There are many paths to becoming a CEO. But when it’s time for companies to pick a new leader, we think business professionals with finance experience bring a lot to the table.

Why? Because the experiences and skills developed in a finance role are highly valuable and can make a highly successful CEO. A wide body of research has explored the characteristics that best equip an individual to be CEO, from educational background and professional experience to skills and personality traits. With these considerations, many financial professionals appear to be a strong fit.

According to research from Korn Ferry, successful CEOs demonstrate strengths in four key areas: managing finances, driving growth, managing crises, and developing strategies. And even CFOs who lack some of the soft skills associated with being a CEO—such as being able to inspire or showing a sense of optimism—can strengthen those gaps through upskilling.

The bottom line: Financial professionals develop skills that well equip them for the CEO role, particularly in today’s uncertain economic environment. According to a 2024 survey of CEOs conducted by Deloitte, many of the top challenges faced by CEOs involve financial expertise, such as dealing with economic uncertainty and inflation—meaning a successful CEO will have the financial expertise to face the most essential risks facing today’s companies.

However, questions remain: Do today’s hiring committees value financial expertise when choosing a CEO? And do certain company characteristics exist that are more associated with hiring a CEO with financial expertise? Let’s explore.

Current Representation of Financial Professionals in the CEO Role

To understand the factors that influence the likelihood of executives with financial expertise becoming the CEO, we looked at the career paths of the CEOs leading the 1,500 largest public U.S. firms in 2022. Using Execucomp, a database containing personal details of public companies’ top executives from disclosures required by the SEC, we classified the CEOs as “Finance CEOs” if they had a job title at any firm in the database associated with finance or accounting (e.g., Chief Financial Officer, Chief Accounting Officer, Controller, or Finance Director) before they were hired as a CEO. All other CEOs were classified as “Non-Finance CEOs”. (Note: CEO personal data is sourced from Compustat’s Execucomp database and firm data is sourced from Compustat’s Fundamentals Annual database.)

We found that 16.2% of CEOs leading S&P 1500 firms in 2022 had a finance background, suggesting a finance career can be a viable route to CEO in corporate America. This is consistent with the Cristholder 2023 Volatility Report review of 674 large public and private U.S. firms, which indicated there’s an increasing trend to appoint CFOs to CEO positions (increasing from 5.3% to 8.4% of sitting CEOs over a ten-year period).

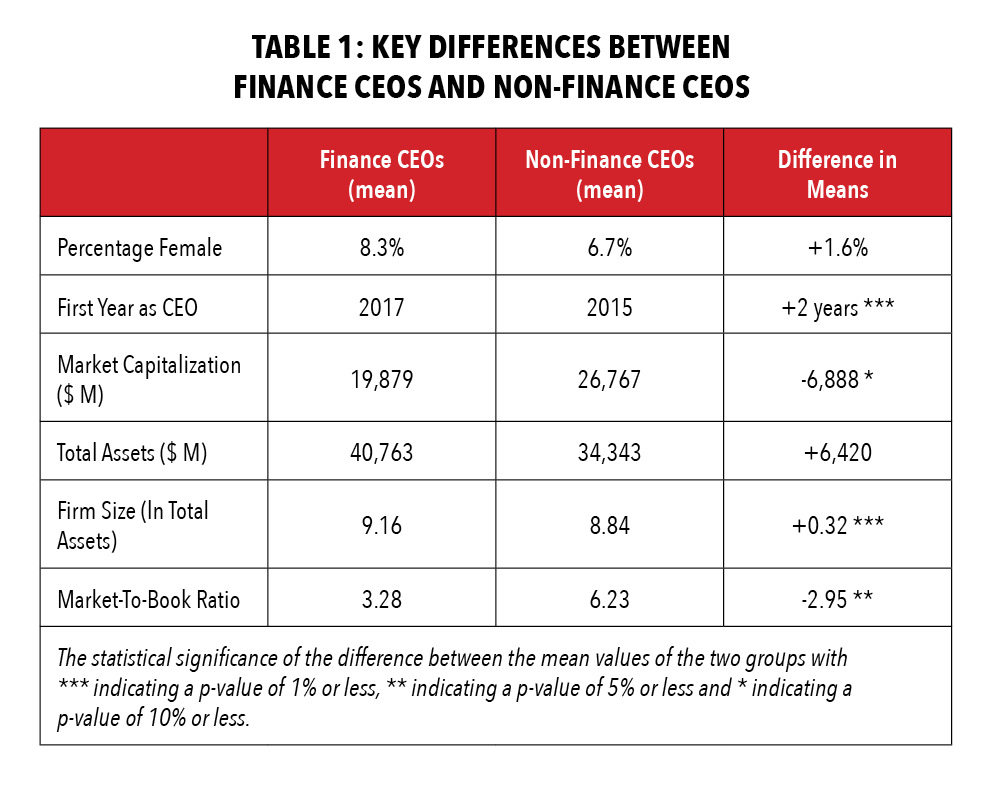

However, we also found noticeable differences between Finance CEOs and Non-Finance CEOs. Table 1 shows the mean values of some key data from FY2022 for the two groups, exploring differences in gender, tenure as CEO, and firm size and growth.

CEOs with a finance or accounting background are more likely to be female (8.3%) than CEOs with alternative career paths (6.7%). The Cristholder Report found that the proportion of female CFOs has grown from 10.2% in 2013 to 18.5% in 2023, comparing favorably to the growth in the proportion of female CEOs from 3.8% to 8.5% over the same period. There are many potential explanations for these observed differences based on variances in women’s preferences and potential barriers to promotion. However, we suggest more research is needed.

CEO Tenure

Another pattern we found: Finance CEOs became CEO for the first time more recently than Non-Finance CEOs. If this trend continues, it suggests that finance skills are increasingly recognized as valuable in a CEO. This would align with Deloitte’s survey, which indicated that the top challenges CEOs faced are economic uncertainties—the very kind of challenges a CEO with financial expertise would be well equipped to face.

Firm Size

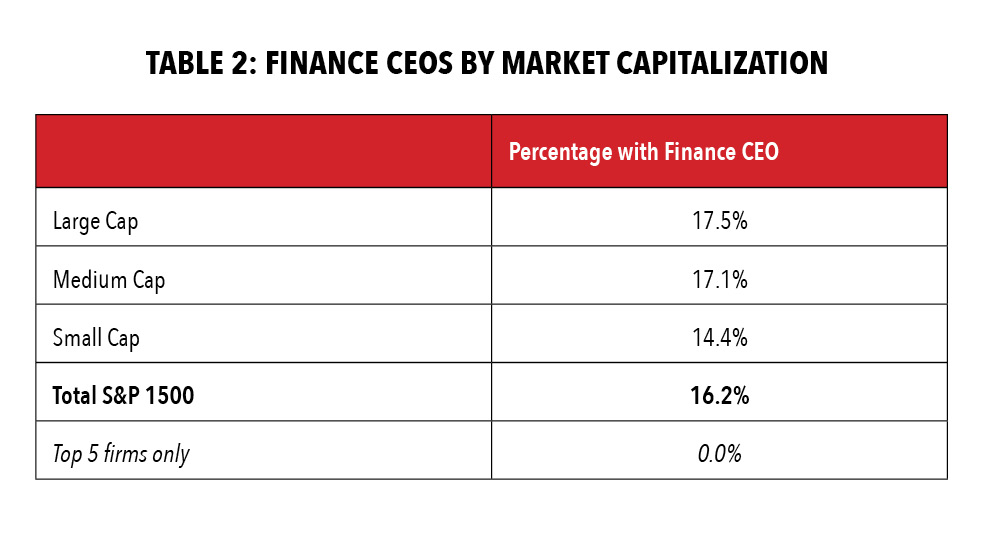

The next factor we examined was the size of the company. Our first two measures of firm size in Table 1 look contradictory: On average, firms led by Finance CEOs have a lower market capitalization but higher book value of total assets. There are two explanations for this. First, while the mean market capitalization of firms led by Non-Finance CEOs is higher, within this group there’s a much larger range: Non-Finance CEOs led both the smallest and the largest firms by market capitalization. Typically, Finance CEOs oversee large firms, but they are not in charge of the largest firms. The top five firms by market capitalization represent about 24% of the total market capitalization of S&P 500 firms, but none of these companies had a Finance CEO (see Table 2). This skews the mean value for firms with Non-Finance CEOs.

If we instead compare the median market capitalizations, which reduces the impact of outliers, firms led by Finance CEOs are larger than those led by Non-Finance CEOs ($5,672 million versus $4,703 million). Due to the skewed distribution of total assets across firms, academics often use the natural logarithm of the total assets as a measure of firm size (see Table 1). Firms led by Finance CEOs are also larger using this measure of firm size, and the difference is statistically significant. Second, market capitalization represents the market value of equity, but Finance CEOs finance a higher proportion of their assets with debt (34%) than Non-Finance CEOs (32%).

Firm Growth Potential

Next, we consider differences in firms’ growth potential. The market-to-book ratio is calculated as the market value of equity divided by the book value of equity. High values are generally interpreted as meaning the firm has high growth potential. Table 1 shows that high growth firms are less likely to employ Finance CEOs than mature, steady-growth firms.

Industry

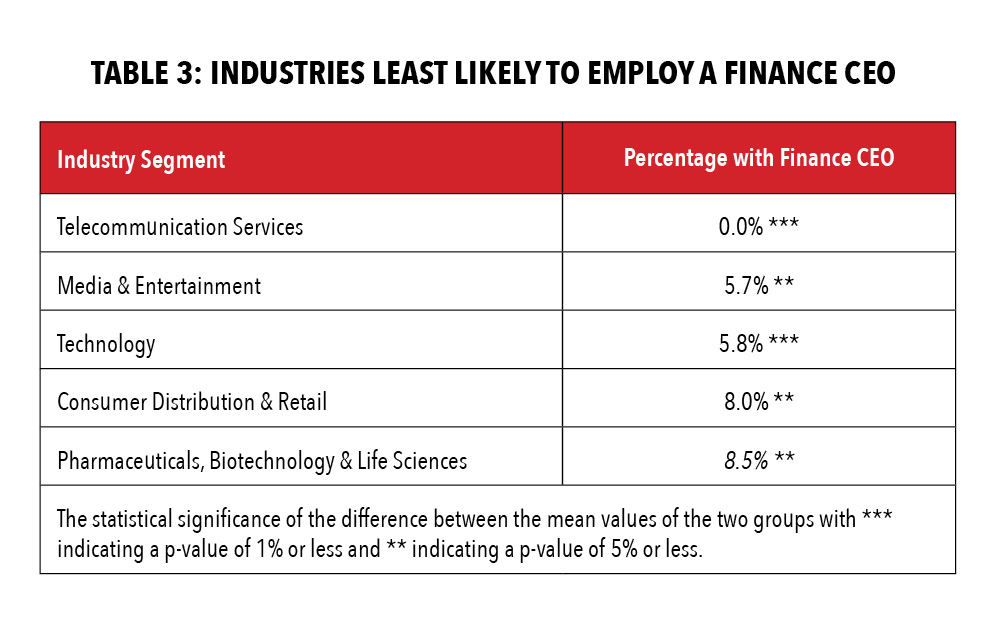

In addition to the above company characteristics, we find considerable differences between industries in the percentage of Finance CEOs. The differences in the means of the two groups of CEOs are highly significant for all five industries.

Table 3 shows the industries least likely to appoint CEOs with a finance background.

Apart from consumer distribution and retail (which may lean toward executives with marketing experience), these industries are associated with high growth potential—and high risk. Investments in these industries are also not easy to value according to traditional finance methodologies: The cashflows are risky and difficult to predict, relate to developing intangible assets and a significant part of their value may be due to real options. So specific technical expertise rather than financial expertise might be more highly valued in CEOs within these industries.

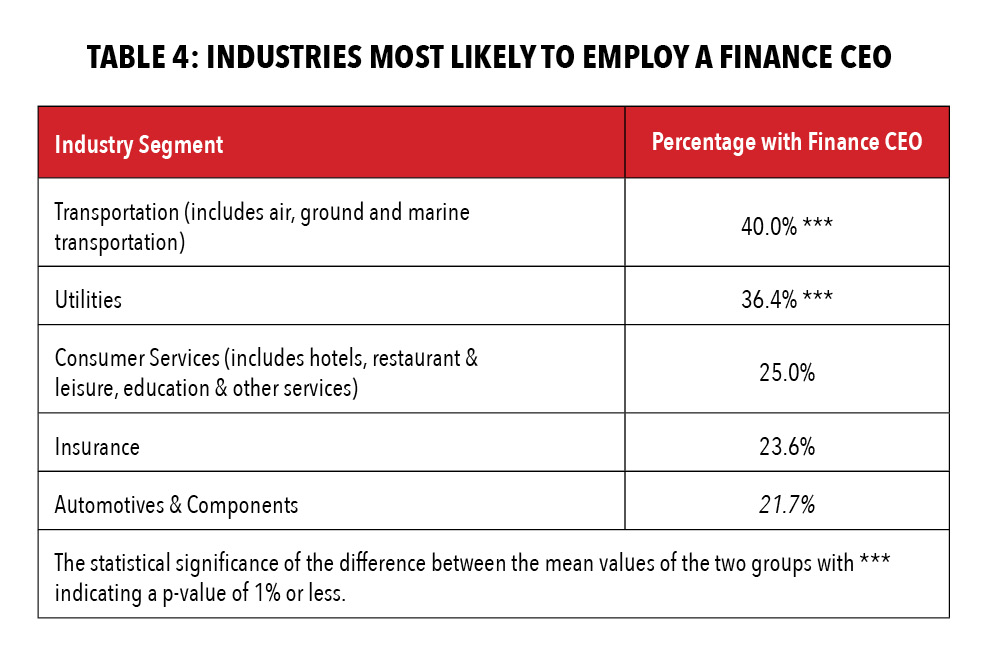

Table 4 shows industries that are most likely to appoint CEOs with a finance background, keeping in mind that on average 16.2% of CEOs are Finance CEOs. The differences in means of the two groups of CEOs are only significant for transportation and utilities.

The similarities among these industries might not be immediately obvious. However, they’re generally mature industries with more predictable cash flows and associated with tangible fixed assets. So, finance skills are useful for managing the generated cash and more directly applicable for valuing investment opportunities in these industries.

Finance skills will also be particularly useful leading insurance companies where managing cash flows and understanding complex mathematical models is important. It’s no surprise that Finance CEOs are also overrepresented in industries where finance expertise is directly applicable: banking (20%), financial services (20%) and REITs (21%).

Cash and Working Capital

Our final section examines one area where finance skills might be beneficial: managing cash and working capital. High cash holdings are useful for avoiding liquidity problems and ensuring cash is readily available to exploit investment opportunities. However, cash and liquid assets generally deliver low returns. Financial expertise may allow cash and working capital policies that better balance the trade-off between avoiding the problems of cash constraints and reducing average returns on assets.

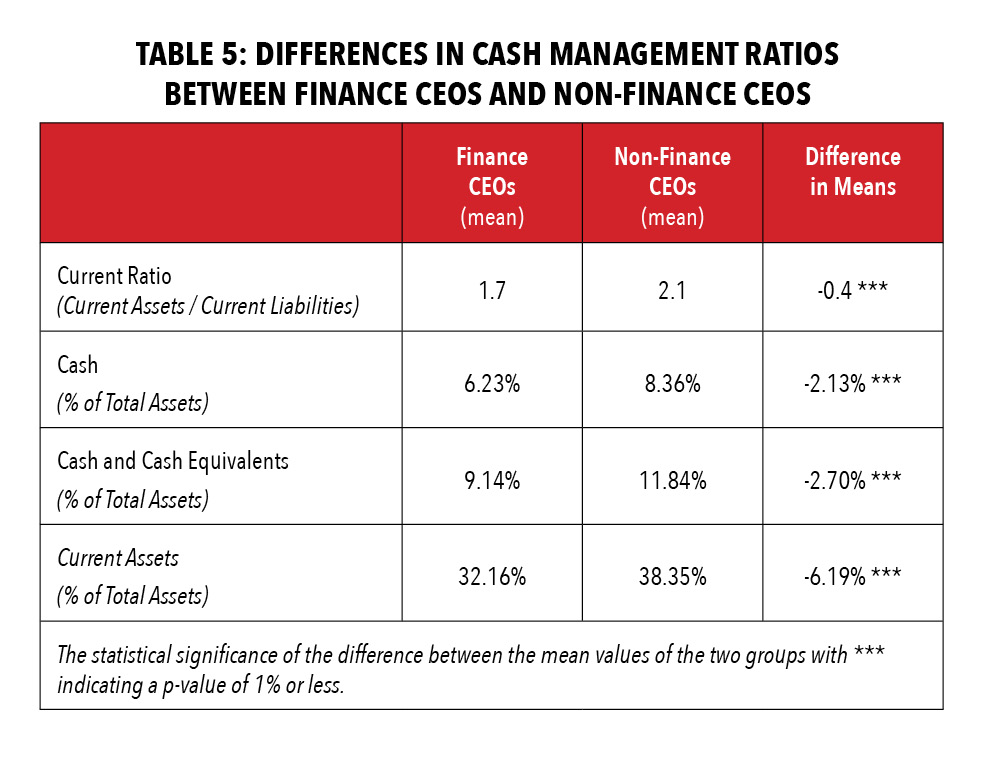

Table 5 shows the mean and median values of several cash management ratios for the two groups of firms based on FY2022 data. The difference in means of the two groups of CEOs are highly significant for all measures shown.

The mean current ratio for firms led by Finance CEOs (1.7) is significantly lower than the mean of firms led by Non-Finance CEOs (2.1). Similarly, the mean cash holdings, cash and cash equivalents, and current assets as a percentage of total assets are all significantly lower for firms led by Finance CEOs than the averages of other firms. This might be because CEOs with a finance background better understand the negative consequences of holding excessive levels of cash, can better judge the optimal level of cash, or are more confident in their ability to quickly raise new financing when necessary.

A Financial Path to CEO

So how can managers with a finance or accounting background get to the top job?

- A career in finance provides a viable route to becoming CEO, with 16.2% of small, medium, and large American public firms being led by CEOs with finance backgrounds in 2022.

- Among Finance CEOs, there’s a slightly higher proportion of females than the proportion of females among Non-Finance CEOs, although further research is needed to draw conclusions.

- Finance executives have a higher representation amongst CEOs of large, mature firms, and in transportation, utility, consumer services, automotive and components or finance-based industries (such as insurance, banking, and financial services).

- Firms led by Finance CEOs have noticeably different cash and working capital management policies; these skills will have been particularly useful during the pandemic lockdowns, unanticipated shortages, and inflationary bouts of recent years.

Overall, recent trends suggest that companies’ boards of directors and executive recruitment agencies have recognized that their firms can benefit from the unique skills learned during a finance career—specifically in the role of CEO.