulling different information from the same data set compared to the CFO. It also assists with audits. In the above scenario, your auditor can now review that journal entry and instantly refer to the original source data point.

Whether it’s processing large-scale documents or reconciling or comparing information, there are phenomenal use cases for AI in finance and accounting—all of which save finance organizations a tremendous amount of time.

Where might finance organizations consider AI adoption?

When it comes to AI adoption, it might feel overwhelming to know where to begin. In general, CFOs are finding ways to bring AI into their workflows and act as an extension of their teams —using it not to displace their workforce, but to augment and maximize what their teams can do.

To achieve that, it’s safe to start with areas where AI can augment repeated processes. These might include:

- Automated financial report generation

- Invoice processing and payment

- Tax preparation and filing

Once AI is comfortably in place in those areas, how can CFOs take it up a notch? Here are some next-step areas for AI:

- Anomaly detection and prevention

- Budgeting and analysis

- Financial advice

Modern finance organizations no longer need an army of bookkeepers to perform backward-looking activities; they are looking for business partners who can provide CEOs with foresight and predictive capabilities to help them decide where and how to invest and scale. With AI, CFOs are building the capacity of their teams to serve as partners.

How should finance leaders evaluate uses for AI in the context of ROI?

From an ROI perspective, CFOs want any changes they make—including any technology they adopt—to save costs, bring efficiencies, and/or decrease risks.

Although cost is the most important of those factors, the CFOs I’ve spoken to aren’t thinking about reducing headcount. Rather, they’re thinking about how AI can get the very most out of their employees and change the nature of the roles on their accounting and finance teams. They’re considering all the tasks distributed around their organizations and among different types of partners. They want to change the dynamic by giving more strategic power to teams or leveraging their partners more, to shift the balance of how they spend money.

CFOs should also consider the amount of scale these tools can absorb, giving leaders more flexibility. Real-time data around transaction flows allows for near-instant decision making. It also buys leaders more time to consider high-stakes decisions. The combination of those advantages puts CFOs in a much more powerful position to deploy capital toward what is truly strategic—and allows them to accomplish these strategic priorities weeks faster than before.

And while CFOs are thinking about what costs they can save today, they also need to think about how they can set themselves up to capture ROI from AI in the not-too-distant future. These leaders should consider how they set their infrastructure, which doesn’t accelerate at the same pace as operational costs.

Increased flexibility is another focus, allowing for easier contract changes or empowering sales teams to perform in a more dynamic fashion, for example, to set their companies up better to grow and scale. CFOs should also consider how AI can help them flex up volume painlessly or deal with ambiguity coming from the sales or marketing teams. This speaks to how AI can help CFOs be less reactive as they grow their businesses.

How should leaders approach developing an AI adoption plan?

When determining and implementing an AI strategy, CFOs shouldn’t work in a vacuum; they should work closely with other C-suite leaders. For their CEO, the CFO will need to frame new technologies in the context of the strategic advantages they pose for the organization across speed, cost, and focus —in short, that they are worth the investment.

The CIO, in turn, can provide the CFO with context of available capabilities and point them toward solutions that are appropriate for their organization’s stage and compatible with the rest of the organization’s technology. On top of that, the CIO can help evangelize these investments to the CEO.

When developing an action plan to get them there, it’s totally fine for finance leaders to start small. They can begin with a small-scale use case—a repetitive task that can easily be performed by AI, for example—to quickly and clearly demonstrate success. Even that one small change can help leaders learn so much about these technologies, think about them more holistically across their organizations, and give them the confidence to keep building.

CFOs can also open up the AI conversation with their vendors and partners. They can ask their software vendors how they are leveraging AI, and what their roadmaps for future growth in this area look like. Vendors may already have ready-made AI capabilities that could be added into your current package, such as a new AI transcription capability built into your existing video-conferencing software. CFOs should also be asking vendors about nuts-and-bolts issues, including accuracy, data privacy, and cybersecurity.

But even if they start small, the CFOs I’ve spoken with agree that finance leaders should also start now. For many, AI’s impact across their organization is already enormous. Leaders who wait too long to learn about and implement these technologies will find themselves playing a very difficult game of catch-up against their competitors in 2025 and beyond.

How can CFOs measure success?

Once CFOs are implementing AI, how can they measure how well it’s working, and what type of ROI it’s generating? It will be critical to ensure clear ROI—from headcount and cost- per-transaction all the way to more free time for leadership to focus on the highest-value activities.

In addition to headcount, there are many layers of operations AI should be handling. Finance leaders should be able to compare the performance and efficiency of these AI tools against their employees’ prior performance in those tasks, as well as performance from outsourced services. Adding up the ability to run things like close cycles, planning cycles, and external reporting more quickly will begin to stack up and be relatively simple to measure, in terms of days and dollars saved. Leaders can also compare various teams’ performance relative to their budgets.

Another significant benefit will be in reducing risk and avoiding long-term potential costs. AI’s ability to perform continuous auditing and monitoring is a double benefit in terms of cost effectiveness as well as the value of information gleaned from these activities.

Finance leaders can be plugged into their controls 24/7, rather than the two or three times during the year when something breaks down. AI can help CFOs identify avoidable spikes in audit or compliance risks, transactional issues, or even potential future risks based on their growth trajectory. These benefits are more difficult to quantify in bottom-line numbers but are undeniably valuable.

Wish list: Future superpowers of AI

AI is already transforming the accounting and finance profession in promising ways—but there’s so much more to come. It’s exciting to imagine what the not-so-distant future might hold.

It’s only a matter of time before AI will be able to look across an organization’s multitudinous data sets to produce high-quality, predictive analytics. This will help organizations understand everything about their businesses and industries instantaneously—and allow for immediate action.

Speed will be another future superpower. Reading contracts could become a thing of the past: Instead, companies could ask an AI tool about a contract’s contents in order to quickly sign the bottom line. AI will likewise revolutionize budgeting and forecasting. No longer will finance professionals need to pore over spreadsheets for weeks on end; rather, an AI assistant could run various scenarios around sales numbers and other inputs to instantly create an ideal budget.

I can’t wait to have my very own AI assistant. I hope to be able to ask an AI co-pilot to perform an action or interpretation, cutting through all the tactics and noise, to point out—in the blink of an eye—all the risks and rewards around a proposed scenario and help the organization get ready to take quick action.

Get ready to enjoy the AI revolution

Today’s growth-minded CFOs want their roles to go far beyond the business-as-usual accounting and the financial reporting. AI has the power to be their close, trusted, and successful growth-minded business partner —and someday, even a co-pilot.

Yes, the bar is high for today’s businesses to succeed. But AI, when used strategically, can help CFOs take their businesses to new heights. With AI, CFOs can help their companies grow exponentially, without an equal increase in infrastructure costs. They can help streamline operations and cut inefficiencies. They can remain flexible, so that today’s problems don’ t grow into intractable quagmires as the company and infrastructure scales. And they can pivot instantly in response to business and economic realities.

Most of all, CFOs should try to enjoy the AI ride. Just as the smartphone transformed the way we interact with the world, AI has the potential to revolutionize the way we work—to be smarter, faster, more intuitive, more dynamic, and even more fun. It’s time for finance leaders to appreciate and embrace AI—for the benefit of their companies and for themselves.