Many CFOs struggle to cultivate true partnerships with their CIOs. While most enjoy collegial relationships, the effectiveness of their collaboration is undermined by the common misconception that the two roles have competing interests.Many CIOs stereotype their CFOs as financial gatekeepers, agnostic to the role of technology. At the same time, CFOs might typecast their CIOs as restless innovators or detail-oriented technologists who seem oblivious to enterprise-level financial constraints.

As a result, CFOs might overlook digital spending and outcomes CIOs can uniquely provide—and neglect a valuable ally in driving forward enterprise strategic priorities.

To maximize the returns from rising digital spending, organizations must create digital cohesion—optimally connecting digital initiatives to achieve specific, enterprise-level business outcomes. This isn’t easy. Gartner research suggests that just 21% of companies are effective at driving enterprise digital cohesion. The CFO plays a key role, but to do it effectively, they need the CIO as a partner.

Gartner research shows strong, business-centric CFO-CIO partnerships are more likely to easily find funding for digital initiatives and more likely to proactively manage expectations for digital technology implementation and subsequent financial outcomes. They are also more likely to achieve intended digital business outcomes than their functionally focused peers. These benefits improve the ability of both the CFO and CIO to deliver on their own priorities and drive better enterprise performance.

CFO and CIO Immediate Priorities Can Feel at Odds

Forging a true and effective partnership between the two roles tends to be difficult and rare, however. Day to day, most CIOs attend to the operational side of the enterprise, while CFOs manage its financial health. According to the 2024 Gartner CIO and Technology Executive Survey, CIOs are most focused on balancing cybersecurity and risk management with running and growing the business as well as integrating, innovating, and modernizing enterprise applications, and improving enterprise operational performance. CFOs, on the other hand, are focused on other concerns, including leading transformation efforts, evaluating or improving the finance function’s strategy and design, and improving finance metrics, insights, and storytelling, according to Gartner’s Top 5 Priorities for CFOs in 2024 survey.

In the most extreme cases, CFOs and CIOs don’t just see the other as having different priorities—they see conflicting priorities and view each other as impediments. Where CIOs want to spend to innovate and modernize technology, CFOs’ cost focus can be an apparent barrier. Where CFOs want clear evidence of investment returns to bring to their board or investors, the CIOs’ often-qualitative narratives about risk management and operational efficiencies can seem insufficient.

CFOs and CIOs Have More in Common Than They Realize

Although the differences in their immediate priority leads to a perception of competing interests, the two executives share the same goal of wanting to drive better enterprise performance.

When it comes to collaboration between the CFO and the CIO, successful partnerships are often built on three shared interests:

- The CIO should play a more strategic role

- Improved visibility into digital spending

- Greater business accountability for digital outcomes

So let’s examine how these mutual goals should play out to a company’s benefit.

1. You Both Want the CIO To Be More of a Strategic Partner

Digital acceleration has shifted the CIO from a functional leader to a strategic executive. A strategic CIO consistently impacts and considers enterprise-wide priorities, is well-versed in business acumen, and incorporates and follows through with a business-outcome-focused IT strategy. CFOs might not realize this, but a strategic CIO aids them in many ways. Yet, many CIOs, while wanting to take on a more strategic role, are still deeply entrenched in acting as a cost center.

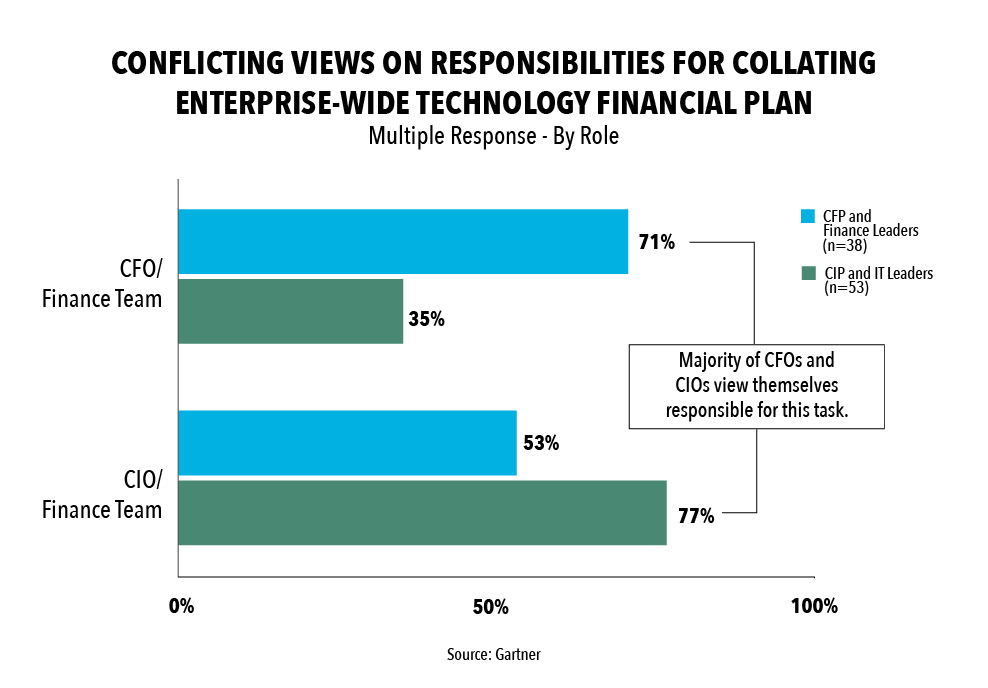

CFOs and CIOs hold conflicting views on the current state of the CIO’s strategic contribution. For example, the 2022 Gartner Enterprise wide Technology Value Survey showed that 77% of CIOs and IT leaders believe they have influence over strategic decisions rather than only executing strategic decisions made by others. In contrast, only 53% of CFOs and finance leaders believe the same of their CIOs. In addition, CFOs and CIOs disagree on whose responsibility it is to collate an enterprise-wide technology financial plan.

Most CFOs and finance leaders (71%) believe they are responsible for the enterprise-wide technology financial plan, but most CIOs and IT leaders (77%) believe they are responsible. Consequently, CIOs may have difficulty situating themselves as a strategic, enterprise-level leader due to pushback from CFOs and others on the executive management team.

CFOs Must Support a Strategic Role for the CIO

For the CIO to take on a more strategic role, they need to actively link IT’s value to enterprise-wide business objectives. A CIO’s acute focus on technology—especially implementation and maintenance—reinforces other stakeholders’ view of IT as a cost center rather than a business driver, which impedes the CIO from being a strategic leader.

Here, the CFO can enable the CIO to consistently tie IT to the business by prioritizing the use of outcome-driven metrics that link tech outcomes to financial ones. Unlike finance metrics, IT metrics uncover the mechanism behind why digital spending improves any financial outcome. Leveraging both sets of metrics provides the CFO and CIO with a more comprehensive view of digital performance.

CFOs should ask their CIOs the following questions to gain a better understanding of how CIOs view their current role and how they can support them in acting as a strategic partner:

- Do you play the role of a strategic partner? If so, in what ways?

- How would others describe your role within the organization?

- What are your criteria for approving a project or resolving one?

- What are the organization’s key value drivers?

- Where are your pain points in explaining IT’s value to the business and other functional teams?

- What organizational impediments do you face in executing your priorities?

CFOs Must Improve Their Own Technological Literacy

Although this role transition is for the CIO, the burden of responsibility cannot fall exclusively on them. To be an effective partner to the CIO in making enterprise digital strategy and investment decisions, CFOs must increase their digital-technological literacy. CFOs can upskill by becoming well-versed on digital metrics and data and analytics terminology. In addition, they should leverage their CIO to stay abreast of the evolving technology landscape and gain a deeper understanding of IT’s strategy to drive business outcomes.

2. You Both Want More Visibility into Digital Spending

Only 36% of senior finance leaders say they are aware of all the digital innovation investments happening across their organization. Many CFOs blame CIOs because they view them as a source for visibility into digital spending. When CFOs are disappointed by the minimal visibility CIOs provide them, they can interpret this as uncooperativeness from CIOs. However, part of what’s really going on is that CIOs are facing a similar problem.

Low Visibility Is Not Exclusive to CFOs

CIOs and IT leaders report a significant gap (43%) in how much transparency they get compared to the transparency they desire for business unit IT and shadow IT spending. The democratization of digital technology means that CIOs have increasingly less visibility into IT investments across the enterprise, as business leaders are increasingly engaging in digital spending without involving corporate IT. Forty-one percent of employees outside of IT now build technological and analytic capabilities, resulting in decreased visibility into decentralized digital spending. This is made worse by the fact that business leaders rate the importance of full transparency into all technology spend categories lower than CFOs and CIOs do.

Leverage Visibility into Different Types of Digital Spending

Although CFOs and CIOs have some shared visibility pain points, their insight into different digital spending areas can be mutually advantageous and provide a more complete picture of organizations’ digital spending.

CFOs and finance leaders often have more visibility into “other IT spend,” (i.e., business IT and shadow IT) than CIOs and IT leaders as well as into “other technology spend” (i.e., digital technology, business technologists, marketing tech) than CIOs. However, CIOs and IT leaders have a clearer view of the formal corporate IT budget than their CFOs. By collaborating to share this information, CFOs and CIOs will both have more information about previously hidden spending.

CFOs should ask CIOs the following questions to gain insights into their visibility of enterprise digital spending and learn how the two can support each other’s pursuit of greater visibility:

- Where do you have strong visibility into digital initiatives across the organization, and what are your blind spots?

- What problems has lack of visibility into digital spending caused for you?

- Are there any organizational structures and policies that prevent you from gaining full visibility into business digital spending?

- How do you view your own role in providing visibility into digital spending for finance and other functions?

3. You Both Want to Drive Business Accountability for Digital Outcomes

As digital spending continues to accelerate, there are growing pressures on CIOs to realize value from digital spending, both within and outside IT. This is because anything digital or technology related tends to be automatically associated with IT. Whether they are involved or not, the burden of poor outcomes tends to fall on IT and the CIO. But when the CIO has little visibility or influence over business-led digital spending, holding them accountable is not only frustrating for the CIO—it’s likely to fail to accomplish the CFO’s goals too.

Although business-led digital spending continues to accelerate, the volume and impact on enterprise outcomes is underappreciated by the organization. Siloed perspectives and “tunnel vision” on their own objectives lead business leaders to believe their digital spending does not impact the rest of the company in ways for which they need to be held accountable.

Business leaders lack sufficient understanding of digital interdependencies and the spillover effects of their digital spending. As a result, they sometimes choose to spend on technology that ends up being duplicative, creates inefficiencies because of incompatibility with other enterprise technology or processes, or simply doesn’t drive enterprise-level outcomes—all of which contribute to enterprise “technical debt.”

Understand Business Leaders’ Perspectives to Promote Business Accountability

Lack of voluntary business accountability can result from business leaders’ distrust of this critical element. When asked about the effectiveness of their organization’s enterprise-wide technology spend management, business leaders were more likely than CFOs/finance leaders and CIOs/IT leaders to rate management as ineffective.

CFOs and CIOs must uncover business leaders’ underlying assumptions and diverging perspectives on the executive leadership team to better understand potential drivers of insufficient business accountability for digital spending outcomes. By doing this, CFOs can enable business leaders to get on the same page as their CFOs and CIOs and recognize the value in taking ownership of digital outcomes for the enterprise.

Collaboratively Enable Business Leaders to Make Responsible Digital Investment Decisions

CFOs should drive business leaders to align their projects with shared enterprise initiatives and tie all investments to the organization’s broader goals and strategies. The CFO can do so by equipping business leaders with enterprise value driver maps and working with their CIO to highlight how operational decisions related to technology implementation affect key drivers of enterprise financial performance.

CFOs should also work in tandem with their CIOs to assess the technical assumptions behind business cases for digital spending, as the appropriateness of these assumptions has a meaningful impact on expected financial outcomes and the overall strength of the business case.

CFOs should begin by asking their CIOs the following questions to gain a deeper understanding of CIOs’ experiences with business leaders:

- How would you describe your relationship with business leaders?

- To what degree do you see business leaders abdicate responsibility for digital investment outcomes? Why do you think that occurs?

- In what ways do you feel lack of business accountability impedes you from achieving your top priorities?

- What approaches have you contemplated or already implemented to encourage business leaders to be more accountable for digital outcomes?

CFOs and CIOs often report significant friction between them gets in the way of an effective partnership. It doesn’t need to be this way. By recognizing these three shared CFO-CIO interests, CFOs can meet more of their own priorities while also driving enterprise-wide benefits from digital spending. Focusing on commonalities also allows them to cultivate and sustain a collaborative relationship with their CIOs, which is proven to lead to better enterprise outcomes. Given ongoing digital acceleration, CFOs must prioritize securing CIOs as an ally instead of a competitor.